Please use a PC Browser to access Register-Tadawul

Will Enovix’s (ENVX) New $300M Convertible Notes Reshape Its Approach to Funding Future Growth?

Enovix Corporation - Common Stock ENVX | 7.61 | -3.73% |

- Enovix Corporation recently completed a US$300 million fixed-income offering of 4.75% senior unsecured convertible notes due September 15, 2030, marking a significant financing milestone for the company.

- This move gives Enovix greater financial flexibility to fund future growth projects, manufacturing expansion, or operational investments as the company enters a critical commercialization phase.

- We'll examine how the completion of this convertible debt offering could impact Enovix's investment narrative and growth potential.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Enovix Investment Narrative Recap

Investors in Enovix are typically betting on the company’s ability to scale smartphone battery production and secure customer qualifications in time for anticipated mass commercialization in late 2025. The recent US$300 million convertible note offering strengthens Enovix’s liquidity position, which could help address short-term funding risks linked to manufacturing expansion, though the most immediate catalyst remains timely execution of high-volume production ramp-up; the impact on production timelines appears limited for now.

Among recent developments, the March 2023 announcement establishing Enovix Malaysia Sdn. Bhd. directly links to production scaling, this move laid the groundwork for the high-volume facility now central to near-term revenue opportunities, supported further by the latest financing round. The company’s ability to align new funding with targeted manufacturing goals will be crucial as market demand materializes.

However, investors should also keep in mind that despite bolstered cash reserves, persistent challenges with ramping up efficient, high-volume output could mean...

Enovix's outlook anticipates $460.3 million in revenue and $48.3 million in earnings by 2028. This requires a 171.2% annual revenue growth rate and an earnings increase of $270.5 million from current earnings of $-222.2 million.

Uncover how Enovix's forecasts yield a $29.50 fair value, a 262% upside to its current price.

Exploring Other Perspectives

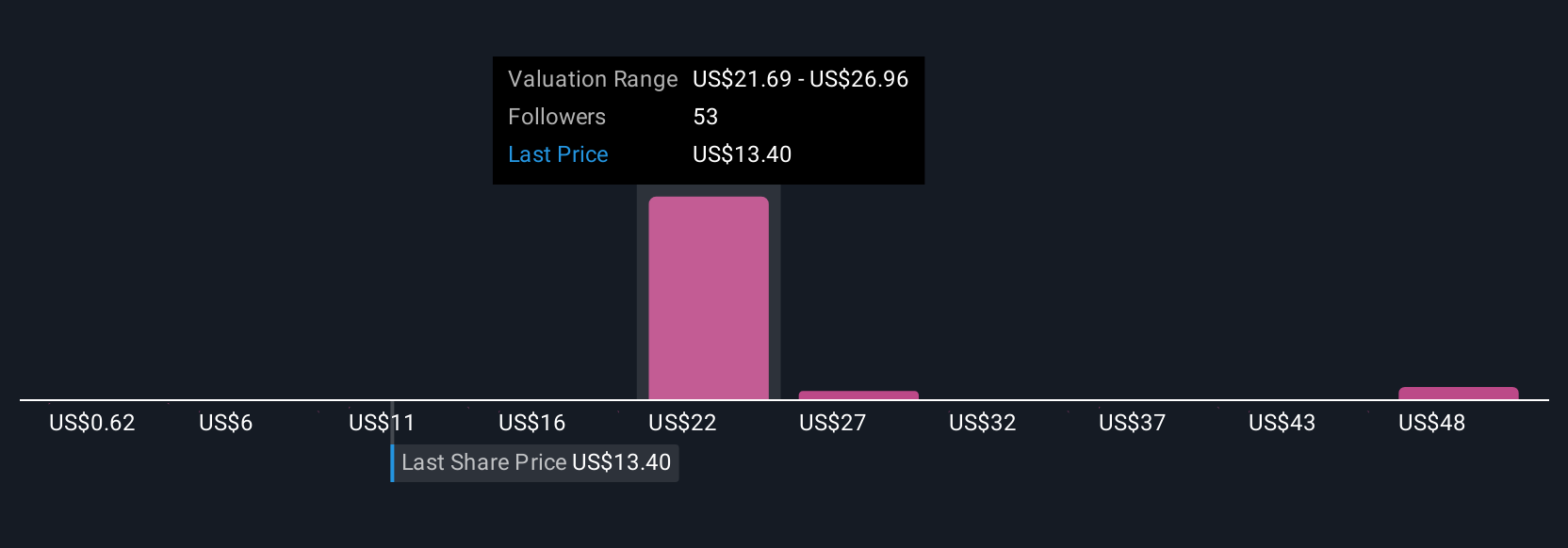

Fair value estimates from eight members of the Simply Wall St Community range widely, from US$0.62 to US$38.48 per share. While views on valuation differ, the ability to successfully ramp Malaysia operations may prove pivotal to real financial improvement, explore how these outlooks compare for a clearer picture.

Explore 8 other fair value estimates on Enovix - why the stock might be worth less than half the current price!

Build Your Own Enovix Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enovix research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Enovix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enovix's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 25 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.