Please use a PC Browser to access Register-Tadawul

Will MasTec’s (MTZ) M&A Selectivity Strengthen Its Position in AI Infrastructure and Energy Markets?

MasTec, Inc. MTZ | 221.01 221.01 | -5.12% 0.00% Pre |

- Earlier this month, MasTec, Inc. announced its openness to mergers and acquisitions, emphasizing selectivity and a focus on transactions that meaningfully enhance its earnings performance and service capabilities.

- This willingness to pursue targeted deals aligns with MasTec’s positioning as a key player benefiting from rapid growth in AI-driven infrastructure, energy, and communications markets.

- We’ll explore how MasTec’s proactive M&A strategy could amplify the company’s growth trajectory and investment outlook going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

MasTec Investment Narrative Recap

MasTec’s investment appeal rests on confidence in structural growth across U.S. energy, grid, and communications infrastructure. The company’s newly restated openness to mergers and acquisitions may reinforce its short-term growth catalyst, securing new project awards to support its revenue backlog, but is unlikely to significantly alter its current exposure to execution risk on large, complex projects or its reliance on robust customer demand. For now, these headwinds remain front of mind.

Among recent updates, MasTec’s July decision to boost full-year 2025 earnings guidance carries the most relevance to its M&A commentary. Revised forecasts now put revenue in the range of US$13.9 to US$14.0 billion and net income at US$388 to US$408 million, reflecting growing management confidence in both market demand and operational performance, but these projections still hinge on successful conversion of its record backlog and the effective integration of any acquisitions.

However, investors should also recognize that, if anticipated project demand fails to materialize or major contracts are delayed, ...

MasTec's narrative projects $17.2 billion revenue and $730.8 million earnings by 2028. This requires 9.6% yearly revenue growth and a $465.2 million earnings increase from $265.6 million today.

Uncover how MasTec's forecasts yield a $211.79 fair value, a 5% upside to its current price.

Exploring Other Perspectives

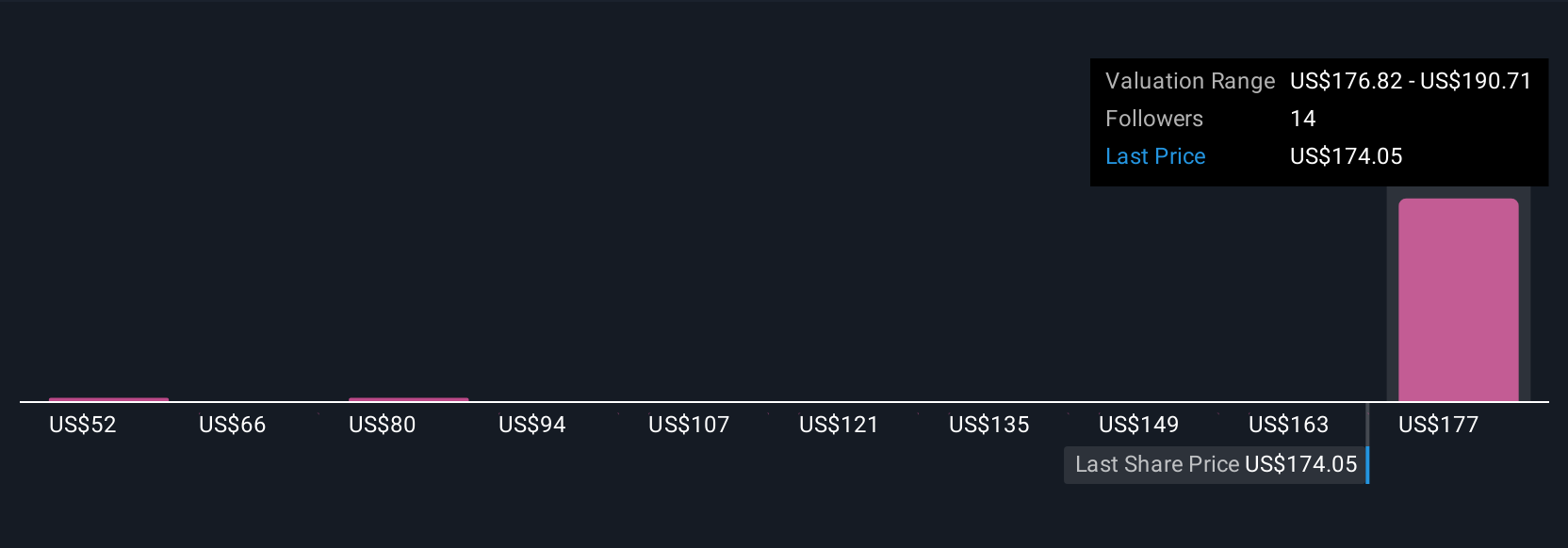

Four different fair value estimates from the Simply Wall St Community span from as low as US$51.88 up to US$211.79 per share. While optimism around MasTec’s enhanced earnings guidance is high, the risk of project delays and margin pressure remains a key factor shaping some of these contrasting outlooks.

Explore 4 other fair value estimates on MasTec - why the stock might be worth as much as 5% more than the current price!

Build Your Own MasTec Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MasTec research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MasTec research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MasTec's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.