Please use a PC Browser to access Register-Tadawul

Will Cardinal Health's (CAH) Automated Logistics Hub Reshape Its Long-Term Growth Narrative?

Cardinal Health, Inc. CAH | 198.18 198.18 | -0.07% 0.00% Pre |

- Cardinal Health recently opened its 350,000-square-foot Consumer Health Logistics Center in Groveport, Ohio, equipped with advanced automation and robotics to streamline distribution of over-the-counter healthcare products across the U.S.

- The facility, which added over 150 jobs, represents a commitment to technology-driven supply chain efficiency and is part of more than US$115 million in infrastructure investments in Ohio over the past five years.

- We’ll explore how this expansion in automated logistics infrastructure may influence Cardinal Health’s long-term growth outlook and investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Cardinal Health Investment Narrative Recap

To be a shareholder in Cardinal Health, you need to believe in the company's ability to deliver greater supply chain efficiency and cost savings through major investments in logistics automation and scale. The opening of the new Consumer Health Logistics Center supports this narrative by promising enhanced operational performance, but does not materially impact the most pressing near-term catalyst, the company's capacity to drive sustained earnings growth, nor does it eliminate the key risk of regulatory and tariff headwinds, which could quickly compress distribution margins if conditions worsen.

Among recent announcements, the decision to open new distribution hubs in Texas and California directly relates to the Groveport facility's goal of national reach, supporting the company's push to optimize inventory and delivery for key customer segments. These moves reflect Cardinal’s focus on expanding infrastructure to underpin operational resilience and meet demand, even as industry risks around government pricing and potential customer contract losses continue to be closely watched as potential disruptors to growth.

Yet, in contrast to these supply chain wins, investors should be aware of the unresolved risk surrounding US medical device tariffs and regulatory uncertainty, especially as ...

Cardinal Health's outlook projects $288.0 billion in revenue and $2.2 billion in earnings by 2028. This implies a 9.0% annual revenue growth rate and an increase in earnings of $0.6 billion from the current $1.6 billion level.

Uncover how Cardinal Health's forecasts yield a $180.46 fair value, a 17% upside to its current price.

Exploring Other Perspectives

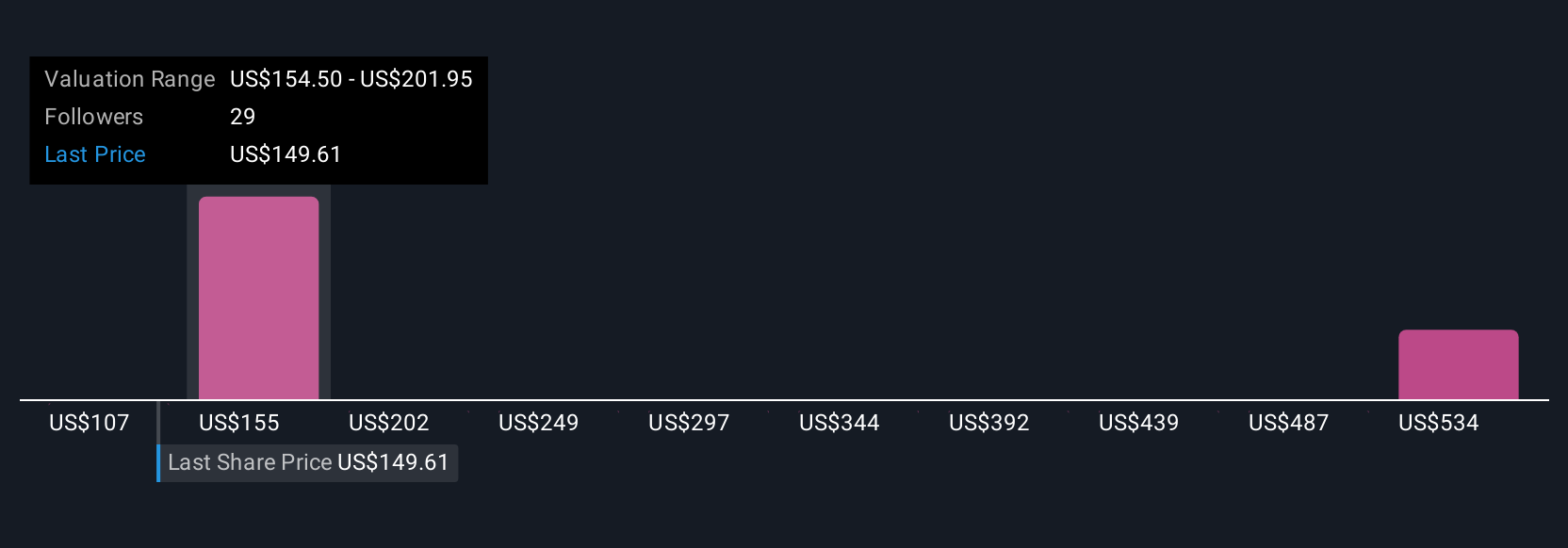

Community members on Simply Wall St estimate Cardinal Health’s fair value between US$135 and US$584, across four independent views. With regulatory and tariff risk still looming, these diverse opinions highlight just how differently market participants see the path forward, consider reviewing multiple viewpoints as you form your own outlook.

Explore 4 other fair value estimates on Cardinal Health - why the stock might be worth 12% less than the current price!

Build Your Own Cardinal Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cardinal Health research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cardinal Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cardinal Health's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.