Please use a PC Browser to access Register-Tadawul

Will Japan’s Approval of Iodine Hip Implants Redefine Zimmer Biomet Holdings' (ZBH) Infection Prevention Narrative?

Zimmer Biomet Holdings, Inc. ZBH | 91.59 91.59 | -0.93% 0.00% Pre |

- Zimmer Biomet Holdings recently announced that Japan's Pharmaceutical and Medical Devices Agency (PMDA) approved its iTaperloc Complete and iG7 Hip System, the world's first orthopedic implants featuring Iodine Technology to prevent bacterial adhesion.

- This regulatory milestone addresses the significant risk of infection in joint replacement surgeries, marking a step forward in infection management solutions for orthopedic patients.

- We'll examine how the approval of Iodine Technology hip implants in Japan could reshape Zimmer Biomet's long-term investment outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Zimmer Biomet Holdings Investment Narrative Recap

Owning Zimmer Biomet Holdings means believing that ongoing innovation in orthopedic implants, combined with a growing elderly population, can drive meaningful long-term growth. While the recent PMDA approval for its Iodine Technology hip implants highlights Zimmer Biomet's focus on reducing surgical infection risk, a persistent challenge, the news is unlikely to materially move the needle for near-term revenue growth or fully address the company's integration and pricing pressure risks just yet.

Zimmer Biomet’s recently announced agreement to acquire Monogram Technologies stands out, especially as the PMDA approval further expands its infection management portfolio. This acquisition, expected to close by end of 2025, could potentially bolster Zimmer Biomet’s robotics capabilities, offering a potential catalyst for future revenue diversification.

However, investors should also keep in mind that, despite innovation, uncertainty around regulatory timelines for new robotics platforms remains a risk that ...

Zimmer Biomet Holdings’ outlook anticipates $9.2 billion in revenue and $1.3 billion in earnings by 2028. This is based on a forecasted annual revenue growth rate of 5.5%, and represents a $476.5 million increase in earnings from the current $823.5 million level.

Uncover how Zimmer Biomet Holdings' forecasts yield a $110.92 fair value, a 10% upside to its current price.

Exploring Other Perspectives

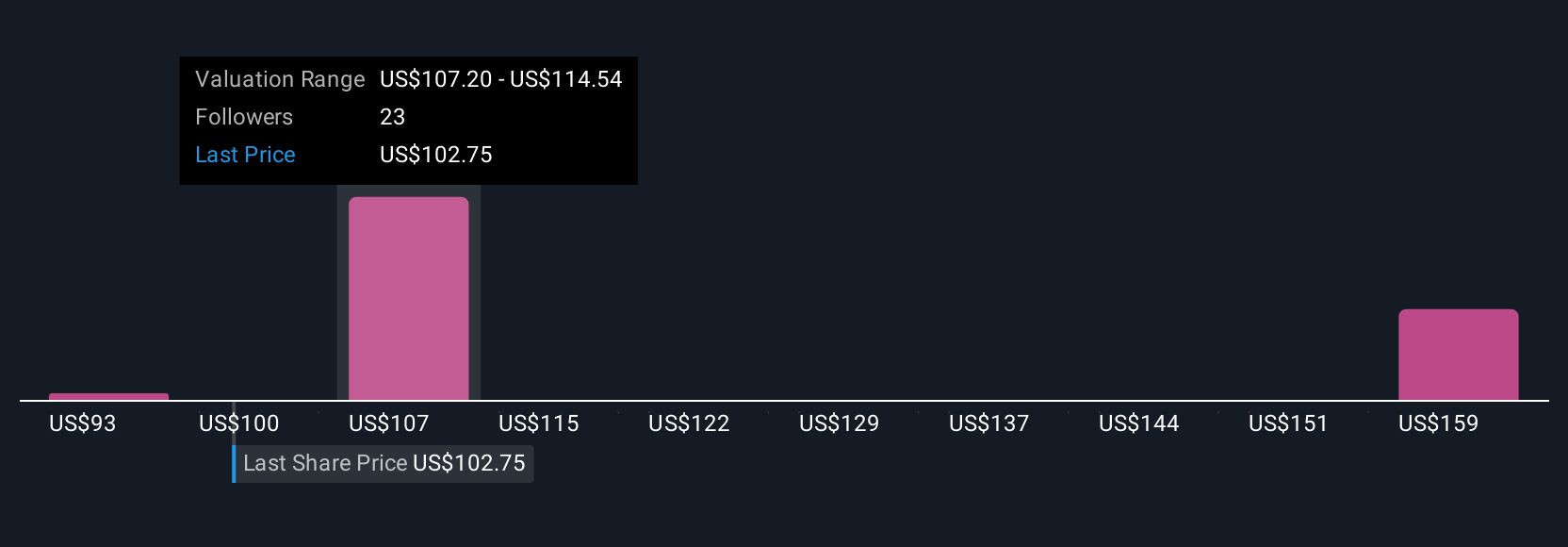

Four opinions from the Simply Wall St Community place Zimmer Biomet’s fair value between US$92.52 and US$169.81 per share. With regulatory delays and integration challenges still in play, you can explore how others interpret the risks and opportunities ahead.

Explore 4 other fair value estimates on Zimmer Biomet Holdings - why the stock might be worth 8% less than the current price!

Build Your Own Zimmer Biomet Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zimmer Biomet Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Zimmer Biomet Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zimmer Biomet Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are the new gold rush. Find out which 34 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.