Please use a PC Browser to access Register-Tadawul

Will Lululemon’s (LULU) Partnership Strategy Offset Competitive Pressures in a Shifting Retail Landscape?

Lululemon Athletica Inc LULU | 204.59 | -0.82% |

- In recent news, lululemon athletica filed a lawsuit against Costco, aiming to halt the sale of alleged knockoff items that could erode its brand strength. Meanwhile, American Express announced a refreshed Platinum card for U.S. customers, featuring benefits like statement credits for lululemon purchases through a new partnership.

- This heightened focus on brand protection and prominent collaborations illustrates lululemon's efforts to reinforce its market presence amid changing consumer trends and competitive pressure.

- We'll examine how lululemon's partnership with American Express could reshape its investment narrative in the context of recent legal action.

Rare earth metals are the new gold rush. Find out which 31 stocks are leading the charge.

lululemon athletica Investment Narrative Recap

Being a lululemon athletica shareholder means believing the company can rekindle growth through new product cycles and international expansion, despite near-term pressures in its core U.S. market and margin headwinds from tariffs. Recent legal action against Costco is unlikely to alter the most important short-term catalyst, U.S. product innovation, nor does it materially change the biggest risk, which remains weakness in U.S. demand for casual and lifestyle products.

Among recent corporate announcements, lululemon's updated guidance lowering full-year revenue and earnings projections is particularly relevant amid these brand and margin questions. This adjustment reflects persistent business challenges and places even more weight on efforts to revive U.S. sales as a critical driver for any rebound in results.

However, in contrast to past years, the rising risk of further gross margin compression from heavy promotional activity is something investors should be aware of...

lululemon athletica's outlook forecasts $12.8 billion in revenue and $1.9 billion in earnings by 2028. This scenario assumes annual revenue growth of 5.4% and a modest earnings increase of $0.1 billion from the current earnings of $1.8 billion.

Uncover how lululemon athletica's forecasts yield a $202.60 fair value, a 19% upside to its current price.

Exploring Other Perspectives

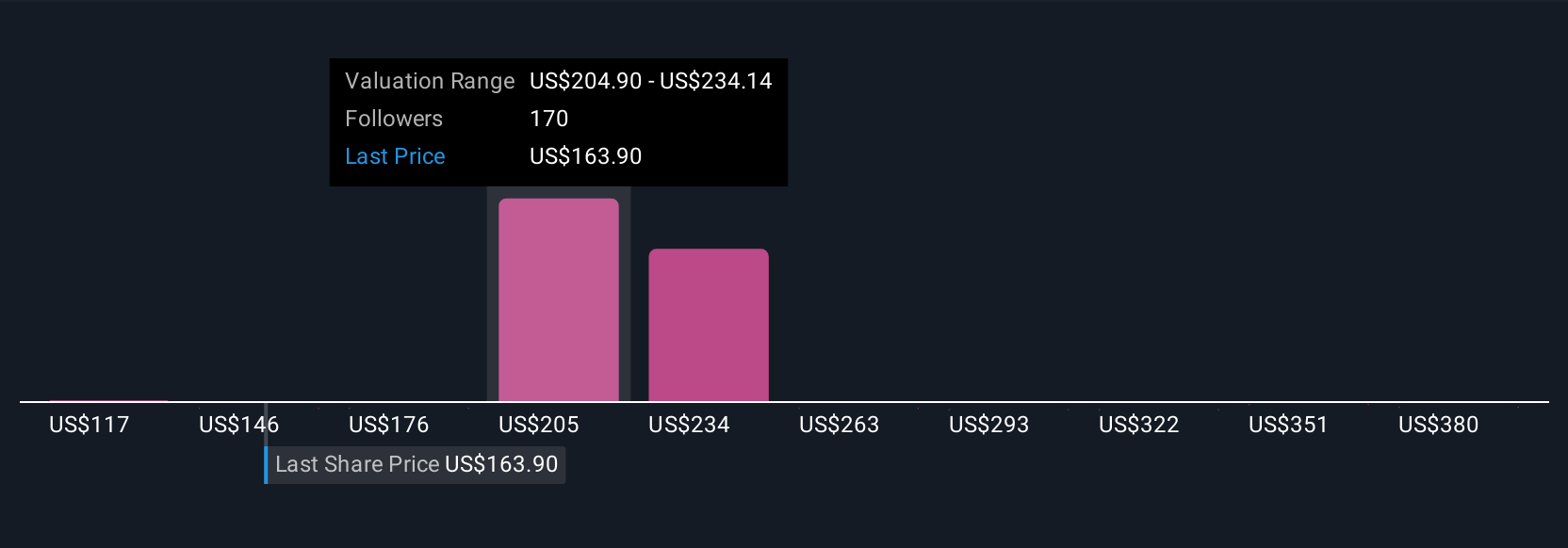

Fifty-two different Simply Wall St Community members have set fair value estimates for lululemon ranging from US$117 to US$409 per share, reflecting a wide span of independent views. While some see the company as undervalued, ongoing macro and competitive headwinds remain a focal point for future performance, so consider how your outlook compares to others.

Explore 52 other fair value estimates on lululemon athletica - why the stock might be worth over 2x more than the current price!

Build Your Own lululemon athletica Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your lululemon athletica research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free lululemon athletica research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate lululemon athletica's overall financial health at a glance.

No Opportunity In lululemon athletica?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.