Please use a PC Browser to access Register-Tadawul

Will FormFactor's (FORM) Projected Revenue Dip Challenge Its Competitive Positioning in the Semiconductor Market?

FormFactor, Inc. FORM | 55.44 | -4.63% |

- FormFactor is scheduled to report its Q2 earnings this week, with analysts anticipating a 4.1% year-on-year decline in revenue, reversing last year’s growth trend.

- Most analysts have maintained their estimates ahead of the results, indicating stable expectations despite uncertainty over the revenue outlook.

- We’ll now consider what the anticipated year-on-year revenue contraction could mean for FormFactor’s investment narrative and outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

FormFactor Investment Narrative Recap

To own FormFactor stock, investors need to believe in the semiconductor industry's long-term demand and the company's role in high-bandwidth memory (HBM) and advanced probe card solutions. The expected year-on-year Q2 revenue decline marks a pause in previously seen growth, but with analysts holding estimates steady, the near-term outcome likely hinges on underlying DRAM demand and the HBM transition, while continued reliance on these markets remains the greatest risk. Unless the magnitude of contraction is larger than expected, the near-term catalyst of HBM-driven recovery is not drastically impacted.

Of the recent announcements, FormFactor’s inclusion in multiple Russell indices in June stands out for this context, as it may encourage broader investor interest and improve trading liquidity. However, index inclusion doesn't address the underlying risk associated with supply chain costs or the critical dependency on DRAM and HBM cycles, which continue to drive both short-term results and long-term confidence in the story.

But against those supportive industry trends, investors should remain mindful of potential setbacks if DRAM demand or HBM adoption slows...

FormFactor's narrative projects $948.2 million in revenue and $83.4 million in earnings by 2028. This requires 7.4% annual revenue growth and a $29.2 million increase in earnings from $54.2 million today.

Uncover how FormFactor's forecasts yield a $37.38 fair value, a 7% upside to its current price.

Exploring Other Perspectives

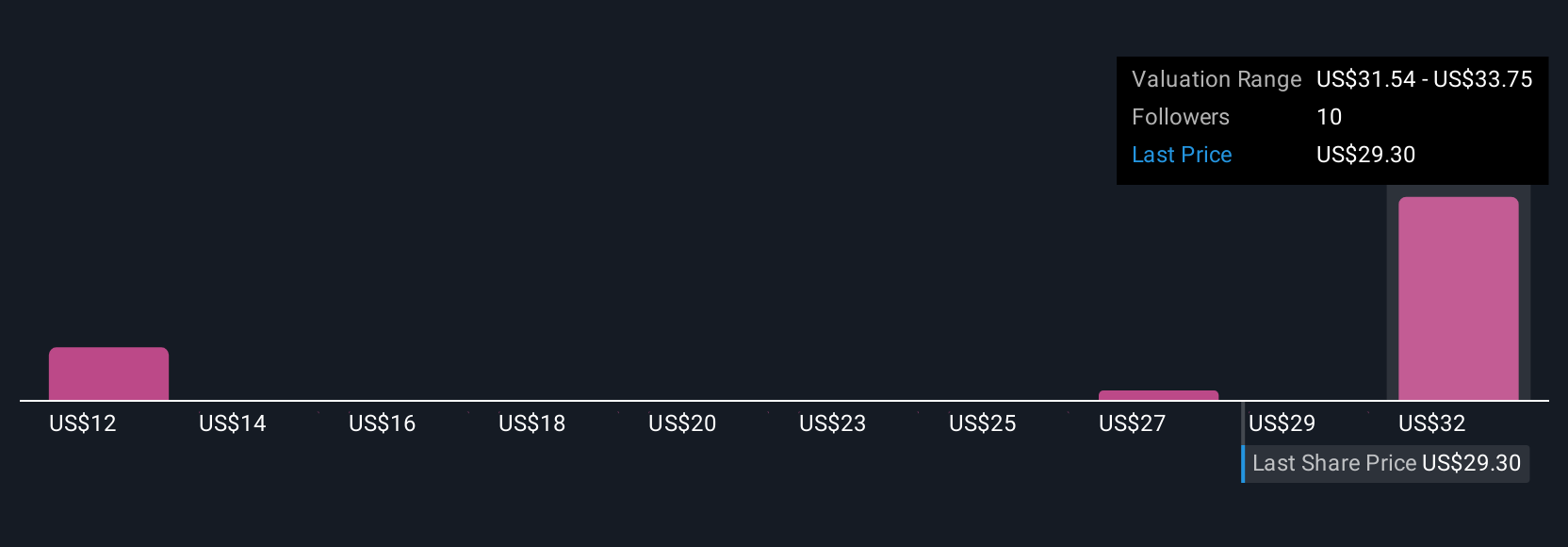

Three community members on Simply Wall St set fair value estimates for FormFactor from US$10.36 to US$37.38, revealing a wide spectrum of outlooks. While some anticipate continued gains, others caution against the ongoing risks tied to DRAM market exposure, underscoring the need to consider a range of opinions.

Explore 3 other fair value estimates on FormFactor - why the stock might be worth as much as 7% more than the current price!

Build Your Own FormFactor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FormFactor research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free FormFactor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FormFactor's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.