Please use a PC Browser to access Register-Tadawul

Will New Prediction Market Competition Force Flutter (FLUT) to Reinvent Its Sports Betting Strategy?

Flutter Entertainment plc Ordinary Shares FLUT | 223.04 | +1.30% |

- Flutter Entertainment recently faced heightened competition after prediction market platform Kalshi launched a parlay-style product that rivals features offered by Flutter’s FanDuel, prompting industry-wide scrutiny and analyst commentary on the sports-betting sector’s evolving landscape.

- This surge in competitive innovation highlights both the rapidly shifting dynamics in regulated betting markets and the importance of product differentiation for operators like Flutter.

- We'll explore how the emergence of new prediction market competition could influence Flutter Entertainment's growth narrative and analyst expectations.

Find companies with promising cash flow potential yet trading below their fair value.

Flutter Entertainment Investment Narrative Recap

To believe in Flutter Entertainment as a shareholder, you need confidence in its ability to sustain growth in regulated betting and iGaming markets through product innovation and effective integration of recent acquisitions. The arrival of Kalshi’s parlay-style product has fueled short-term volatility but does not appear to materially threaten the main catalyst, continued expansion in the US and Brazil, while regulatory risk remains the most significant near-term concern for the business. Among Flutter’s recent updates, the launch of FanDuel’s new features with Amazon Prime Video, including bet tracking and Odds View during NBA and WNBA broadcasts, aligns closely with the product innovation that underpins growth expectations, especially in the competitive US market. On the other hand, investors should not overlook the heightened regulatory scrutiny shaping the sector, which...

Flutter Entertainment is projected to reach $23.5 billion in revenue and $2.5 billion in earnings by 2028. This outlook is based on an expected 16.4% annual revenue growth rate and a $2.1 billion increase in earnings from the current $366 million.

Uncover how Flutter Entertainment's forecasts yield a $341.53 fair value, a 37% upside to its current price.

Exploring Other Perspectives

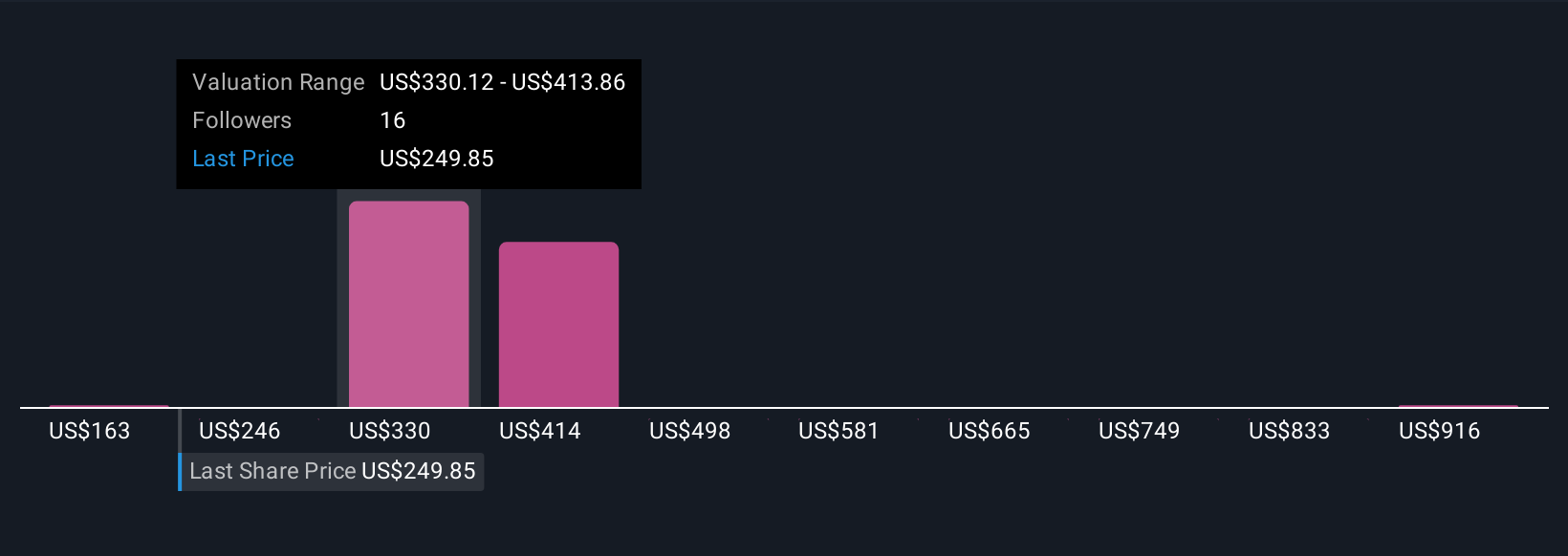

Simply Wall St Community members produced five fair value estimates for Flutter, from US$162.65 to US$1,000, showing a striking diversity of outlooks. While product innovation remains a major growth driver, the ongoing regulatory pressure may weigh more on future results than some expect.

Explore 5 other fair value estimates on Flutter Entertainment - why the stock might be worth over 4x more than the current price!

Build Your Own Flutter Entertainment Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Flutter Entertainment research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Flutter Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Flutter Entertainment's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.