Please use a PC Browser to access Register-Tadawul

Will HPE’s (HPE) AI-Driven 5G Partnership Reveal a New Edge in Telecom Innovation?

Hewlett Packard Enterprise Co. HPE | 23.87 | -2.73% |

- Earlier this week, Ericsson and Hewlett Packard Enterprise announced the launch of a joint validation lab in Sweden to help telecommunications providers test and deploy AI-enabled, cloud-native 5G solutions across multi-vendor infrastructure. The facility brings together Ericsson’s dual-mode 5G core, HPE ProLiant Gen12 servers, Juniper Networking switches, and Red Hat OpenShift, aiming to streamline network innovation and operational complexity for telcos.

- This collaboration reflects the industry's shift towards interoperable, cloud-based networks as service providers seek higher performance and agility while managing the challenges of rapid service rollouts.

- We'll explore how the company's soft 2026 guidance and ambitious focus on AI-driven innovation alter Hewlett Packard Enterprise's investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Hewlett Packard Enterprise Investment Narrative Recap

To own shares in Hewlett Packard Enterprise, you need to believe the company's move toward AI-powered networking and cloud services can deliver growth and offset its traditional hardware exposure. The new Ericsson partnership highlights HPE’s commitment to long-term innovation, but the most immediate catalyst, leveraging AI and networking to drive margin improvement, remains constrained by near-term revenue headwinds and post-acquisition execution risks. This news does not materially alter those short-term drivers or the key risk of integrating Juniper, which is central to future profit growth.

Among HPE's recent updates, the 10 percent dividend increase for fiscal 2026 stands out as most relevant in this context. This move reflects management’s confidence in cash flow generation and willingness to reward shareholders, providing support for investor sentiment as HPE seeks to refocus the business around higher-growth segments like AI and networking, even as short-term integration challenges and market competition persist.

In contrast, shareholders should remain alert to the risk that cost synergies and sales momentum from the Juniper deal might take longer to materialize than expected if...

Hewlett Packard Enterprise's outlook anticipates $44.4 billion in revenue and $2.7 billion in earnings by 2028. This forecasts a 10.3% annual revenue growth rate and a $1.6 billion increase in earnings from the current $1.1 billion.

Uncover how Hewlett Packard Enterprise's forecasts yield a $26.26 fair value, a 17% upside to its current price.

Exploring Other Perspectives

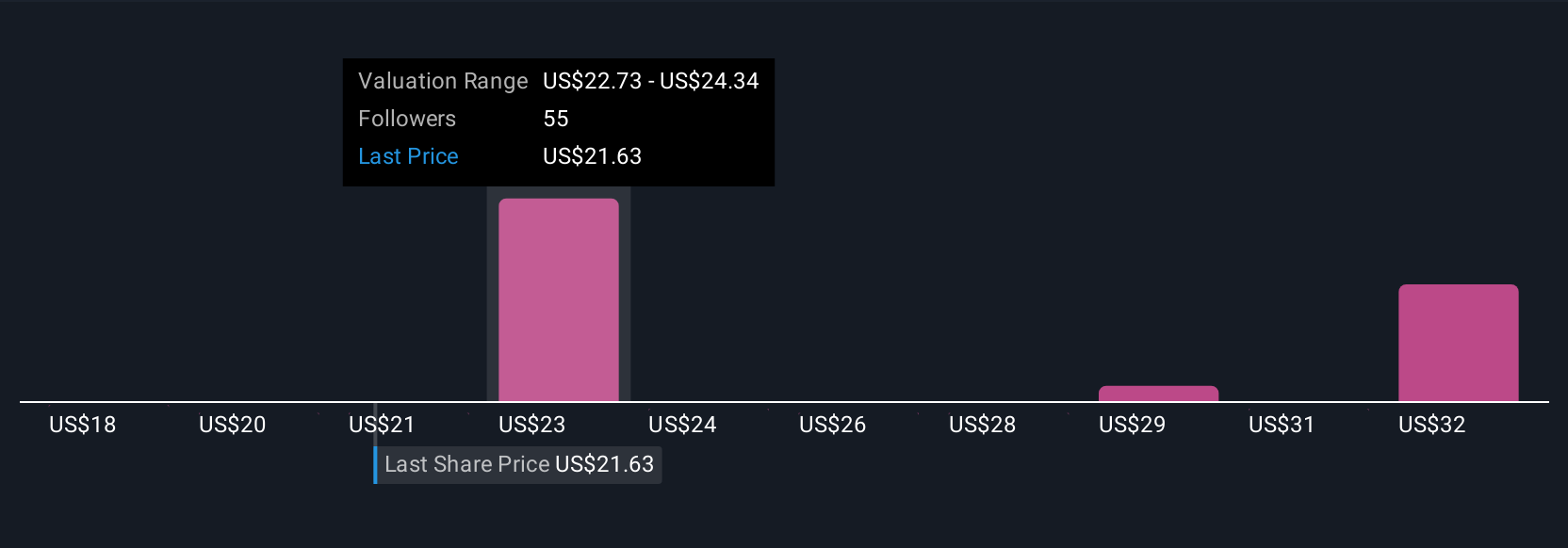

Simply Wall St Community estimates for HPE’s fair value range from US$17.90 to US$59.74 across 7 perspectives. With integration execution still a material risk, these wide opinions underline how future profitability could hinge on successful synergy and margin delivery.

Explore 7 other fair value estimates on Hewlett Packard Enterprise - why the stock might be worth 20% less than the current price!

Build Your Own Hewlett Packard Enterprise Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hewlett Packard Enterprise research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Hewlett Packard Enterprise research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hewlett Packard Enterprise's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.