Please use a PC Browser to access Register-Tadawul

Will Centuri’s (CTRI) New Fleet Leadership Shape Its Operational Efficiency and Capital Allocation Strategy?

Centuri Holdings, Inc. CTRI | 25.25 | -0.90% |

- Centuri Holdings, Inc. recently announced the appointment of Jason Lentz as Senior Vice President of Fleet and Procurement, effective August 11, placing him in charge of the company’s fleet and sourcing strategy across its more than US$1 billion in equipment assets.

- This move brings nearly three decades of industry expertise to the leadership team and is positioned to support capital efficiency and operational discipline as Centuri manages a growing customer base.

- We’ll explore how appointing a leader skilled in fleet management could impact Centuri’s investment narrative and operational outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Centuri Holdings' Investment Narrative?

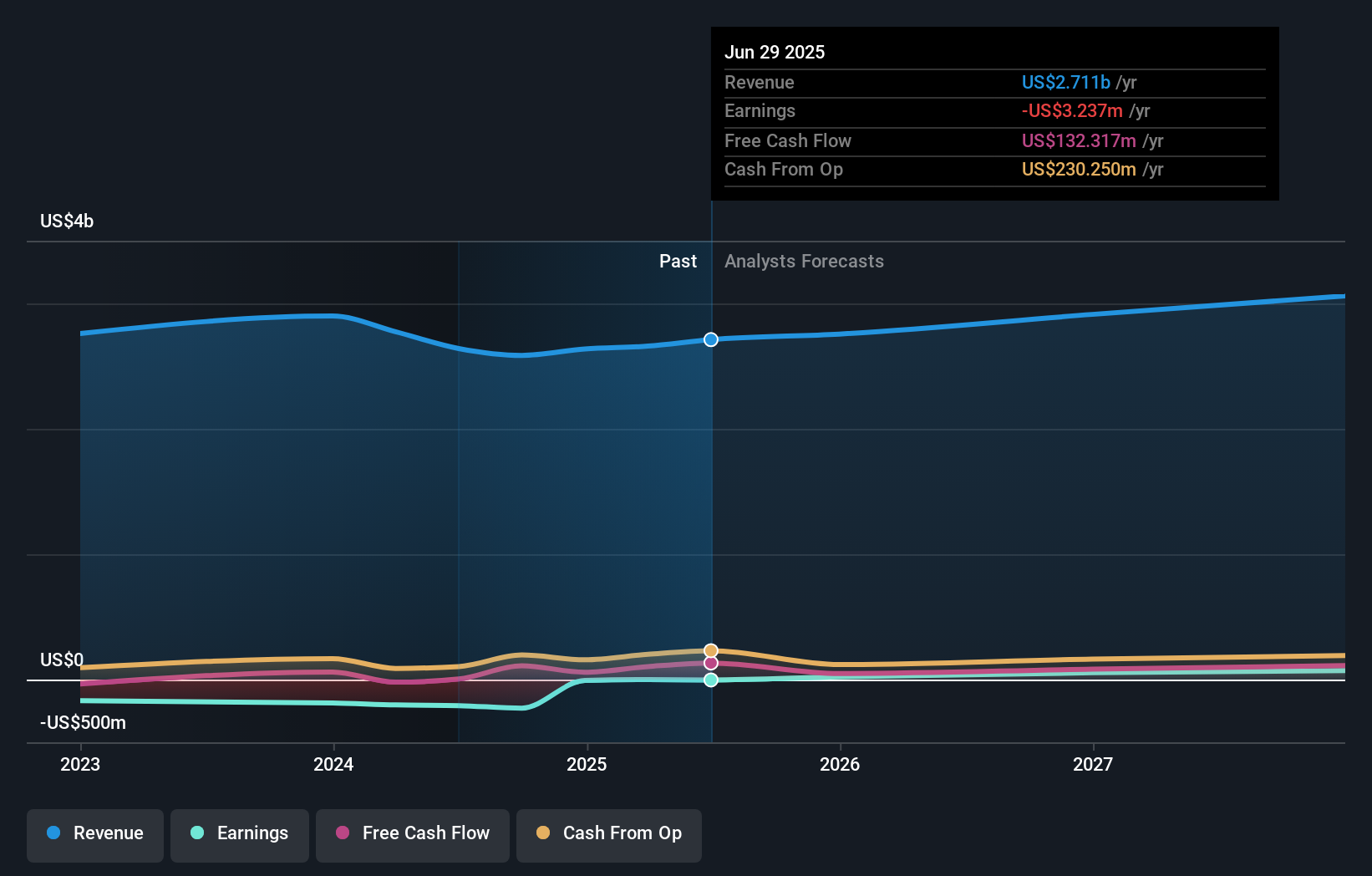

For anyone considering Centuri Holdings, the investment thesis is anchored in the company's push for efficiency as it manages a growing portfolio of major US$1 billion-plus equipment assets and a customer base that keeps expanding. The recent leadership addition of Jason Lentz as Senior Vice President of Fleet and Procurement introduces specialized fleet management experience that could influence short-term catalysts like cost controls, capital discipline, and operational margins as Centuri integrates a largely new management team. With ongoing contract wins, a recently strengthened balance sheet, and a track record of annual earnings growth, the biggest risk has been executive inexperience and the impact of large one-off financial items. Lentz’s track record managing complex fleet operations may help mitigate operational risks and increase reliability, but whether this change meaningfully alters near-term fortunes is unclear at present, reflected by the relatively modest share price move after the announcement.

However, new leaders can only do so much to offset risk tied to rapid management turnover. Centuri Holdings' shares have been on the rise but are still potentially undervalued by 8%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on Centuri Holdings - why the stock might be worth less than half the current price!

Build Your Own Centuri Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centuri Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Centuri Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centuri Holdings' overall financial health at a glance.

No Opportunity In Centuri Holdings?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.