Please use a PC Browser to access Register-Tadawul

Will Dividend Approval and New Board Members Change Royalty Pharma's (RPRX) Narrative?

Royalty pharma plc RPRX | 38.31 | -0.18% |

- Royalty Pharma recently approved a third quarter 2025 dividend of US$0.22 per Class A ordinary share, payable on September 10, 2025, to shareholders of record as of August 15, 2025.

- The company also expanded its Board of Directors by appointing Carole Ho and Elizabeth (Bess) Weatherman, both bringing significant industry and capital markets experience that could influence corporate governance and strategy.

- With these experienced board additions, we'll explore what this means for Royalty Pharma's investment narrative and leadership trajectory.

Royalty Pharma Investment Narrative Recap

Being a Royalty Pharma shareholder often means believing in the strength and growth of pharmaceutical royalty streams, the pipeline of new therapies, and prudent capital management. The recent approval of a Q3 2025 dividend and the addition of two experienced directors are positive for stability and governance but don’t materially alter the company’s main short-term catalyst, executing on new royalty acquisitions, or fully address the biggest current risk: sustaining consistent revenue absent those one-off milestones that drove past results.

This quarter’s dividend continuity, following the prior increase, signals management’s intent to return capital consistently, which may resonate with investors seeking predictable payouts amid ongoing efforts to internalize operations and achieve cost efficiencies. While board changes enhance expertise, the company’s ability to replicate or replace large milestone payments, rather than governance shifts, remains more critical to both its catalysts and potential risks ahead.

But investors should also be mindful that, despite board appointments and stable dividends, the challenge of revenue stability in the absence of more milestone deals is something...

Royalty Pharma's narrative projects $3.1 billion revenue and $1.6 billion earnings by 2028. This requires 11.4% annual revenue growth and a $741 million earnings increase from $859.0 million today.

Exploring Other Perspectives

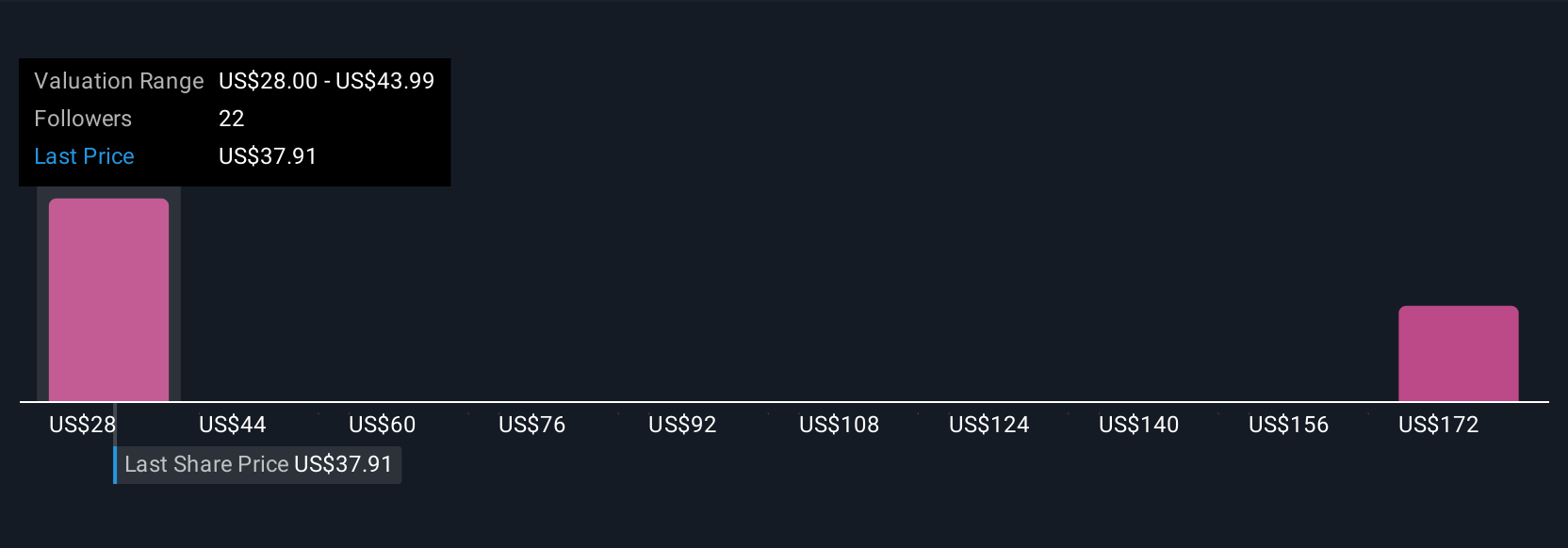

Simply Wall St Community members produced four fair value estimates on Royalty Pharma ranging from US$28 to US$201.90 per share. These views highlight differing opinions, while the risk of inconsistent revenue growth from one-off milestones could influence overall direction.

Build Your Own Royalty Pharma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Royalty Pharma research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Royalty Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Royalty Pharma's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.