Please use a PC Browser to access Register-Tadawul

Will CNO Financial Group’s (CNO) New Mental Health Partnership Help Offset Ongoing Profitability Challenges?

CNO Financial Group, Inc. CNO | 41.24 41.24 | +0.24% 0.00% Pre |

- Optavise, a provider of employee benefits services under CNO Financial Group, recently announced a partnership with Rula to offer expanded access to a nationwide network of over 21,000 licensed behavioral health professionals for its clients, with quick and guided appointment scheduling at no added cost.

- This collaboration aims to improve workforce wellness by making comprehensive mental healthcare accessible not just to employees but also to their families, highlighting the growing industry focus on holistic employee benefits.

- We'll explore how continued operational headwinds, including stagnant net premiums, rising costs, and a declining book value, could impact CNO Financial Group's investment narrative.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 32 companies in the world exploring or producing it. Find the list for free.

CNO Financial Group Investment Narrative Recap

Shareholders in CNO Financial Group must have conviction in the company’s ability to grow its customer base and earnings, particularly as its operating environment presents challenges like sluggish net premiums, rising costs, and declining book value. The recent Optavise–Rula partnership expands access to mental health services and improves competitive positioning in workplace benefits but is unlikely to materially impact the near-term financial outlook given that the most important catalysts and risks remain rooted in operating profitability and cost control. For now, the biggest swing factor for investors remains how CNO can stabilize margins and reverse cost trends in the coming quarters.

Of recent announcements, the steady increase in CNO’s quarterly dividend stands out, with a fourteenth consecutive year of payout hikes reflecting management’s confidence in the company’s ability to generate cash returns for investors. While this may reassure some about cash flow resilience, the fundamental challenge tied to rising costs outpacing revenue and affecting profit margins continues to shape the near-term narrative as the company balances capital returns with a need to sustain earning power.

However, investors should also note that, despite ongoing improvements in customer offerings, the risk of cost inflation and margin pressure remains significant if...

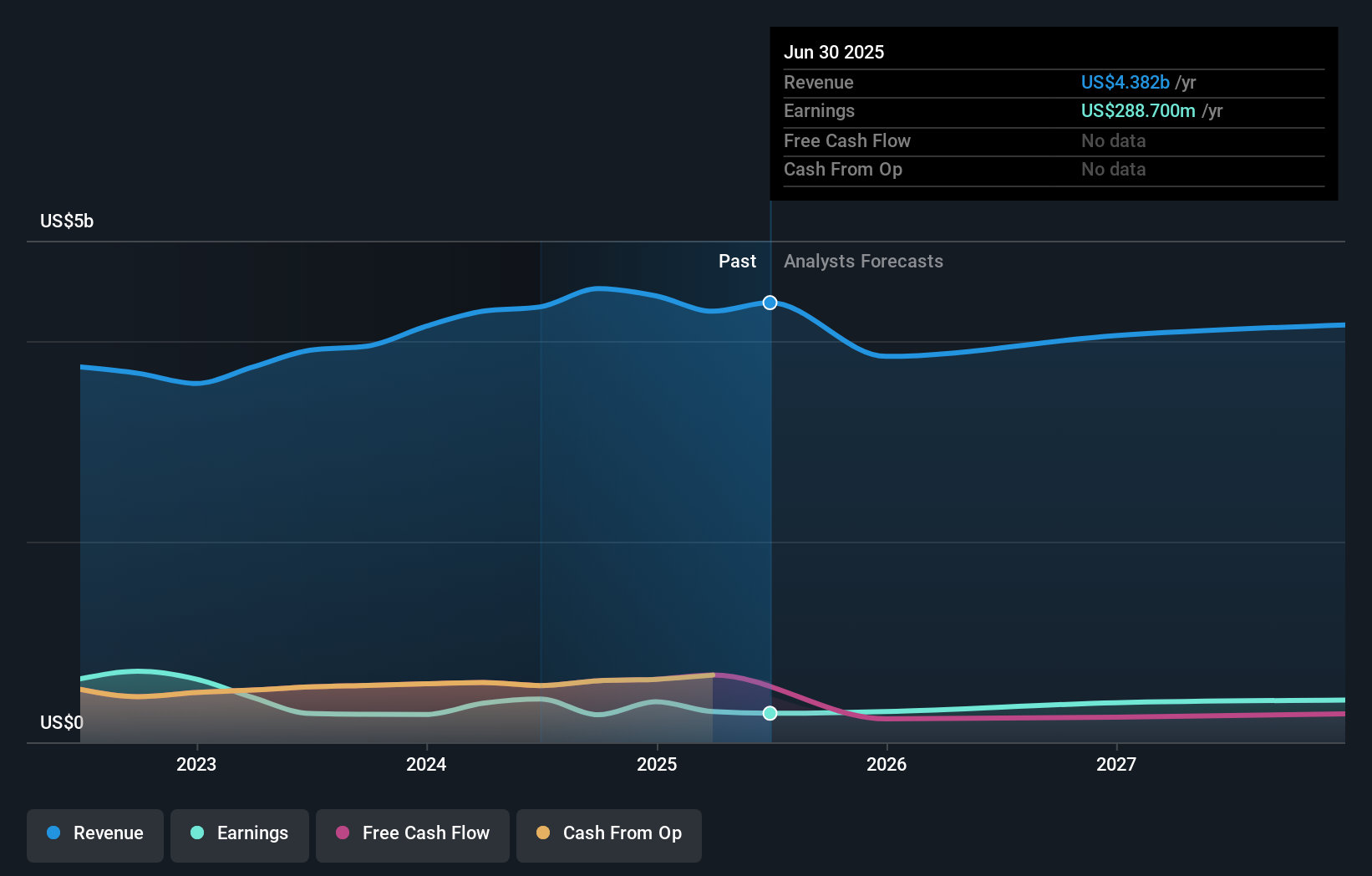

CNO Financial Group is expected to generate $4.3 billion in revenue and $432.2 million in earnings by 2028. This outlook assumes a 0.8% annual revenue decline and an earnings increase of $143.5 million from the current earnings of $288.7 million.

Uncover how CNO Financial Group's forecasts yield a $42.40 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members currently provide a single fair value estimate of US$42.40 for CNO Financial Group. Cost management challenges highlighted above could have broader implications for CNO's ability to enhance shareholder value in your view.

Explore another fair value estimate on CNO Financial Group - why the stock might be worth as much as 7% more than the current price!

Build Your Own CNO Financial Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CNO Financial Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CNO Financial Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CNO Financial Group's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.