Please use a PC Browser to access Register-Tadawul

Will HoldCo’s Push for a Sale and Board Shakeup Change Comerica’s (CMA) Narrative

Comerica Incorporated CMA | 88.67 | 0.00% |

- On September 2, 2025, HoldCo Asset Management, LP publicly announced its intention to initiate a board fight at Comerica Incorporated, urging the company to explore a sale and threatening to nominate five new directors if a sale is not considered.

- This move reflects growing investor frustration with Comerica’s extended period of underperformance and raises the possibility of significant changes in leadership or strategic direction at the bank.

- We’ll examine how HoldCo’s push for a potential sale and new board members could reshape Comerica’s future business outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Comerica Investment Narrative Recap

To be a shareholder in Comerica, you need to believe that its strong presence in high-growth markets and ongoing digital investments will translate into sustainable long-term earnings growth, despite modest near-term revenue expansion and a historically challenged cost structure. The recent activist push by HoldCo Asset Management, calling for a sale and potential board changes, could become a short-term catalyst, or risk, depending on whether it catalyzes transformative action or creates uncertainty, but for now the direct impact on core business drivers appears limited.

In the context of this activist pressure for strategic shifts, Comerica’s Q2 2025 earnings release is relevant, it showed higher net interest income year-on-year but another dip in net income and EPS. This underscores the core challenges in balancing profitability with necessary investments, and frames why shareholders seeking quicker progress might support external intervention or fresh leadership intent on accelerating changes.

By contrast, even with activist activity intensifying, investors should be aware that Comerica’s structurally higher expenses...

Comerica's outlook projects $3.5 billion in revenue and $702.1 million in earnings by 2028. This scenario requires 3.1% annual revenue growth and a $10.1 million earnings increase from current earnings of $692.0 million.

Uncover how Comerica's forecasts yield a $67.38 fair value, a 4% downside to its current price.

Exploring Other Perspectives

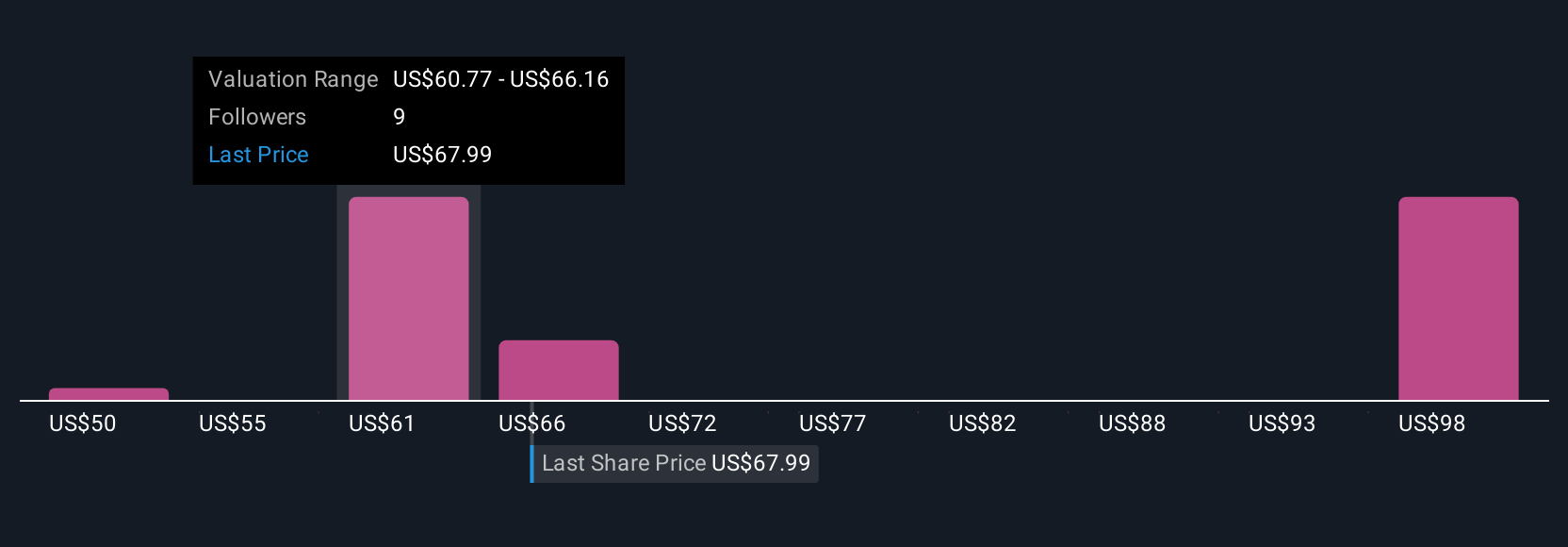

Five fair value estimates from the Simply Wall St Community range from US$50.00 to US$89.78, showing wide divergence. Many see robust Sunbelt growth as a catalyst, but elevated costs could test earnings improvement over time.

Explore 5 other fair value estimates on Comerica - why the stock might be worth as much as 27% more than the current price!

Build Your Own Comerica Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Comerica research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Comerica research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Comerica's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.