Please use a PC Browser to access Register-Tadawul

Will Dave's (DAVE) New CashAI v5.5 Engine Redefine Its Edge in Credit Innovation?

Famous Dave's of America, Inc. DAVE | 197.61 197.61 | -3.30% 0.00% Pre |

- Earlier this month, Dave Inc. announced the full rollout of CashAI v5.5, its newest AI-powered cash flow underwriting engine, which doubles the feature set and is optimized for the company's updated fee structure.

- With real-time credit analysis trained on over 7 million recent ExtraCash originations, Dave expects CashAI v5.5 to improve risk ranking, approval rates, and credit performance, supporting broader access to ExtraCash and potential gross profit expansion.

- We'll explore how CashAI v5.5’s improved credit decisioning could impact Dave’s long-term outlook and drive credit quality gains.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Dave Investment Narrative Recap

To be a shareholder in Dave Inc., you need to believe that technology-driven underwriting, combined with efficient fee monetization and digital banking adoption, can deliver sustainable revenue and profit growth. The announcement of CashAI v5.5, with real-time credit analysis and expanded feature set, appears to directly reinforce the key profit catalyst of improved credit performance from advances like ExtraCash. However, it does not ease the regulatory scrutiny risk surrounding fees, a major business threat that remains material in the short term.

The most relevant recent company move is the implementation of CashAI v5.5, which nearly doubles its feature set and supports Dave’s new fee structure. Early results pointing to better credit risk rankings and higher approval amounts suggest potential for improved unit economics, but wider profit expansion still hinges on sustained ExtraCash demand without regulatory disruption.

By contrast, investors should be mindful that regulatory action on fee models could arrive swiftly and...

Dave's outlook anticipates $702.2 million in revenue and $193.0 million in earnings by 2028. This scenario assumes 17.5% annual revenue growth and a $137.9 million increase in earnings from the current $55.1 million.

Uncover how Dave's forecasts yield a $271.86 fair value, a 18% upside to its current price.

Exploring Other Perspectives

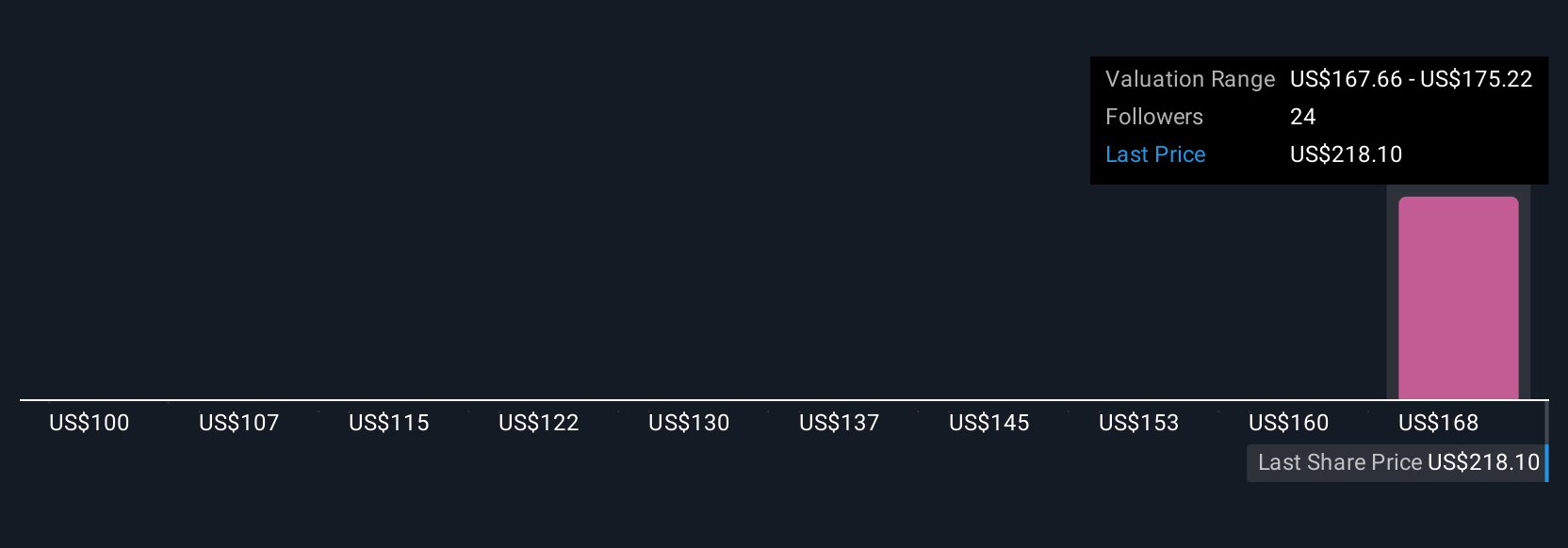

Four fair value estimates from the Simply Wall St Community range between US$99.65 and US$320 per share, reflecting wide-ranging opinions. While some see substantial upside, the ongoing risk of regulatory scrutiny around Dave’s fee-based products could quickly impact sentiment and future results, explore more perspectives to round out your view.

Explore 4 other fair value estimates on Dave - why the stock might be worth as much as 39% more than the current price!

Build Your Own Dave Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dave research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dave research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dave's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.