Please use a PC Browser to access Register-Tadawul

Will Countyline Corporate Park’s Strong Pre-Leasing Momentum Shift Terreno Realty’s (TRNO) Growth Narrative?

Terreno Realty Corporation TRNO | 60.59 | -0.02% |

- Terreno Realty Corporation announced it has commenced construction of Countyline Corporate Park Phase IV Building 36 in Hialeah, Florida, a 214,000-square-foot industrial distribution building that is already 51% pre-leased, with completion targeted for early 2027.

- This project is part of a wider $511.5 million investment in sustainable, LEED-certified industrial facilities at Countyline, reflecting significant tenant demand and continued expansion in a key logistics hub.

- We'll explore how robust pre-leasing activity at Countyline Corporate Park shapes Terreno Realty's investment narrative in the industrial real estate sector.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Terreno Realty's Investment Narrative?

For anyone considering Terreno Realty, the long-term narrative hinges on confidence in sustained demand for well-located, sustainable logistics real estate. The latest announcement about Countyline Corporate Park Phase IV Building 36 reinforces this story: a large, LEED-certified asset over half pre-leased before breaking ground signals significant tenant demand and helps lock in future income streams. This comes amid evidence of solid recent leasing momentum across the Countyline portfolio, ongoing expansion in major US coastal hubs, and a focus on quality tenants operating under long-term leases. In the short term, major catalysts, like progress on new developments and the pace of leasing at Countyline, remain unchanged, but the news further reduces near-term vacancy risk and suggests management can convert its growth pipeline into actual rental income. Risks such as moderate earnings growth and a relatively high price-to-earnings ratio persist, though project execution appears to be mitigating immediate operational concerns. If there’s a pivotal takeaway, it’s that Countyline’s leasing progress is now an even bigger swing factor for near-term investor sentiment. In contrast, the earnings outlook still warrants careful attention from investors.

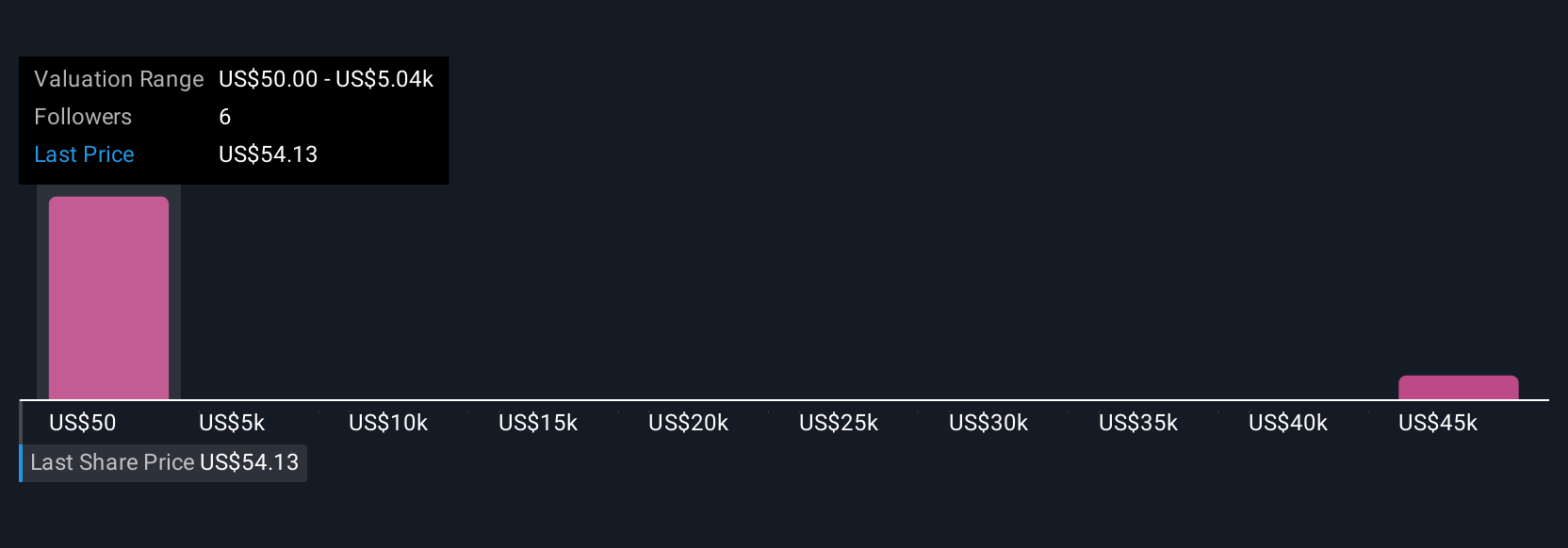

Terreno Realty's shares have been on the rise but are still potentially undervalued by 29%. Find out what it's worth.Exploring Other Perspectives

Explore 4 other fair value estimates on Terreno Realty - why the stock might be worth 13% less than the current price!

Build Your Own Terreno Realty Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Terreno Realty research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Terreno Realty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Terreno Realty's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.