Please use a PC Browser to access Register-Tadawul

Will Fed Rate Cut and Analyst Upgrades Shift AZZ's (AZZ) Long-Term Trajectory?

AZZ Inc. AZZ | 107.17 107.17 | -2.35% 0.00% Pre |

- The Federal Reserve recently cut its benchmark interest rate by 25 basis points, prompting renewed optimism for industrial companies such as AZZ as investor sentiment turned more positive across the sector.

- Analyst upgrades and improved full-year earnings estimates for AZZ have coincided with broader sector gains, underscoring the combined impact of monetary policy changes and industry-specific momentum.

- We’ll examine how the Federal Reserve’s rate cut and rising analyst confidence could alter AZZ’s long-term investment outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

AZZ Investment Narrative Recap

AZZ's appeal for investors centers on its capacity to translate industrial sector momentum and government infrastructure spending into steady growth, while maintaining capital discipline. The recent Federal Reserve rate cut contributed to a stronger near-term outlook across industrials, yet key risks such as input cost volatility from tariffs remain elevated and were not materially addressed by this policy change; shorter-term catalysts like acquisition execution and new facility ramp-ups still anchor the story.

In this context, AZZ's announcement of a 17.6% dividend increase to US$0.20 per share stands out, signaling management's confidence in cash flows and balance sheet strength even as economic uncertainty lingers. The move compliments sector optimism sparked by the Fed’s rate cut while providing additional value to shareholders amid ongoing operational expansion and debt reduction efforts.

However, in contrast to these strengths, investors should be aware that risks remain from tariff-related cost swings and the potential for new competitive pressures if reshoring accelerates...

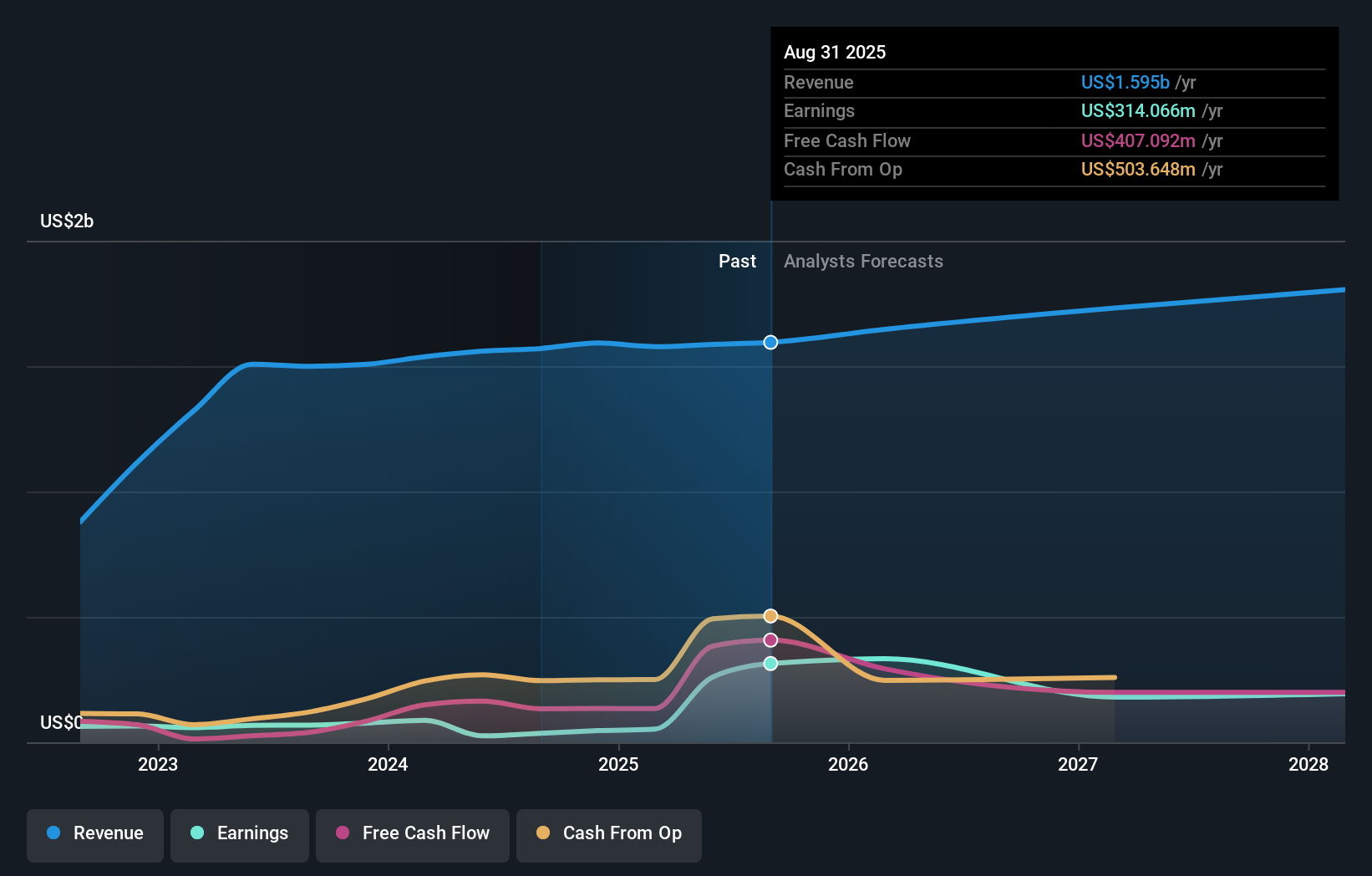

AZZ's outlook anticipates $1.8 billion in revenue and $195.5 million in earnings by 2028. This is based on a 5.0% annual revenue growth rate, but earnings are expected to decrease by $64.6 million from the current $260.1 million.

Uncover how AZZ's forecasts yield a $125.89 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered two fair value estimates for AZZ, ranging from US$84.41 to US$125.89 per share. While some expect overvaluation can persist, the risk of volatile material costs could weigh on future profitability and is causing many to seek out more opinions.

Explore 2 other fair value estimates on AZZ - why the stock might be worth 26% less than the current price!

Build Your Own AZZ Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AZZ research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free AZZ research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AZZ's overall financial health at a glance.

No Opportunity In AZZ?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 31 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.