Please use a PC Browser to access Register-Tadawul

Will Recursion (RXRX) Share Registration Deepen Its Tech Partnerships or Signal a Shift in Strategy?

Recursion Pharmaceuticals, Inc. Class A RXRX | 4.86 4.86 | +6.81% 0.00% Pre |

- Earlier this week, Recursion Pharmaceuticals registered over 7 million Class A common shares for resale, which had been issued to Tempus AI as payment for annual license fees.

- This development signals a significant move in asset management and partnership monetization, highlighting both the company's use of equity and its technology-driven collaborations.

- We will now examine how the registration of Tempus AI's shares may influence Recursion Pharmaceuticals’ investment narrative and business outlook.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Recursion Pharmaceuticals Investment Narrative Recap

At its core, Recursion Pharmaceuticals’ investment case centers on the potential of AI-driven drug discovery platforms to transform R&D efficiency and attract significant pharma partnerships, a narrative built on accelerating clinical progress and data-powered collaboration. The recent registration for resale of over 7 million shares to Tempus AI, while reflecting active balance sheet and partnership management, does not shift the current focus: advancing key internal programs and navigating early-stage clinical risks remain the primary near-term catalyst and a critical business risk.

The June announcement of Boltz-2, Recursion’s open-sourced biomolecular foundation model, is particularly relevant given its integration with Tempus AI and broader partner ecosystem. Continued rollout and uptake of cutting-edge AI tools like Boltz-2 is intended to drive superior R&D performance, potentially influencing both collaborations and internal pipeline milestones, but execution risk around realizing marketable assets persists.

By contrast, investors should remain aware of the ongoing risk that Recursion’s heavy reliance on revenues from a small group of pharma partners poses to topline stability, especially if partnership terms shift or milestones are delayed…

Recursion Pharmaceuticals' outlook anticipates $220.9 million in revenue and $35.5 million in earnings by 2028. This scenario relies on 50.7% annual revenue growth and a $684.6 million increase in earnings from the current $-649.1 million.

Uncover how Recursion Pharmaceuticals' forecasts yield a $6.33 fair value, a 37% upside to its current price.

Exploring Other Perspectives

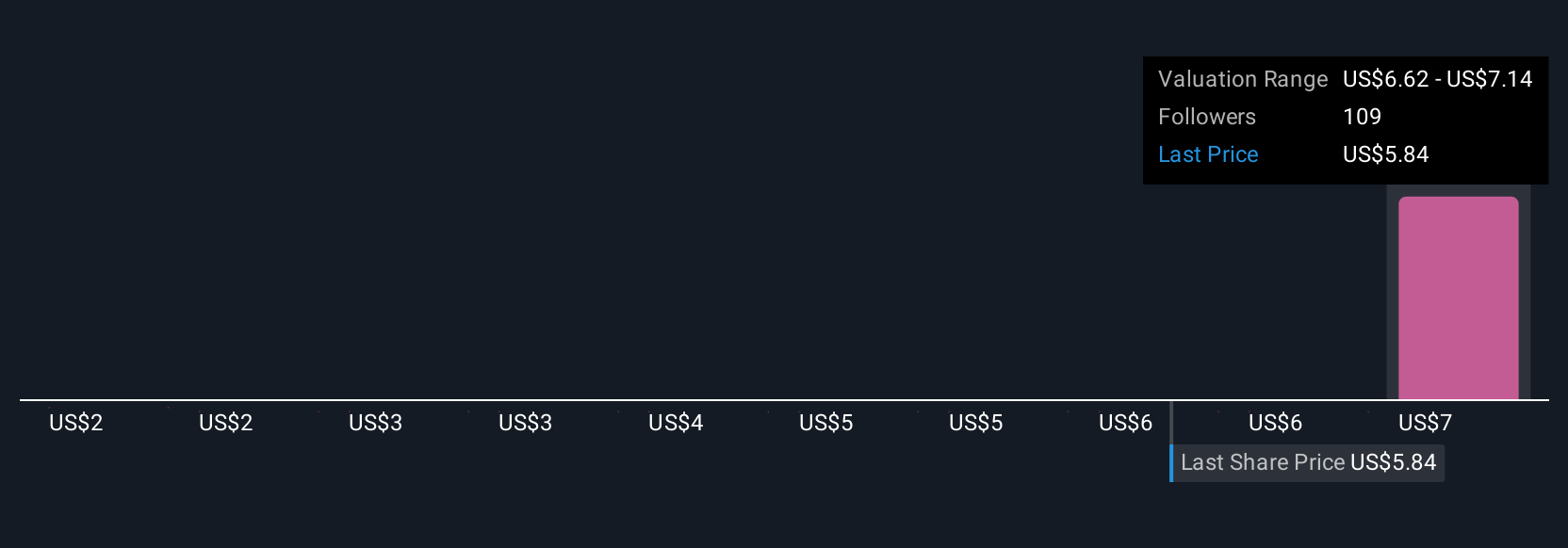

Five Simply Wall St Community fair value estimates for Recursion range from US$1.92 to US$10 per share, showing a wide spread of investor expectations. This underscores how partnership revenue concentration and evolving collaboration terms may continue to play an outsized role in shaping near term valuations, be sure to compare these viewpoints for a fuller picture.

Explore 5 other fair value estimates on Recursion Pharmaceuticals - why the stock might be worth over 2x more than the current price!

Build Your Own Recursion Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Recursion Pharmaceuticals research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Recursion Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Recursion Pharmaceuticals' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.