Please use a PC Browser to access Register-Tadawul

Will Rising Sales and the Schaeffler Partnership Shift SolarEdge Technologies' (SEDG) Investment Narrative?

SolarEdge Technologies, Inc. SEDG | 29.20 | -1.12% |

- SolarEdge Technologies reported second-quarter 2025 results with sales rising to US$289.43 million and net loss narrowing to US$124.74 million, while also issuing third-quarter guidance for revenues between US$315 million and US$355 million.

- Additionally, Schaeffler recently announced a partnership with SolarEdge to deploy EV charging solutions at over 2,300 charging points across its European sites, underscoring SolarEdge's growing presence in commercial energy infrastructure.

- We'll explore how the new Schaeffler partnership and improved earnings outlook could influence SolarEdge's investment narrative going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

SolarEdge Technologies Investment Narrative Recap

To be a shareholder in SolarEdge Technologies, an investor needs to believe in the company’s ability to return to profitability through improved earnings and operational efficiency, even as challenges in European markets and pressure on net margins persist. The recent earnings report, showing climbing sales and a narrowing net loss, signals some progress, but not enough to materially change the most important short-term catalyst: a sustained turnaround in revenue supported by operational cost control. The biggest risk continues to be weak demand and elevated costs, especially in Europe, which could delay recovery.

Among recent announcements, the partnership with Schaeffler to deploy EV charging solutions across Europe stands out as especially relevant. This move expands SolarEdge's commercial reach and adds to its infrastructure business, aligning with efforts to strengthen sales and potentially support a rebound in European market demand, which is a core catalyst for growth.

In contrast, investors should also be aware of ongoing cost pressures that may not be fully offset by these commercial wins if...

SolarEdge Technologies' narrative projects $1.7 billion revenue and $228.6 million earnings by 2028. This requires 21.9% yearly revenue growth and a $1.93 billion increase in earnings from -$1.7 billion today.

Uncover how SolarEdge Technologies' forecasts yield a $19.19 fair value, a 27% downside to its current price.

Exploring Other Perspectives

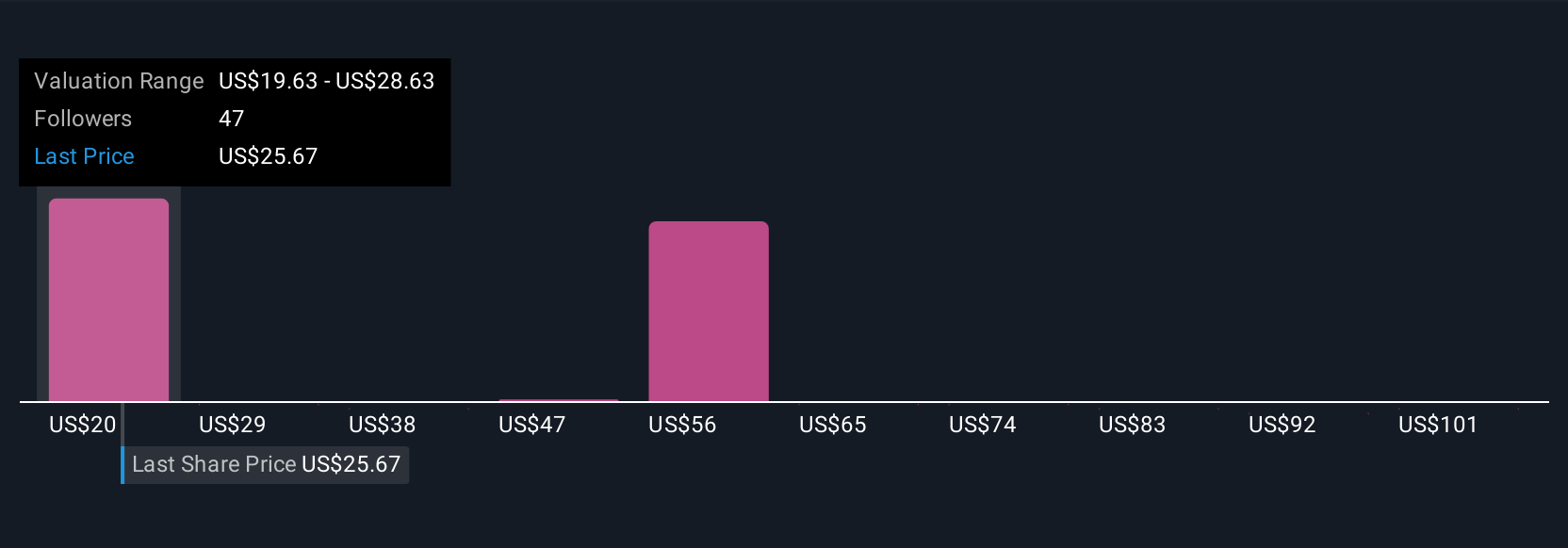

Nineteen Simply Wall St Community fair value estimates for SolarEdge range widely from US$19.19 to US$109.67. With the spectrum of views, keep in mind that weak demand in key international regions could remain a significant drag on growth.

Explore 19 other fair value estimates on SolarEdge Technologies - why the stock might be worth 27% less than the current price!

Build Your Own SolarEdge Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SolarEdge Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SolarEdge Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SolarEdge Technologies' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.