Please use a PC Browser to access Register-Tadawul

Will Pagaya Technologies’ (PGY) New Credit Terms Reveal a Shift in Its Growth Strategy?

Pagaya Technologies PGY | 22.70 22.90 | -9.05% +0.88% Pre |

- Pagaya Technologies recently announced it had amended and expanded its revolving credit facility, increasing it to $132 million, more than doubling its previous $58 million facility, and significantly reducing its interest rate by nearly 35% with support from major new and existing banking partners.

- This refinancing signals stronger financial flexibility and lower borrowing costs, positioning Pagaya to better support its growth initiatives amid ongoing product and customer expansion.

- We'll explore how the improved funding terms reinforce Pagaya's investment narrative and support its continued momentum in financial technology.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Pagaya Technologies Investment Narrative Recap

To be a Pagaya Technologies shareholder, you need to believe in the company’s ability to scale its AI-driven credit platform while continually attracting new banking partners and controlling funding costs. The recent expansion and refinancing of its revolving credit facility meaningfully improves near-term financial flexibility and lowers capital costs, but does not eliminate challenges surrounding regulatory oversight or market competition. The biggest immediate catalyst remains successful partner onboarding, while concentrated reliance on top lenders is still a key risk.

A particularly relevant recent announcement is Pagaya’s successful $500 million bond offering, which generated significant interest and allowed the company to refinance pricier loans, boosting annual cash flow by about $40 million. This move, along with the expanded credit facility, supports Pagaya’s ongoing efforts to optimize its capital structure and invest in unlocking further growth from new and existing partnerships.

But in contrast, investors should be aware that even with better funding terms, the risk of regulatory scrutiny and its potential effects on integration timelines...

Pagaya Technologies' outlook anticipates $1.8 billion in revenue and $311.7 million in earnings by 2028. This scenario is based on 17.0% annual revenue growth and a turnaround in earnings of $594.1 million from the current loss of $-282.4 million.

Uncover how Pagaya Technologies' forecasts yield a $40.50 fair value, a 30% upside to its current price.

Exploring Other Perspectives

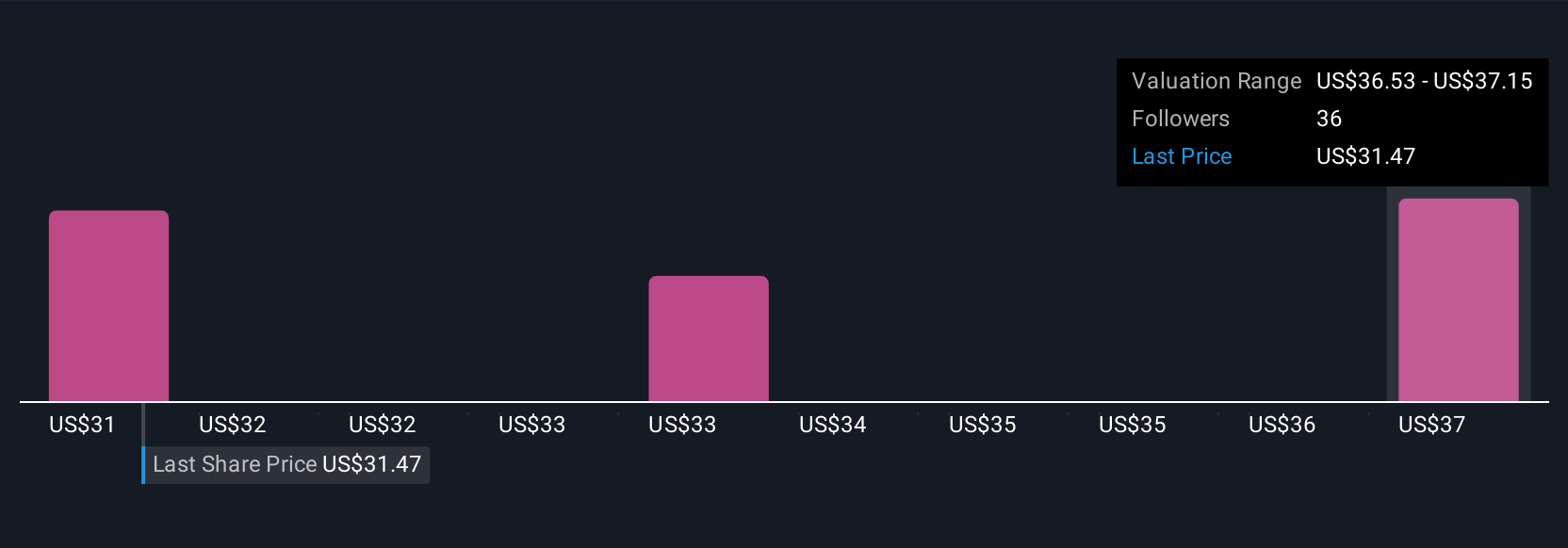

Seven distinct fair value estimates from the Simply Wall St Community put Pagaya’s worth between US$34.05 and US$85.98 per share. While assessments vary, many are watching closely to see if Pagaya’s lower funding costs from recent credit moves can spur accelerated growth despite intensified competition.

Explore 7 other fair value estimates on Pagaya Technologies - why the stock might be worth just $34.05!

Build Your Own Pagaya Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pagaya Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Pagaya Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pagaya Technologies' overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.