Please use a PC Browser to access Register-Tadawul

Will Patterson-UTI’s (PTEN) Vaca Muerta Rig Lease with Archer Redefine its International Growth Narrative?

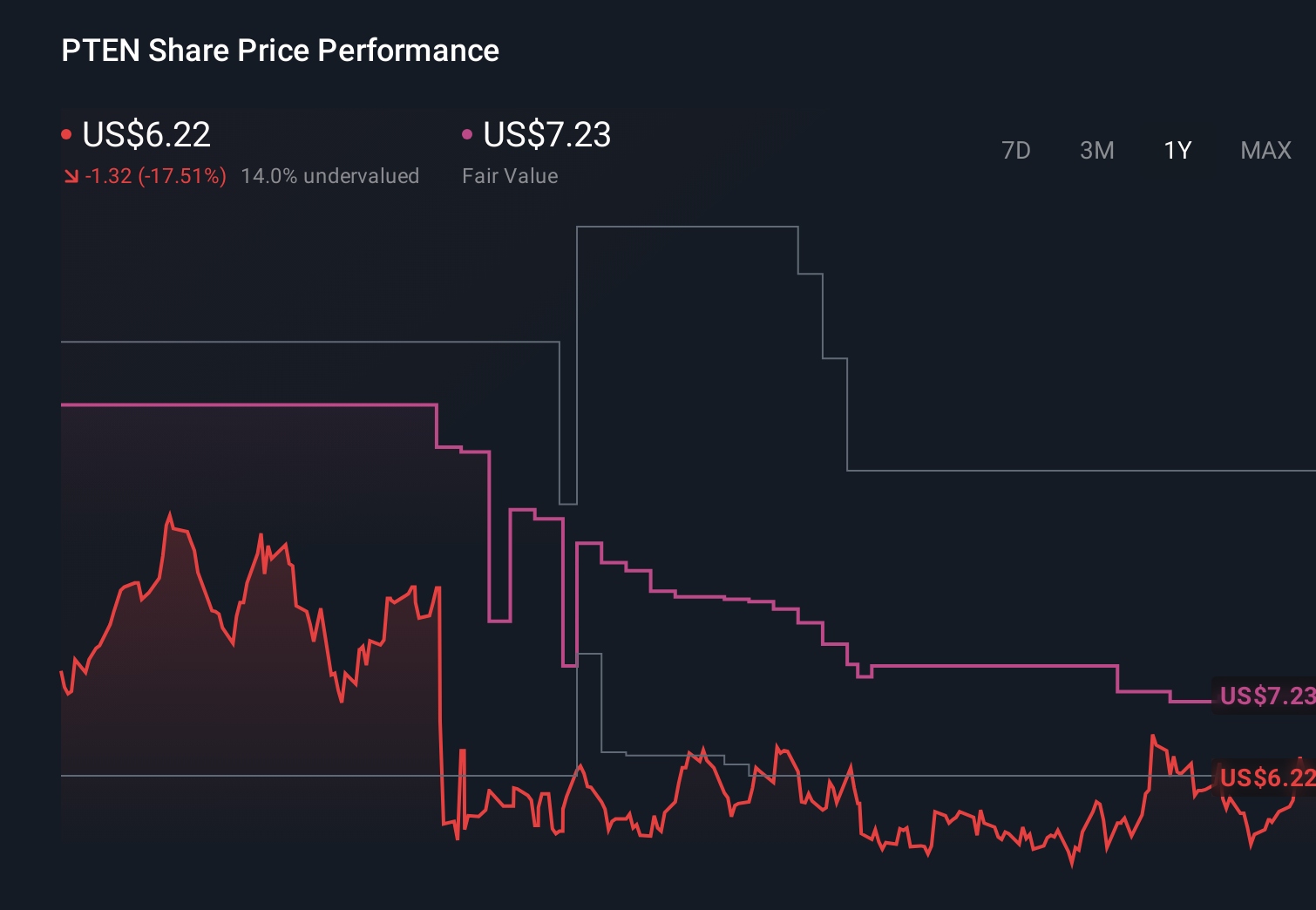

Patterson-UTI Energy, Inc. PTEN | 7.30 | -1.22% |

- Patterson-UTI Energy recently agreed a multi-year deal to lease two high-spec APEX 1500 drilling rigs from its U.S. fleet to Archer for deployment in Argentina’s Vaca Muerta shale under Archer’s seven-rig contract with YPF, with Archer funding all preparation, upgrades, and mobilization.

- This arrangement uses underutilized high-end equipment to deepen Patterson-UTI’s international presence in non-conventional plays while broadening customer exposure beyond its core U.S. base.

- We’ll now examine how this multi-year Vaca Muerta rig lease, leveraging existing high-spec assets, could influence Patterson-UTI’s broader investment narrative.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

Patterson-UTI Energy Investment Narrative Recap

To own Patterson-UTI, you need to believe that high-spec, technology-enabled drilling and completion assets can stay meaningfully utilized despite industry softness and capital intensity. The new multi-year Vaca Muerta rig lease modestly supports that thesis by putting idle high-end rigs to work internationally, but it does not fundamentally change the key near term catalyst of activity recovery or the main risk that sustained volatility and customer caution keep utilization and margins under pressure.

The upcoming February 5, 2026 conference call on fourth quarter 2025 results looks like the more relevant near term checkpoint, as it should give investors clearer detail on current drilling and completion activity trends, customer behavior, and how management is thinking about capex and fleet deployment in light of both the underutilization risk and emerging international opportunities like Vaca Muerta.

Yet while high-spec rigs find new homes abroad, investors still need to be aware of the risk that...

Patterson-UTI Energy's narrative projects $4.8 billion revenue and $337.4 million earnings by 2028. This requires a 1.3% yearly revenue decline and an earnings increase of about $1.4 billion from -$1.1 billion today.

Uncover how Patterson-UTI Energy's forecasts yield a $7.20 fair value, in line with its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community value Patterson-UTI between US$2 and US$26.12, underlining how far apart views on upside really are. Against that wide spread, the current moderation in drilling and completion activity raises important questions about how quickly the business can translate premium assets and international moves into more durable utilization and margins, so it is worth weighing several different interpretations of the same facts before forming your own view.

Explore 5 other fair value estimates on Patterson-UTI Energy - why the stock might be worth over 3x more than the current price!

Build Your Own Patterson-UTI Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Patterson-UTI Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Patterson-UTI Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Patterson-UTI Energy's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.