Please use a PC Browser to access Register-Tadawul

Will Ericsson-HPE 5G Lab Collaboration Reshape Hewlett Packard Enterprise's (HPE) Networking Innovation Narrative?

Hewlett Packard Enterprise Co. HPE | 23.91 23.84 | +1.27% -0.29% Pre |

- On October 16, 2025, Ericsson and HPE announced the establishment of a joint validation lab to address key challenges for telecommunications service providers deploying multi-vendor infrastructure, focusing on cloud-native, AI-enabled 5G solutions combining Ericsson’s dual-mode 5G Core, HPE ProLiant Gen12 servers, HPE Juniper Networking, and Red Hat OpenShift.

- This collaboration aims to empower telcos to streamline operations, accelerate innovation, and test advanced solutions in a real-world environment, highlighting HPE’s increasing focus on networking and AI-driven offerings.

- We’ll explore how the expanded HPE-Ericsson partnership amplifies HPE’s commitment to networking and service provider innovation within its investment story.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Hewlett Packard Enterprise Investment Narrative Recap

To believe in HPE as a shareholder today, you need confidence that its shift toward AI-enabled networking and recurring service revenues will more than offset challenges in traditional hardware and cloud competition. The new joint validation lab with Ericsson bolsters HPE’s move into AI and telco networking but does not materially reduce near-term integration and execution risks from the Juniper acquisition, which remain the key variable for short-term results and earnings quality.

Of recent announcements, HPE’s 10 percent dividend increase for FY2026 is especially relevant, signaling management’s confidence in cash flow at a time when investors are looking for tangible evidence that investments in next-gen networking and AI solutions will pay off. This is particularly significant as the Juniper integration and evolving revenue mix are closely watched catalysts for margin and free cash flow improvement.

However, with such transitions, a contrasting risk remains: if the Juniper Networks integration hits delays or falls short of synergy targets, investors should be aware of ...

Hewlett Packard Enterprise's outlook anticipates $44.4 billion in revenue and $2.7 billion in earnings by 2028. This assumes a 10.3% annual revenue growth rate and an increase in earnings of $1.6 billion from the current $1.1 billion.

Uncover how Hewlett Packard Enterprise's forecasts yield a $26.26 fair value, a 12% upside to its current price.

Exploring Other Perspectives

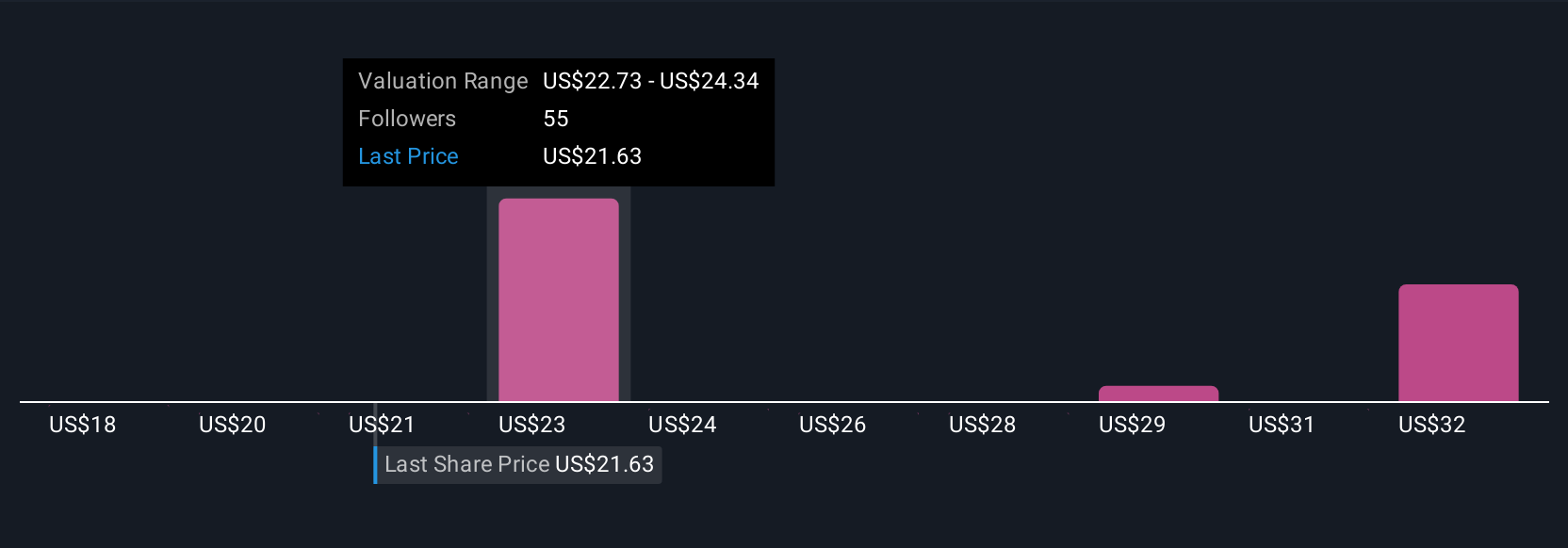

Six private investor fair value estimates for HPE in the Simply Wall St Community range from US$17.90 to US$35.11 per share. While optimism about AI and hybrid cloud catalysts stands out, your outlook may hinge on how these shifting business models reshape long-term margins and returns.

Explore 6 other fair value estimates on Hewlett Packard Enterprise - why the stock might be worth as much as 49% more than the current price!

Build Your Own Hewlett Packard Enterprise Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hewlett Packard Enterprise research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Hewlett Packard Enterprise research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hewlett Packard Enterprise's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.