Please use a PC Browser to access Register-Tadawul

Will Canadian Solar’s (CSIQ) Battery Project Shape Its Competitive Edge in Global Energy Storage?

Canadian Solar Inc. CSIQ | 19.13 | -3.26% |

- Canadian Solar's subsidiary e-STORAGE recently achieved commercial operation of the 220 MWh DC Mannum Battery Energy Storage Project in South Australia, using its SolBank technology as the Engineering, Procurement, and Construction provider for Epic Energy.

- This milestone supports South Australia's target of 100% renewable electricity by 2027 and highlights Canadian Solar's expanding role in global battery storage solutions.

- We'll explore how the successful launch of the Mannum project could impact Canadian Solar's investment narrative and long-term positioning.

We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Canadian Solar Investment Narrative Recap

Investors in Canadian Solar need to believe in the global momentum behind electrification and the company’s strategy to expand its integrated battery storage and solar offerings. While the successful commercial launch of the Mannum Battery Energy Storage Project reinforces Canadian Solar’s progress in storage and enhances its positioning for long-term growth, it does not meaningfully shift the most urgent short-term catalyst, profitability, and the largest risk remains pressure on module margins from supply chain and pricing challenges.

Of the recent announcements, the September 2025 launch of next-generation Low Carbon modules featuring advanced heterojunction technology stands out. These new products underscore Canadian Solar’s bid to maintain competitiveness and improve margins, supporting its efforts to counteract industry-wide price declines and persistent cost headwinds. But despite exciting technical progress, investors should watch out for…

Canadian Solar's outlook projects $8.0 billion in revenue and $201.9 million in earnings by 2028. This scenario requires a 10.4% annual revenue growth rate and a $208.8 million increase in earnings from the current level of -$6.9 million.

Uncover how Canadian Solar's forecasts yield a $12.37 fair value, a 31% downside to its current price.

Exploring Other Perspectives

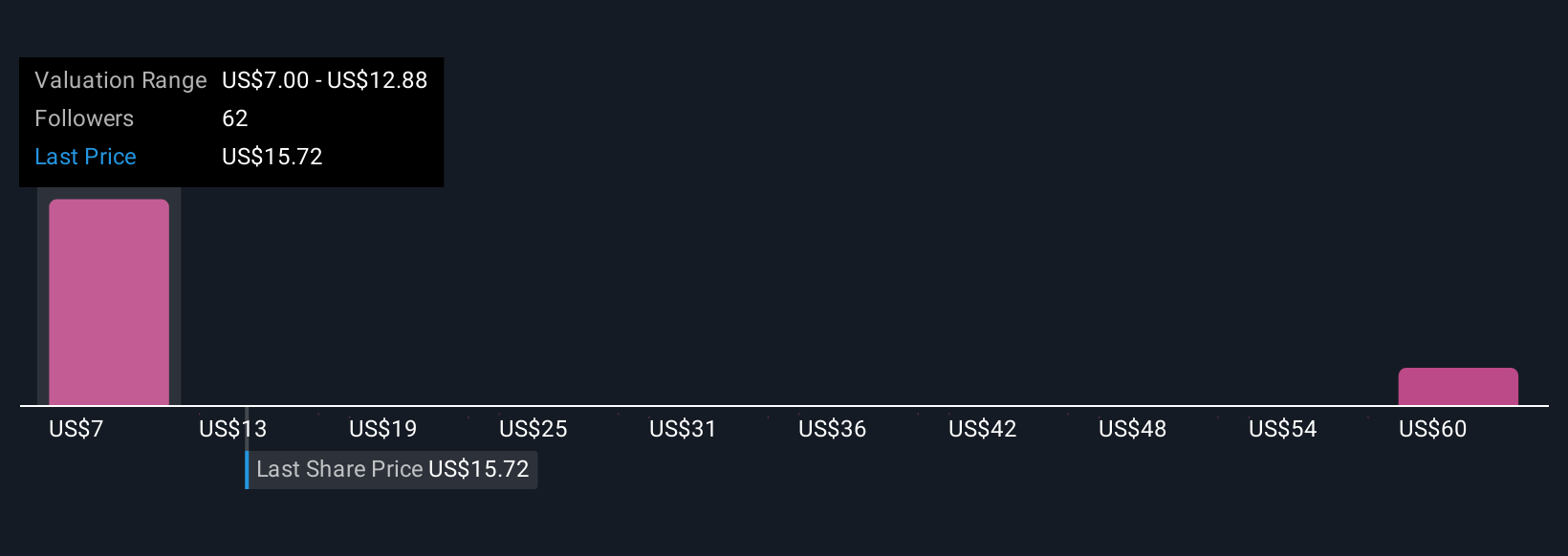

Simply Wall St Community members provided 5 fair value estimates for Canadian Solar ranging from US$7 to US$65.81 per share. Opinions are varied but underscore how factors like margin pressure from rising input costs could play a central role in shaping future outcomes.

Explore 5 other fair value estimates on Canadian Solar - why the stock might be worth over 3x more than the current price!

Build Your Own Canadian Solar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian Solar research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Canadian Solar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian Solar's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.