Please use a PC Browser to access Register-Tadawul

Will nVent Electric’s (NVT) Manufacturing Expansion for AI Data Centers Reshape Its Growth Narrative?

nVent Electric plc Ordinary Shares NVT | 101.71 101.71 | -6.82% 0.00% Pre |

- nVent Electric plc recently expanded its manufacturing footprint, adding 117,000 square feet to its Eleanor, West Virginia facility and announcing a new production site in Blaine, Minnesota, both aimed at meeting surging demand for large enclosures and liquid cooling solutions in the data center industry.

- This emphasis on supporting AI-driven data center infrastructure has resulted in the creation of hundreds of new jobs and signals the company’s push to serve high-growth, technology-focused markets.

- We’ll explore how nVent’s doubling down on capacity for AI and liquid cooling solutions reshapes its outlook and investment rationale.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

nVent Electric Investment Narrative Recap

To invest in nVent Electric, you need confidence in sustained AI and data center infrastructure spending, ongoing electrification, and the company's ability to capitalize on these trends through portfolio transformation. The recent expansion of nVent’s manufacturing capacity directly supports the critical short-term catalyst, record new orders and a high backlog fueled by rapid growth in AI-related infrastructure. However, the concentration of business in high-growth verticals also heightens sensitivity to any shifts in data center capital investment trends, which is currently the largest risk for the business.

The recent lease announcement for a new 117,000-square-foot facility in Blaine, Minnesota, is especially relevant as it further increases capacity for data center solutions, directly addressing surging demand for liquid cooling technologies. This not only reinforces nVent’s positioning in competitive, fast-growing markets, but also strengthens support for near-term revenue growth tied to the AI-driven buildout cycle.

But even as order books grow, investors should be aware that if AI and data center CapEx trends reverse or slow faster than expected, the impact on nVent’s top line could be ...

nVent Electric's narrative projects $4.5 billion in revenue and $651.5 million in earnings by 2028. This requires 10.4% annual revenue growth and a $395.4 million increase in earnings from $256.1 million today.

Uncover how nVent Electric's forecasts yield a $100.59 fair value, a 3% upside to its current price.

Exploring Other Perspectives

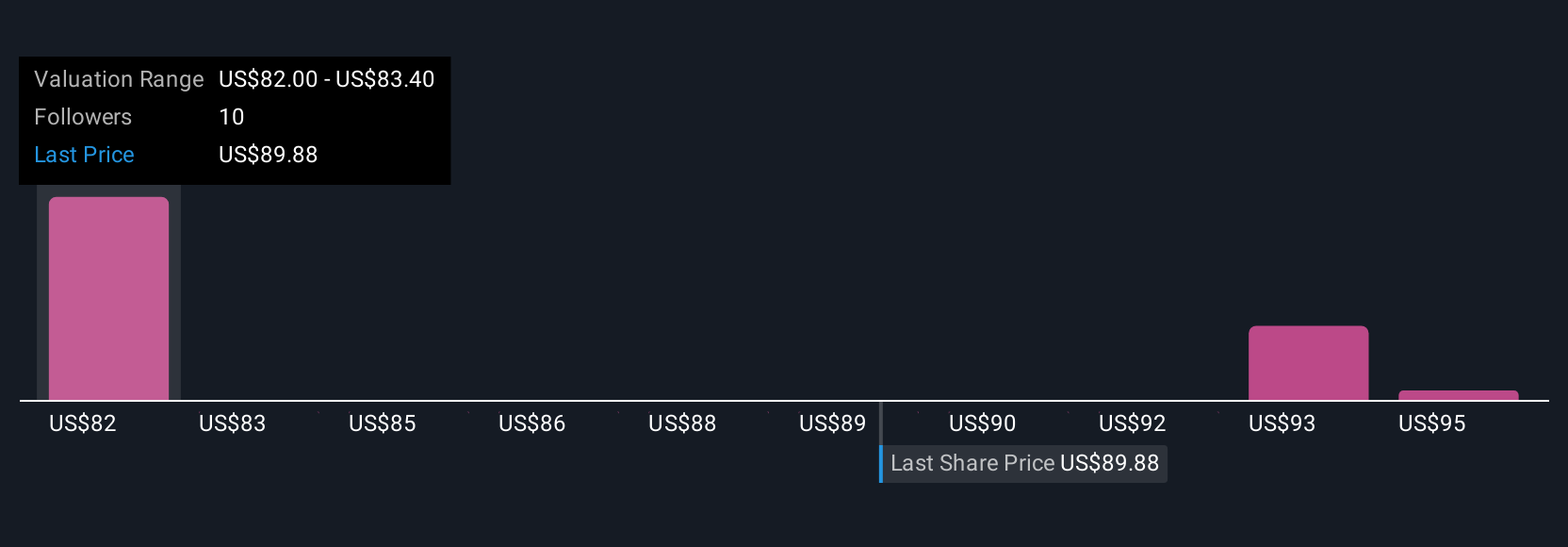

Simply Wall St Community members provided three fair value estimates for nVent Electric, ranging from US$89.35 to US$105 per share. As market participants weigh these perspectives, the business’s exposure to AI data center demand cycles remains a key factor shaping future performance.

Explore 3 other fair value estimates on nVent Electric - why the stock might be worth 9% less than the current price!

Build Your Own nVent Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your nVent Electric research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free nVent Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate nVent Electric's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.