Please use a PC Browser to access Register-Tadawul

Will Proposed $111 Million Settlement Shift Cencora’s (COR) Risk Profile and Investment Narrative?

CoreSite Realty Corporation COR | 342.96 | +0.36% |

- Earlier this month, Cencora announced it had reached a proposed settlement to resolve a shareholder derivative lawsuit concerning its oversight of controlled substance diversion, with insurance carriers expected to pay US$111.3 million to the company if approved by the court.

- This development not only addresses legal uncertainties, but also results in a direct financial benefit to Cencora without an admission of liability by company leadership.

- We'll examine how this proposed legal resolution and insurance payment may influence Cencora's investment narrative and risk profile.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Cencora Investment Narrative Recap

To be a shareholder in Cencora, it's important to believe in the company’s ability to grow amid the expanding demand for specialty drugs and its investments in digital infrastructure to streamline the healthcare supply chain. The proposed US$111.3 million insurance-funded settlement helps resolve a significant legal overhang, but does not materially alter the most important near-term catalyst, volume growth in high-margin specialty distribution, or address the ongoing margin pressure from generics and biosimilars, which remains the biggest risk to the business today.

Among recent announcements, the appointment of D. Mark Durcan as Chairman of the Board is particularly relevant. Leadership stability and fresh oversight may matter as Cencora works to strengthen internal controls, which is timely given the spotlight on compliance highlighted by the lawsuit resolution. While this change may support confidence during a period of ongoing risk, it does not affect the headwinds from shifting product mix and compressed margins that many investors are watching closely.

By contrast, one risk that investors should not overlook is the persistent pressure on Cencora’s profit margins as lower-fee generics and biosimilars grow in share...

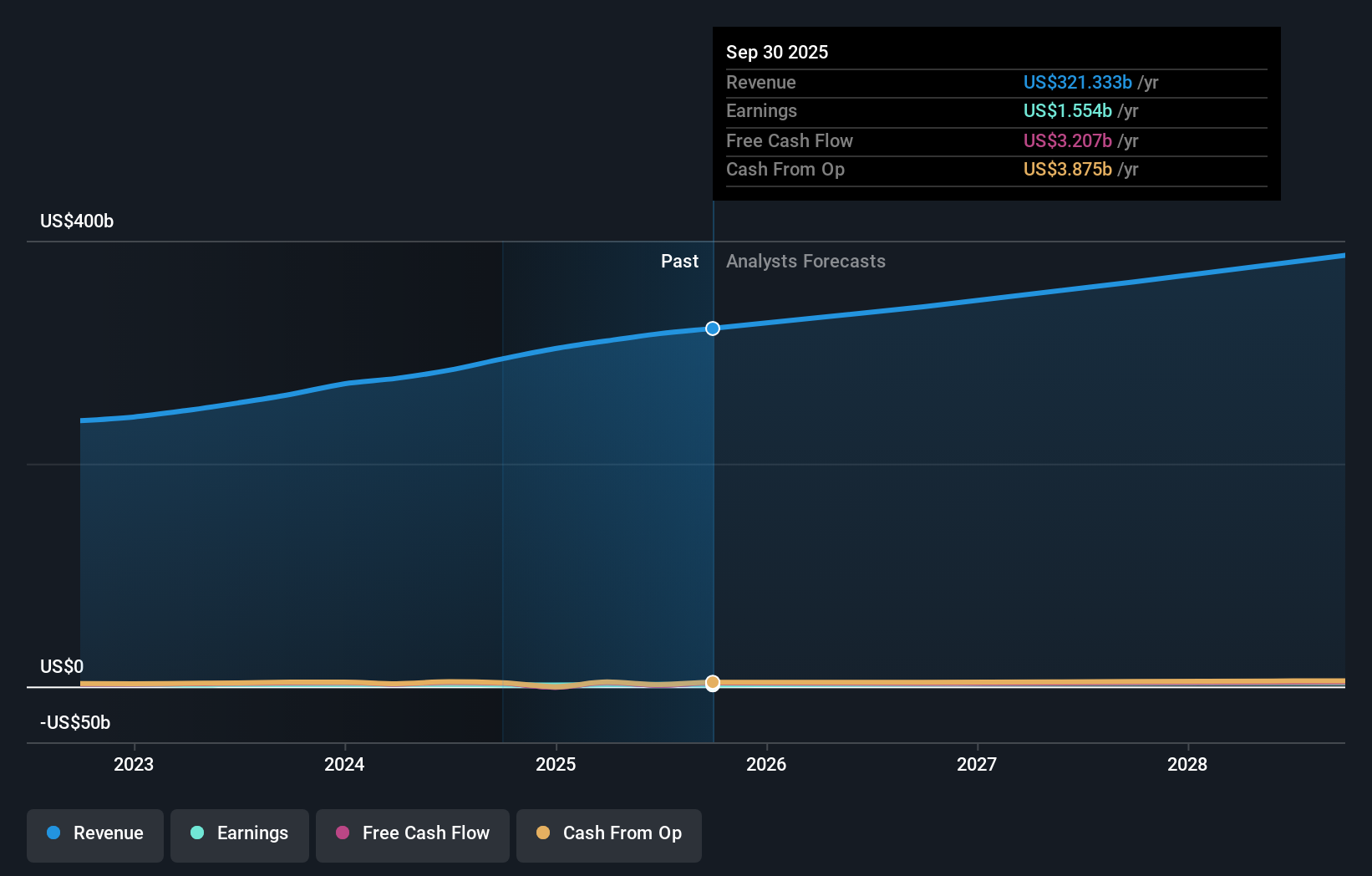

Cencora's outlook anticipates $385.4 billion in revenue and $3.3 billion in earnings by 2028. This scenario assumes annual revenue growth of 6.8% and an increase in earnings of $1.4 billion from the current $1.9 billion.

Uncover how Cencora's forecasts yield a $333.29 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Four individual fair value estimates from the Simply Wall St Community put Cencora’s intrinsic worth between US$298 and US$684 per share. Market participants continue to weigh these wide-ranging opinions against risks like margin compression, shaping the debate about Cencora’s future performance.

Explore 4 other fair value estimates on Cencora - why the stock might be worth over 2x more than the current price!

Build Your Own Cencora Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cencora research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Cencora research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cencora's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.