Please use a PC Browser to access Register-Tadawul

Will Lower Rates Change Grocery Outlet’s (GO) Value Strategy or Just Short-Term Sentiment?

Grocery Outlet Holding GO | 9.93 | -2.98% |

- Recently, shares of Grocery Outlet Holding rose after a Federal Reserve official signaled the possibility of upcoming interest rate cuts, which boosted optimism among retailers heading into the peak holiday spending season.

- This event is particularly striking because it lifted investor sentiment despite the company's recent disappointing quarterly results and lowered guidance, highlighting how macroeconomic signals can influence outlooks for value-oriented grocers.

- We'll consider how the prospect of lower interest rates could influence Grocery Outlet's consumer demand expectations and reshape its investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Grocery Outlet Holding Investment Narrative Recap

To be a shareholder in Grocery Outlet Holding, you need to believe that the company can continue attracting value-conscious shoppers and drive performance through disciplined store expansion and merchandising innovation. While the recent boost in shares on the prospect of lower interest rates provides a tailwind for short-term consumer demand, ongoing weakness in comparable sales and profit margins remains the most significant risk. The impact of interest rate optimism appears modest relative to the need for tangible improvements in store execution and earnings recovery.

One recent announcement that stands out is the company’s decision to lower its full-year guidance, revising targets for both net sales and same-store sales growth following underperformance in the latest quarter. This signals the near-term challenge of translating improved consumer confidence, potentially spurred by lower rates, into actual top-line momentum, reaffirming the importance of operational improvement as the key catalyst for a positive investment narrative.

However, against the backdrop of interest rate optimism, investors should also consider the risk that persistent margin pressure could…

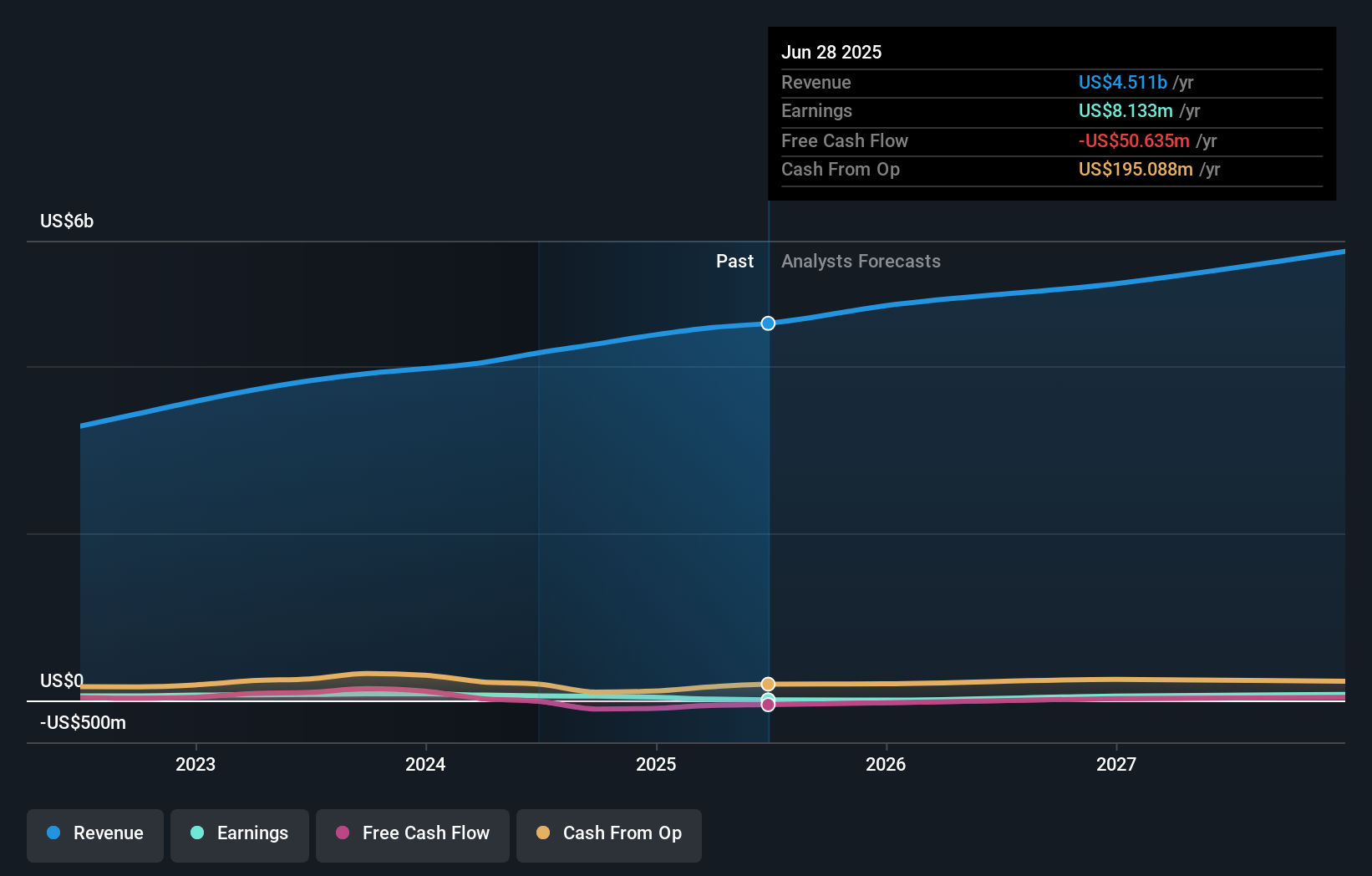

Grocery Outlet Holding is forecast to achieve $5.7 billion in revenue and $88.0 million in earnings by 2028. This outlook assumes annual revenue growth of 8.3% and a jump in earnings of $79.9 million from the current $8.1 million.

Uncover how Grocery Outlet Holding's forecasts yield a $17.15 fair value, a 67% upside to its current price.

Exploring Other Perspectives

All one Community member on Simply Wall St values the stock at US$17.15 per share, pointing to a possible disconnect with the current market price. With cost pressures showing little sign of easing, it’s worth exploring how alternate views weigh the balance between value potential and near-term risks.

Explore another fair value estimate on Grocery Outlet Holding - why the stock might be worth as much as 67% more than the current price!

Build Your Own Grocery Outlet Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Grocery Outlet Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Grocery Outlet Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Grocery Outlet Holding's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.