Please use a PC Browser to access Register-Tadawul

Will FormFactor's (FORM) CFO Transition Shed New Light on Management Credibility and Strategy?

FormFactor, Inc. FORM | 55.44 | -4.63% |

- FormFactor reaffirmed its third quarter 2025 earnings guidance in August and announced the appointment of Aric McKinnis as Chief Financial Officer, following the resignation of Shai Shahar, who will stay on as Executive Advisor through year-end.

- This leadership transition comes as the company maintains its financial outlook and prepares for upcoming presentations at major investor conferences in September 2025.

- With stable guidance reaffirmed amid a CFO change, we'll examine how this leadership shift may influence FormFactor's investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

FormFactor Investment Narrative Recap

To own shares of FormFactor, an investor generally needs to believe in the company’s ability to capture growing demand for advanced semiconductor testing tied to AI, high-performance computing, and HBM DRAM. The recent reaffirmation of earnings guidance and CFO transition appears to leave the near-term financial catalyst, capturing AI-driven test demand, unchanged, while significant risks like customer concentration and margin pressure from product mix remain material.

Among recent announcements, the company’s confirmed participation in two major investor conferences in September stands out. These events will likely provide transparency around business stability and leadership changes, which could support confidence as FormFactor addresses its key risk of rapidly shifting product demand.

By contrast, investors should be aware of the ongoing margin headwinds arising from unfavorable product mix and operational cost pressures...

FormFactor's outlook anticipates $984.3 million in revenue and $97.0 million in earnings by 2028. This is based on analysts projecting an annual revenue growth rate of 8.8% and a $53.1 million increase in earnings from current earnings of $43.9 million.

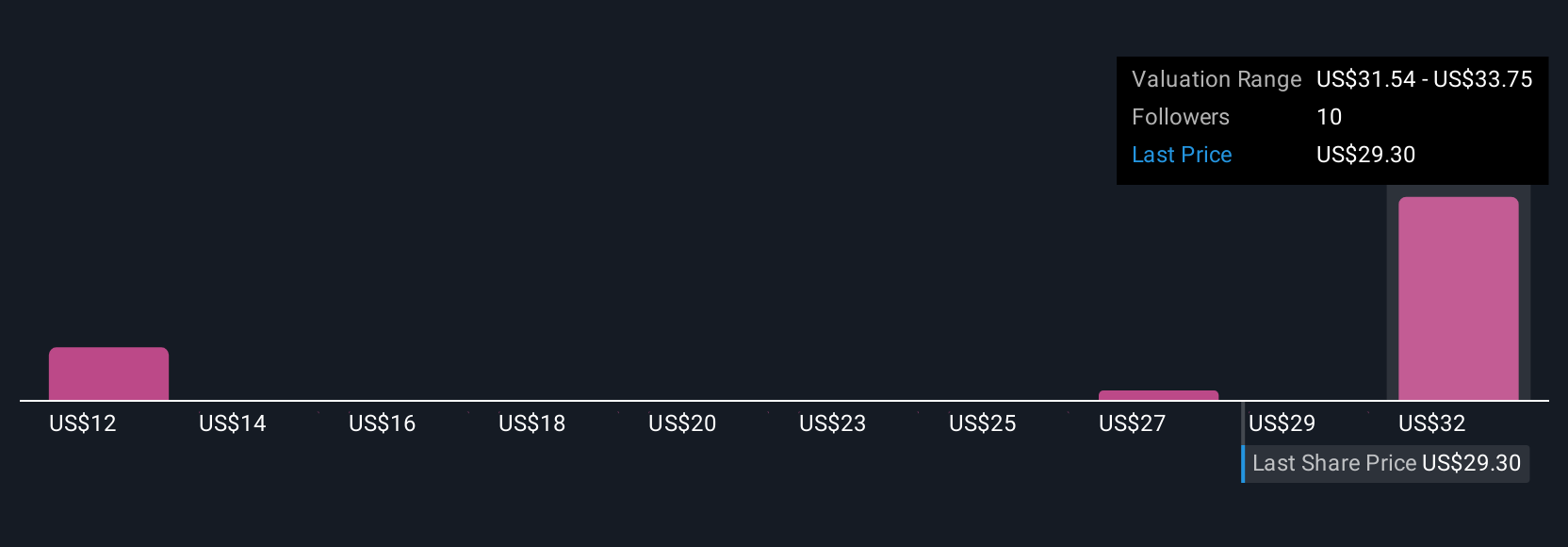

Uncover how FormFactor's forecasts yield a $33.75 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community estimate FormFactor’s fair value anywhere from US$10.83 to US$45 per share. In light of ongoing gross margin pressures, these diverging analyses reflect a wide spectrum of anticipated outcomes and highlight why it’s important to explore several viewpoints before making a decision.

Explore 4 other fair value estimates on FormFactor - why the stock might be worth less than half the current price!

Build Your Own FormFactor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FormFactor research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free FormFactor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FormFactor's overall financial health at a glance.

No Opportunity In FormFactor?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.