Please use a PC Browser to access Register-Tadawul

Will First Watch’s (FWRG) Equity Offering and Expansion Plans Shift Its Growth and Profitability Narrative?

First Watch Restaurant Group, Inc. FWRG | 16.33 | -0.18% |

- First Watch Restaurant Group recently filed for a follow-on equity offering of 5,000,000 shares and released second quarter earnings, reporting US$307.89 million in revenue and US$2.11 million in net income, both increases from the prior year.

- Alongside these updates, the company announced plans for significant unit expansion and projected improved profitability for the remainder of fiscal year 2025, despite confirming three restaurant closures.

- We'll examine how the follow-on equity offering and earnings release may influence First Watch's growth and profitability narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

First Watch Restaurant Group Investment Narrative Recap

To be a shareholder in First Watch Restaurant Group, one should believe in the company’s ability to drive restaurant expansion and generate higher profitability from its daytime dining focus, even as margins remain under pressure from rising costs. The recent follow-on equity offering does not appear to materially alter the key catalysts or the most important short-term risk, execution of rapid new unit growth amid ongoing margin compression, though it could provide additional capital support for expansion plans.

Among recent announcements, the confirmation of plans to open 59 to 64 new system-wide restaurants in fiscal 2025 is especially relevant. This move directly supports the catalyst of accelerated market expansion and aims to leverage untapped demand for daytime dining, underpinning First Watch’s revenue growth ambitions while increasing exposure to potential risks around site selection and ramp-up performance.

Yet, in contrast to the upbeat expansion narrative, investors should be aware of the persistent margin pressures from commodity and labor cost inflation, which...

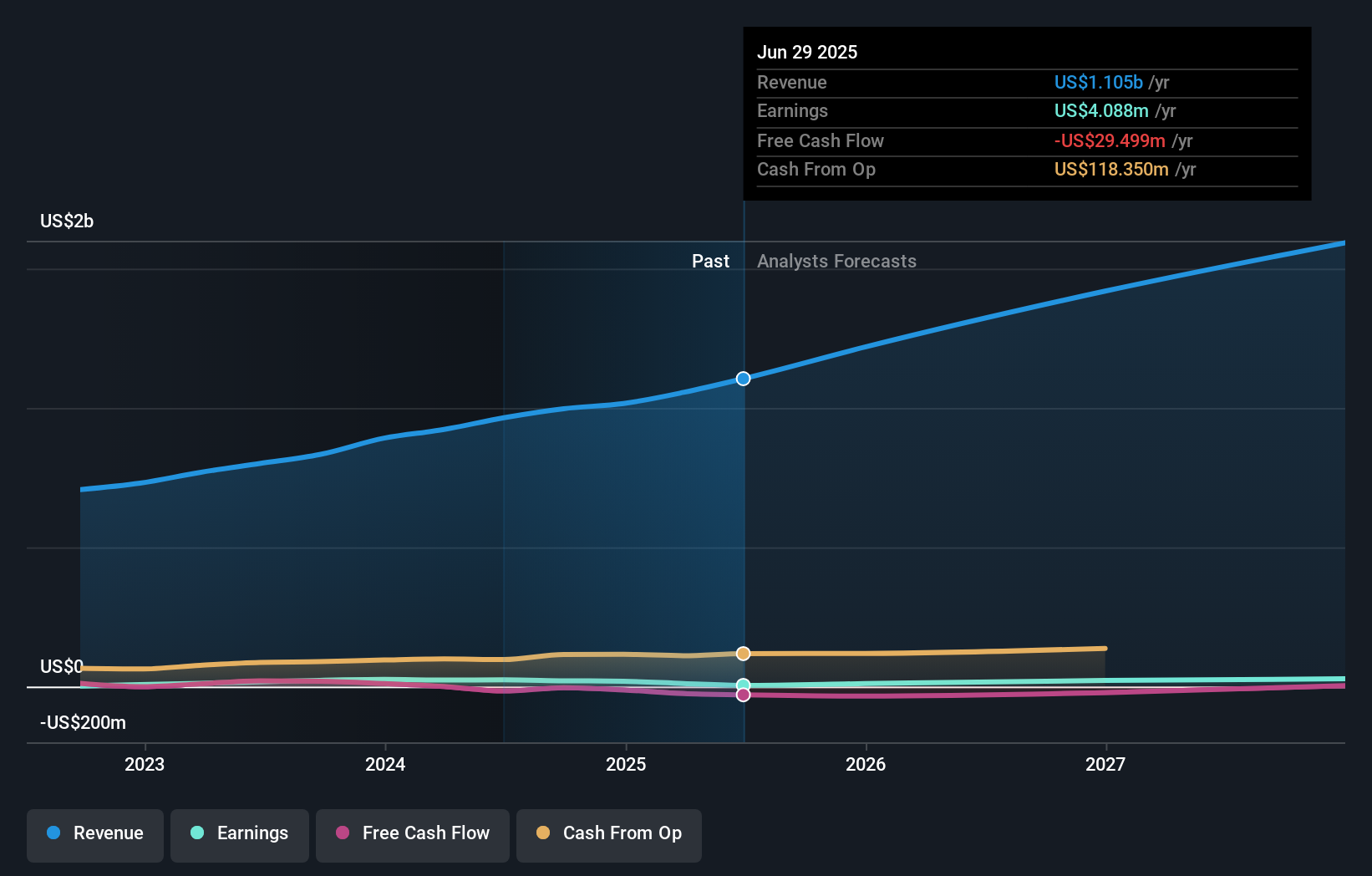

First Watch Restaurant Group's narrative projects $1.7 billion in revenue and $32.7 million in earnings by 2028. This requires 15.0% yearly revenue growth and a $28.6 million increase in earnings from $4.1 million today.

Uncover how First Watch Restaurant Group's forecasts yield a $21.80 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members supplied two distinct fair value estimates for First Watch, ranging from US$7.17 to US$21.80. Opinions contrast sharply as some see potential in the company’s unit growth while others remain cautious about rising input costs and their impact on long-term margins.

Explore 2 other fair value estimates on First Watch Restaurant Group - why the stock might be worth as much as 23% more than the current price!

Build Your Own First Watch Restaurant Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Watch Restaurant Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free First Watch Restaurant Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Watch Restaurant Group's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.