Please use a PC Browser to access Register-Tadawul

Will JFrog’s (FROG) Board Refresh Strengthen Its Edge in AI-Driven Enterprise Software Innovation?

JFrog Ltd. FROG | 68.98 | +0.94% |

- JFrog Ltd. recently appointed Sigal Zarmi to its Board of Directors, effective November 1, 2025, bringing her deep CIO and board experience from leading firms including ADT, GoDaddy, and Staples.

- Zarmi’s background in driving technology transformation and her expertise in enterprise IT leadership could further enhance JFrog’s focus on DevOps, DevSecOps, and MLOps amid ongoing AI adoption trends.

- We'll explore how Zarmi's addition to the board may influence JFrog's positioning for enterprise growth in AI-driven software development.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

JFrog Investment Narrative Recap

To be a shareholder in JFrog, an investor needs confidence in the expanding demand for AI-ready DevOps and secure software supply chain offerings, where JFrog’s platform aims to serve as a core enterprise solution. The appointment of Sigal Zarmi builds on this vision but is unlikely to notably shift the most important short-term catalyst, enterprise adoption of JFrog’s new AI and security tools, or the ongoing risk of slower cloud migration and elongated sales cycles among large customers.

The most relevant recent announcement is the September 2025 launch of JFrog AppTrust and the JFrog AI Catalog, both focused on automating security, governance, and model management as AI adoption grows. These solutions directly support the company’s push to win larger, multi-year enterprise deals, a key catalyst, but do not eliminate the risk from increasing customer concentration and contract renegotiation that could affect revenue stability.

By contrast, investors should also be aware of how increased reliance on large, multi-year enterprise contracts could expose future earnings to...

JFrog's outlook anticipates $736.3 million in revenue and $96.4 million in earnings by 2028. This requires 15.8% annual revenue growth and an earnings increase of $182.7 million from current earnings of $-86.3 million.

Uncover how JFrog's forecasts yield a $54.88 fair value, a 14% upside to its current price.

Exploring Other Perspectives

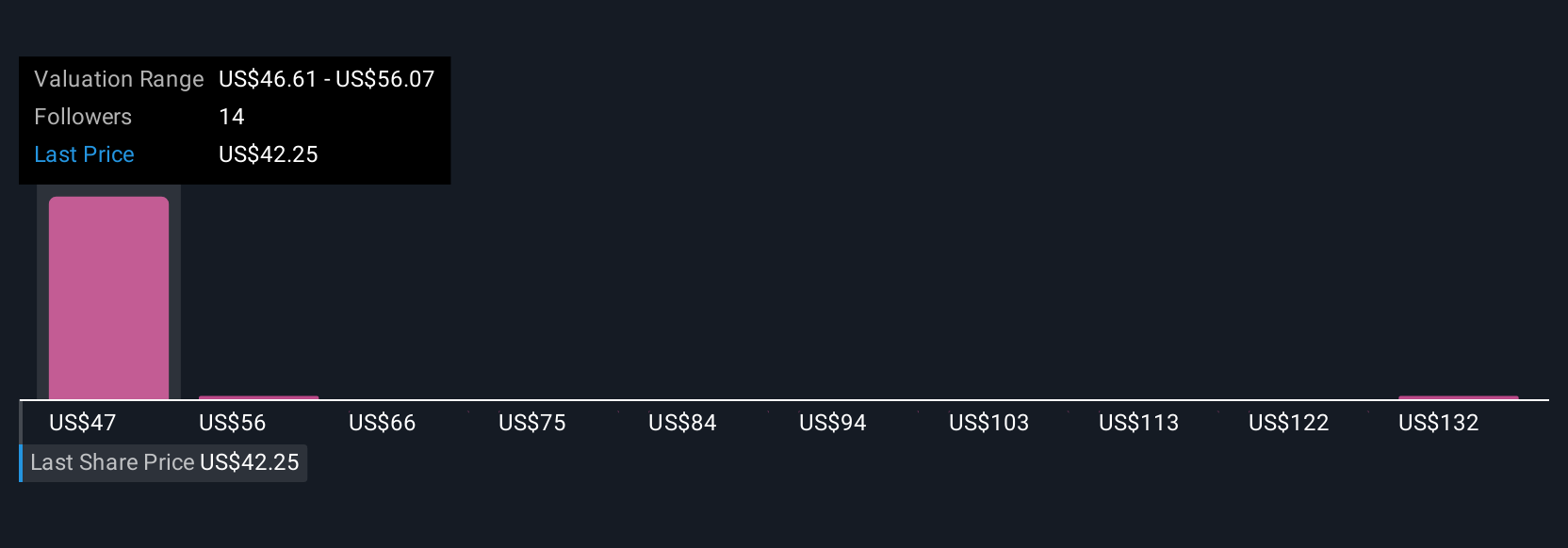

Four members of the Simply Wall St Community set JFrog’s fair value anywhere from US$29.68 to US$141.21 per share, reflecting wide-ranging views. Strong momentum in new business wins may not offset potential volatility if key enterprise contracts are delayed or lost, highlighting the importance of examining multiple perspectives on the company’s performance and outlook.

Explore 4 other fair value estimates on JFrog - why the stock might be worth over 2x more than the current price!

Build Your Own JFrog Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JFrog research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free JFrog research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JFrog's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 32 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.