Please use a PC Browser to access Register-Tadawul

Will Automated Risk Management Partnerships Redefine Assurant's (AIZ) Growth Ambitions?

Assurant, Inc. AIZ | 229.30 | +0.56% |

- Assurant announced a partnership with Evident to deliver the commercial equipment rental industry's first fully automated risk management solution, integrating insurance verification, real-time compliance checks, and instant enrollment in Assurant-backer protection programs.

- This move highlights Assurant's push to expand its suite of protection products with advanced automation, targeting sectors like construction and agriculture where unverified insurance poses significant risks.

- Let's explore how Assurant's entry into automated risk solutions could influence its investment outlook and growth narrative going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Assurant Investment Narrative Recap

For shareholders, believing in Assurant means seeing the company as an agile innovator, expanding insurance and protection services into industries facing digital disruption and automation pressure. The newly announced Evident partnership, while promising for sector expansion and cross-selling opportunities, is unlikely to significantly shift near-term catalysts, which remain anchored by the company’s ongoing efforts to diversify beyond lender-placed insurance and drive growth in embedded digital offerings. The largest immediate risk remains heavy regulatory scrutiny and pressure on fee structures in the housing insurance segment.

Among Assurant’s recent updates, the launch of HOIVerify Origination stands out as most relevant to this push for automation. Like the Evident partnership, it targets operational efficiency and regulatory compliance through real-time insurance verification, aligning with core growth drivers in automation and embedded insurance solutions. However, the success of such digital initiatives is subject to the same risks faced elsewhere in the business, especially as new technologies attract competitor attention and evolving compliance requirements.

On the other hand, investors should be aware just how much future returns could be affected if regulators decide to clamp down on fee structures across...

Assurant's narrative projects $14.2 billion revenue and $1.2 billion earnings by 2028. This requires 4.9% yearly revenue growth and a $483 million earnings increase from $717 million today.

Uncover how Assurant's forecasts yield a $241.00 fair value, a 13% upside to its current price.

Exploring Other Perspectives

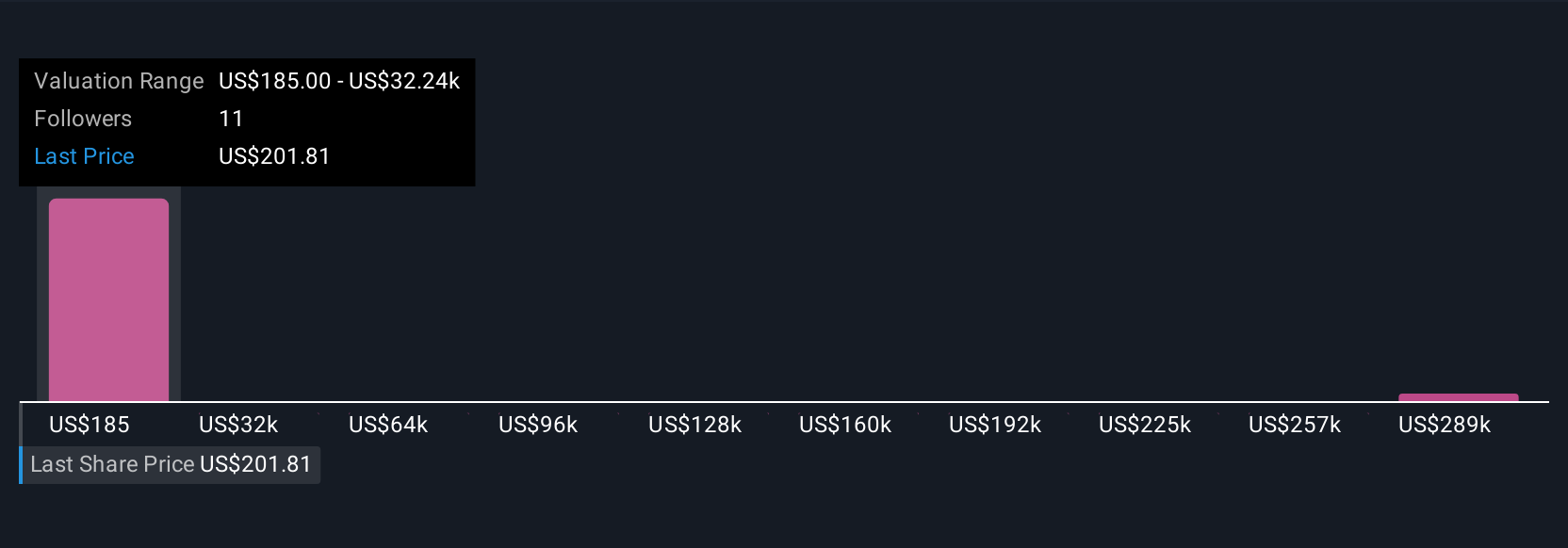

Simply Wall St Community members’ fair value estimates for Assurant range widely across US$185 to US$320,700 based on four independent calculations. With ongoing digital expansion, concerns about regulatory action in key insurance segments add crucial context for anyone considering these divergent viewpoints.

Explore 4 other fair value estimates on Assurant - why the stock might be worth 13% less than the current price!

Build Your Own Assurant Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Assurant research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Assurant research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Assurant's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.