Please use a PC Browser to access Register-Tadawul

Will Bitdeer Technologies Group's (BTDR) New Shelf Registration Reshape Its Approach to Balancing Growth and Losses?

Bitdeer Technologies Holding Co Ordinary Shares BTDR | 10.65 | -9.13% |

- In August 2025, Bitdeer Technologies Group filed a shelf registration for 186,627 Class A Ordinary Shares worth approximately US$2.45 million after reporting second-quarter sales of US$155.58 million and a net loss of US$147.73 million.

- This move to potentially raise additional funding by offering new shares follows a period of contrasting financial results, with strong revenue growth but a widening net loss for the quarter.

- We’ll explore how this capital-raising step may influence Bitdeer's ongoing efforts to balance growth ambitions against recent financial pressures.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Bitdeer Technologies Group Investment Narrative Recap

Owning Bitdeer Technologies Group stock means believing in the company's ability to convert its high revenue growth into sustainable profitability, especially as it invests in proprietary ASIC development and vertically integrated mining operations. The recent shelf registration to raise around US$2.45 million is modest relative to overall capital needs and does not materially shift the main catalysts or risks for Bitdeer at this time; the most important short-term driver remains the successful execution of ASIC commercialization, while the biggest risk continues to be the company’s high operating expenses and cash burn.

Among recent developments, Bitdeer’s second-quarter 2025 results showed sales climbing to US$155.58 million from US$99.23 million year-on-year, but net loss also widened significantly to US$147.73 million. This increase in net loss underlines the central risk: unless Bitdeer’s investments in ASIC sales and vertical integration generate efficient returns soon, sustaining high expense levels could impact financial stability regardless of capital raises.

Yet while optimism surrounds Bitdeer’s ambitions, investors should be mindful that, despite revenue growth, the company’s path to efficient profitability still faces...

Bitdeer Technologies Group's outlook projects $1.8 billion in revenue and $329.5 million in earnings by 2028. This requires 71.9% annual revenue growth and a $649.8 million increase in earnings from the current -$320.3 million level.

Uncover how Bitdeer Technologies Group's forecasts yield a $22.22 fair value, a 55% upside to its current price.

Exploring Other Perspectives

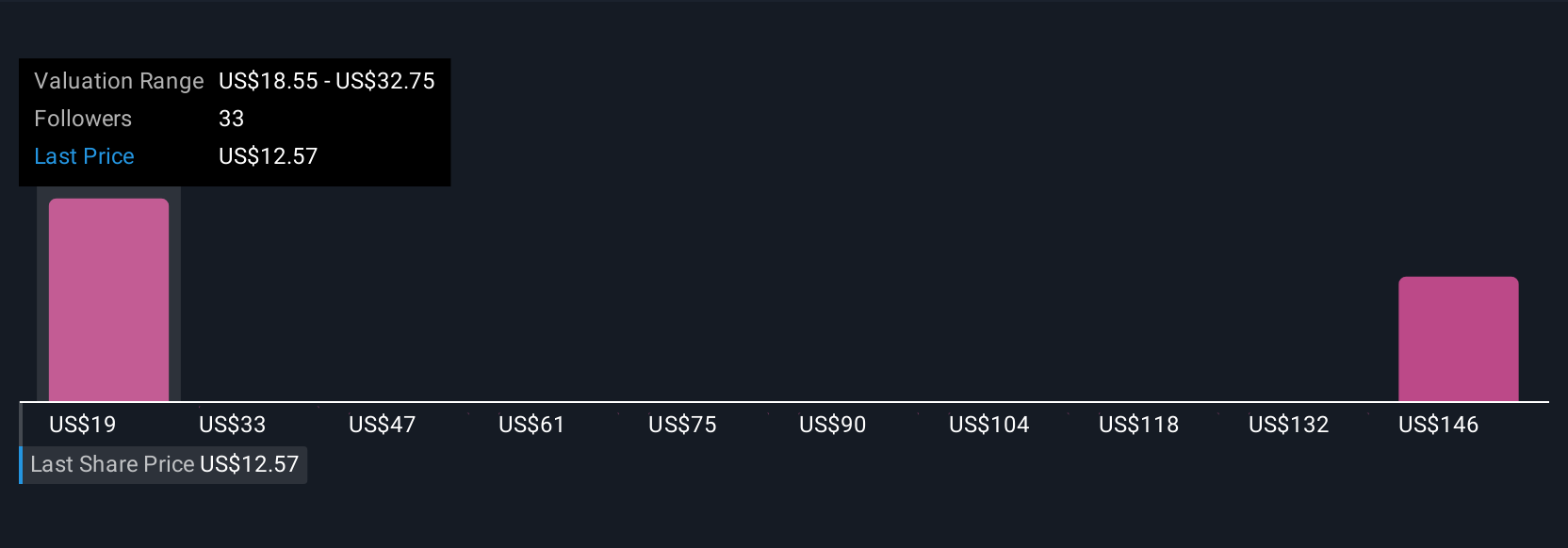

Fair value estimates from 7 Simply Wall St Community members ranged from US$18.55 to US$181.42. While these opinions vary widely, Bitdeer’s rising net losses raise important questions about how operational execution may ultimately shape future returns.

Explore 7 other fair value estimates on Bitdeer Technologies Group - why the stock might be a potential multi-bagger!

Build Your Own Bitdeer Technologies Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bitdeer Technologies Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bitdeer Technologies Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bitdeer Technologies Group's overall financial health at a glance.

No Opportunity In Bitdeer Technologies Group?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.