Please use a PC Browser to access Register-Tadawul

Will Banquet’s New High‑Protein MEGA Breakfast Bowls Reshape Conagra Brands' (CAG) Value Portfolio Narrative?

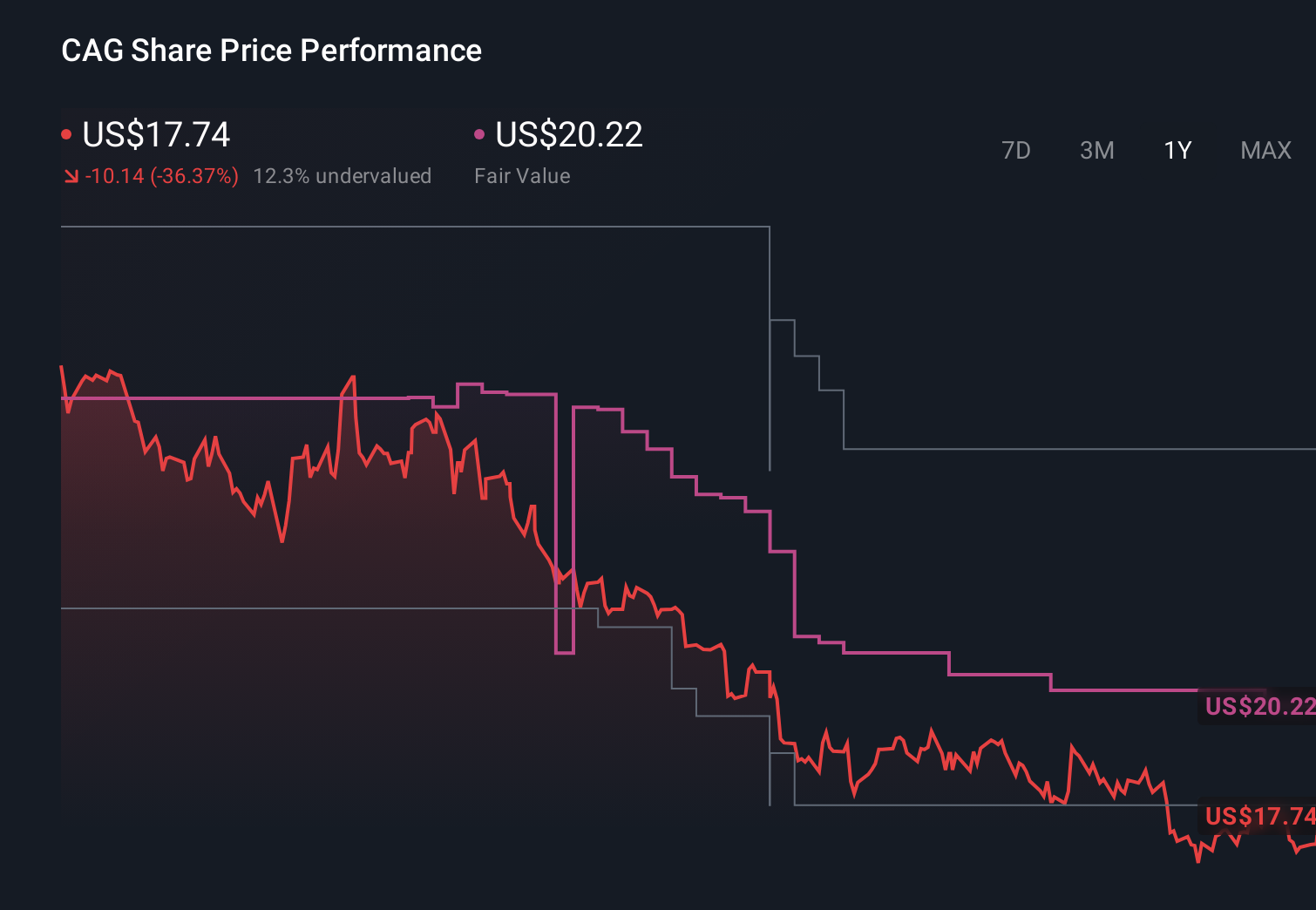

Conagra Brands, Inc. CAG | 18.47 | -1.18% |

- Earlier this month, Conagra Brands launched Banquet MEGA Breakfast Bowls, a frozen breakfast line offering four varieties with 30g of protein and tray-in-tray steaming technology to improve texture and taste.

- The move targets the US$626 million breakfast bowls category where protein is consumers’ top purchase driver, aligning Banquet with demand for convenient, high-protein value meals.

- We’ll now explore how this high-protein Banquet MEGA Breakfast Bowls launch could influence Conagra’s investment narrative and long-term brand positioning.

Capitalize on the AI infrastructure supercycle with our selection of the 34 best 'picks and shovels' of the AI gold rush converting record-breaking demand into massive cash flow.

Conagra Brands Investment Narrative Recap

To own Conagra Brands today, you need to believe its broad, value-focused food portfolio can convert product innovation into steadier earnings after a tough stretch of losses and soft sales. The Banquet MEGA Breakfast Bowls launch speaks to that story by leaning into high-protein convenience, but it does not materially change the near term focus on stabilizing margins, managing inflation and tariffs, and addressing supply chain costs that have weighed on recent results.

The most relevant recent announcement alongside this launch is Conagra’s June 2025 rollout of more than 50 new frozen items across brands like Healthy Choice, Marie Callender’s and Banquet. Together with MEGA Breakfast Bowls, this underlines how much of the near term catalyst rests on whether a heavier innovation slate in frozen can support volumes and pricing, without adding unsustainable complexity or pressure to already sensitive supply chains.

Yet even if new high protein bowls gain traction, investors still need to watch the risk that shifting preferences toward fresher, less processed foods could...

Conagra Brands' narrative projects $11.4 billion revenue and $905.9 million earnings by 2028. This implies a 0.5% yearly revenue decline and an earnings decrease of about $300 million from $1.2 billion today.

Uncover how Conagra Brands' forecasts yield a $18.81 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Some of the lowest ranked analysts were far more cautious, assuming revenue could fall about 1.2% a year to roughly US$11.2 billion and earnings to about US$983 million, so this new Banquet MEGA Breakfast Bowls push may eventually challenge that pessimism if it helps offset concerns about shifting consumer tastes toward fresher, minimally processed options.

Explore 11 other fair value estimates on Conagra Brands - why the stock might be worth 16% less than the current price!

Build Your Own Conagra Brands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Conagra Brands research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Conagra Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Conagra Brands' overall financial health at a glance.

No Opportunity In Conagra Brands?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with 28 elite penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.