Please use a PC Browser to access Register-Tadawul

Will Hims & Hers Health's (HIMS) Lab Partnership Shape Its Path to Recurring Revenue Leadership?

Hims & Hers Health, Inc. Class A HIMS | 25.54 | -3.40% |

- Earlier this month, Hims & Hers Health announced the launch of Labs, a direct-to-consumer laboratory testing platform in partnership with Quest Diagnostics, offering customers affordable access to over 120 biomarker tests and doctor-developed action plans for proactive health management.

- This move not only strengthens the company's personalized healthcare offerings but also signals a shift toward preventative care solutions in an evolving digital health landscape.

- Next, we'll explore how this direct-to-consumer lab partnership enhances Hims & Hers Health's investment narrative and outlook on recurring revenue streams.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Hims & Hers Health Investment Narrative Recap

For shareholders, the key investment thesis in Hims & Hers Health centers on its ability to drive recurring, high-margin revenue through an expanding suite of accessible, digital healthcare solutions. While the Labs launch with Quest Diagnostics aligns with this vision by reinforcing product personalization and engagement, its immediate impact on top short-term catalysts, customer retention and revenue per user, appears incremental. The biggest risk remains margin pressure as ongoing investments and marketing spend continue to rise.

Of the recent corporate announcements, the narrowed full-year guidance is most closely tied to the Labs initiative, as both reflect management's efforts to balance growth with near-term profitability. This revenue outlook comes amid rapid product rollouts, reinforcing the need to carefully monitor whether investments in new offerings translate to sustained subscriber spending and cost efficiencies.

In contrast, investors should also be aware of mounting risks from regulatory and operational complexity as the healthcare platform scales into more specialties and preventative care...

Hims & Hers Health's outlook projects $3.3 billion in revenue and $261.3 million in earnings by 2028. This is based on an anticipated 18.3% annual revenue growth rate and an increase in earnings of about $67.7 million from the current $193.6 million.

Uncover how Hims & Hers Health's forecasts yield a $46.67 fair value, a 26% upside to its current price.

Exploring Other Perspectives

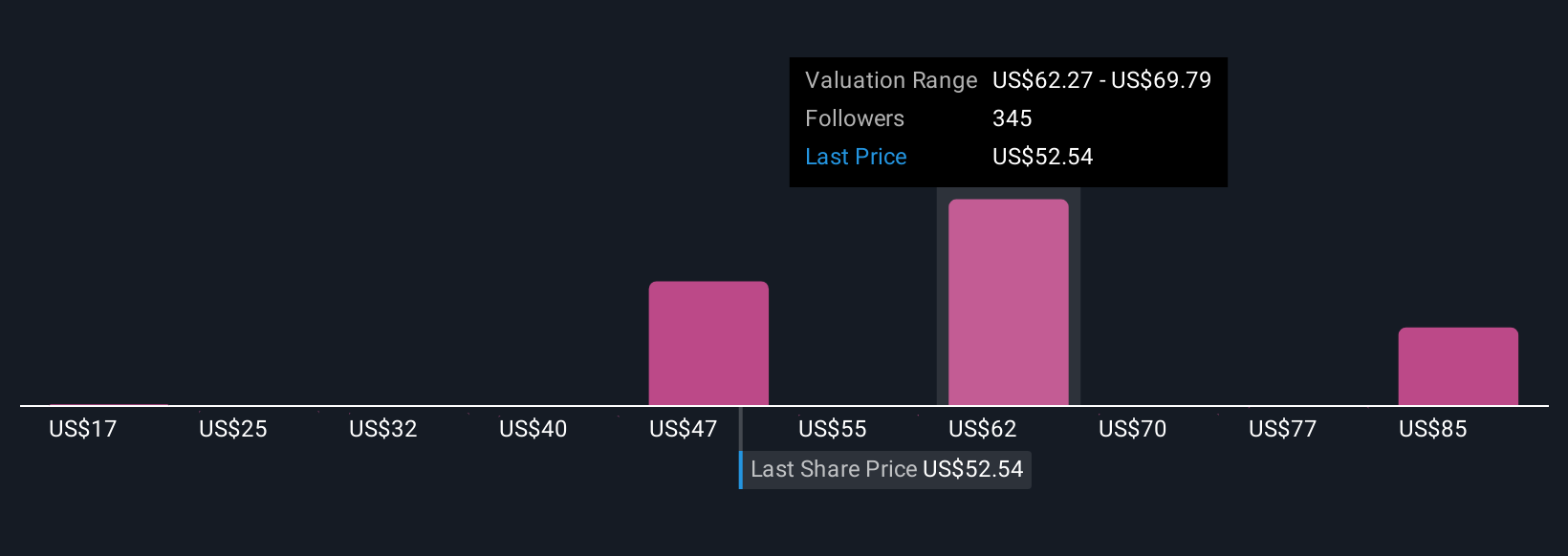

The Simply Wall St Community generated 39 fair value estimates for Hims & Hers Health, ranging from US$34.69 to US$97.04 a share. While some project substantial upside, ongoing margin and cost pressures remind us opinions differ widely on future profitability, explore a range of viewpoints to form your own assessment.

Explore 39 other fair value estimates on Hims & Hers Health - why the stock might be worth 6% less than the current price!

Build Your Own Hims & Hers Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hims & Hers Health research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hims & Hers Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hims & Hers Health's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.