Please use a PC Browser to access Register-Tadawul

Will Moelis (MC) Analyst Support Reinforce Its Standing in a Shifting Investment Banking Landscape?

Moelis & Co. Class A MC | 63.18 | +0.72% |

- Earlier today, Moelis & Company received renewed attention after an analyst maintained a positive outlook on the firm despite a revised view, coinciding with a broader upswing in U.S. equity markets.

- This analyst reaffirmation appeared to encourage investor confidence, with market participants reacting strongly even amid evolving expectations within the investment banking sector.

- We'll explore how the reaffirmed analyst outlook during a positive market session influences Moelis's investment narrative and sector outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Moelis Investment Narrative Recap

To own Moelis shares, an investor usually needs to be confident in the firm’s ability to grow its deal flow and earnings through specialized advisory services and expansion efforts, especially in areas like Private Capital Advisory. The recent reaffirmed 'Outperform' rating likely reinforces this narrative in the short term, but the lowered price target and ongoing volatility in transaction activity mean the most important catalyst, consistent growth in fee-generating mandates, remains unchanged, and key risks around expense pressure and earnings swings are not materially impacted by this news.

One recent development closely tied to catalysts is Moelis’s strong Q2 earnings, which showed a jump in net income to US$41.54 million from last year’s US$13.16 million. While this improvement is encouraging for margin and revenue momentum, the short-term focus still sits on whether such performance can be sustained through continued expansion and stable deal activity in a competitive sector.

By contrast, higher compensation costs tied to Moelis’s aggressive hiring and retention model remain a risk investors should be watching closely if...

Moelis is projected to reach $2.1 billion in revenue and $381.7 million in earnings by 2028. This outlook assumes a 15.3% annual revenue growth rate and reflects a $183.6 million increase in earnings from the current $198.1 million.

Uncover how Moelis' forecasts yield a $80.00 fair value, a 22% upside to its current price.

Exploring Other Perspectives

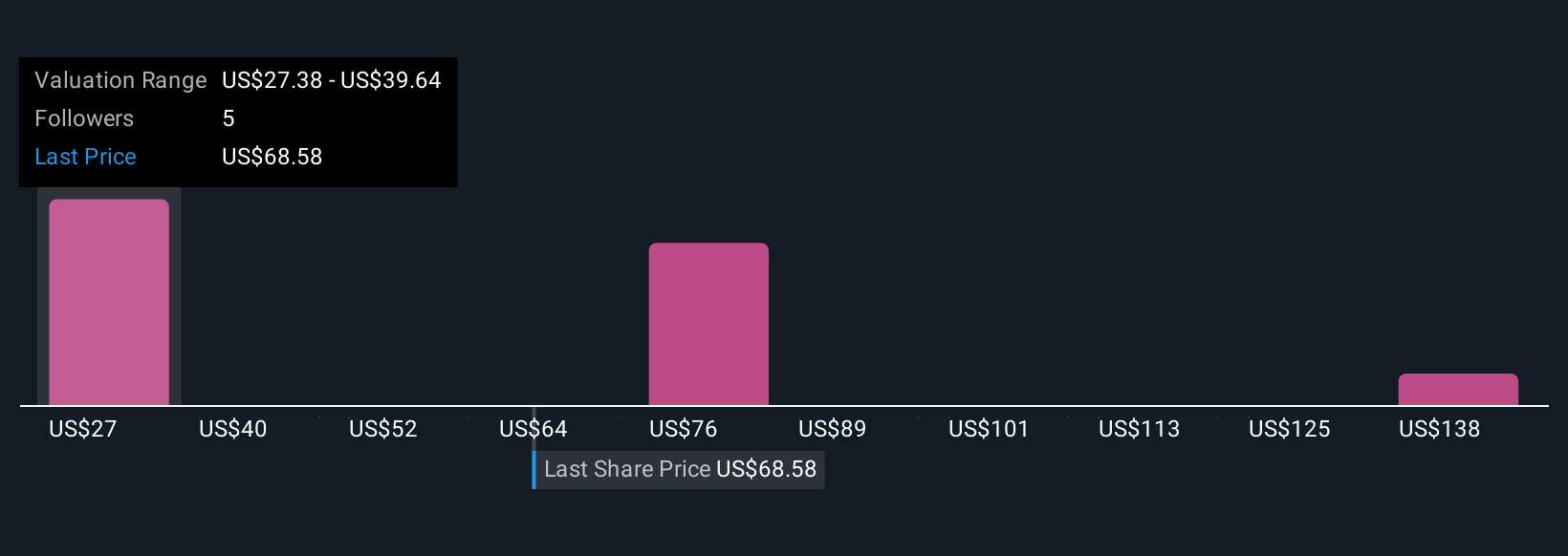

Three private investor estimates from the Simply Wall St Community put Moelis’s fair value between US$27.42 and US$150. In a marketplace where opinions widely differ, ongoing investments in talent and higher expenses could have broad implications for how you assess the company’s long-term performance.

Explore 3 other fair value estimates on Moelis - why the stock might be worth over 2x more than the current price!

Build Your Own Moelis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Moelis research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Moelis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Moelis' overall financial health at a glance.

No Opportunity In Moelis?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.