Please use a PC Browser to access Register-Tadawul

Will Rising Short Interest Shift Artisan Partners Asset Management's (APAM) Investment Narrative?

Artisan Partners Asset Management, Inc. Class A APAM | 41.49 41.49 | +0.05% 0.00% Pre |

- Artisan Partners Asset Management recently saw its short interest as a percent of float rise to 7.88%, surpassing the peer group average, with 3.52 million shares now sold short.

- This heightened level of short interest stands out against industry peers, which may indicate shifting investor sentiment toward the company's outlook.

- We'll assess how this increase in short interest could influence Artisan Partners' investment narrative and its industry positioning moving forward.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Artisan Partners Asset Management Investment Narrative Recap

To be a shareholder in Artisan Partners Asset Management, you need confidence in the company’s ability to scale its diverse investment strategies and maintain strong long-term client relationships, particularly as it invests in growth areas like fixed income and private wealth. The recent uptick in short interest to 7.88% is unlikely to materially impact the most immediate catalyst, ongoing shifts in distribution and strategy expansion, but it could sharpen attention on operational efficiency, which remains a key risk if profitability becomes pressured.

Of recent company announcements, the CEO transition stands out. Jason Gottlieb’s appointment as CEO in June 2025 comes as the firm’s industry positioning evolves, intersecting directly with questions raised by increased short interest around leadership’s capacity to manage expense discipline amid expanding operations. Sustaining performance during this leadership change may be closely watched as a catalyst for near-term confidence.

However, investors should not overlook the risk that rising costs from broader strategy launches could eventually challenge...

Artisan Partners Asset Management's narrative projects $1.4 billion revenue and $303.7 million earnings by 2028. This requires 8.1% yearly revenue growth and a $56.7 million earnings increase from $247.0 million.

Uncover how Artisan Partners Asset Management's forecasts yield a $46.12 fair value, a 5% upside to its current price.

Exploring Other Perspectives

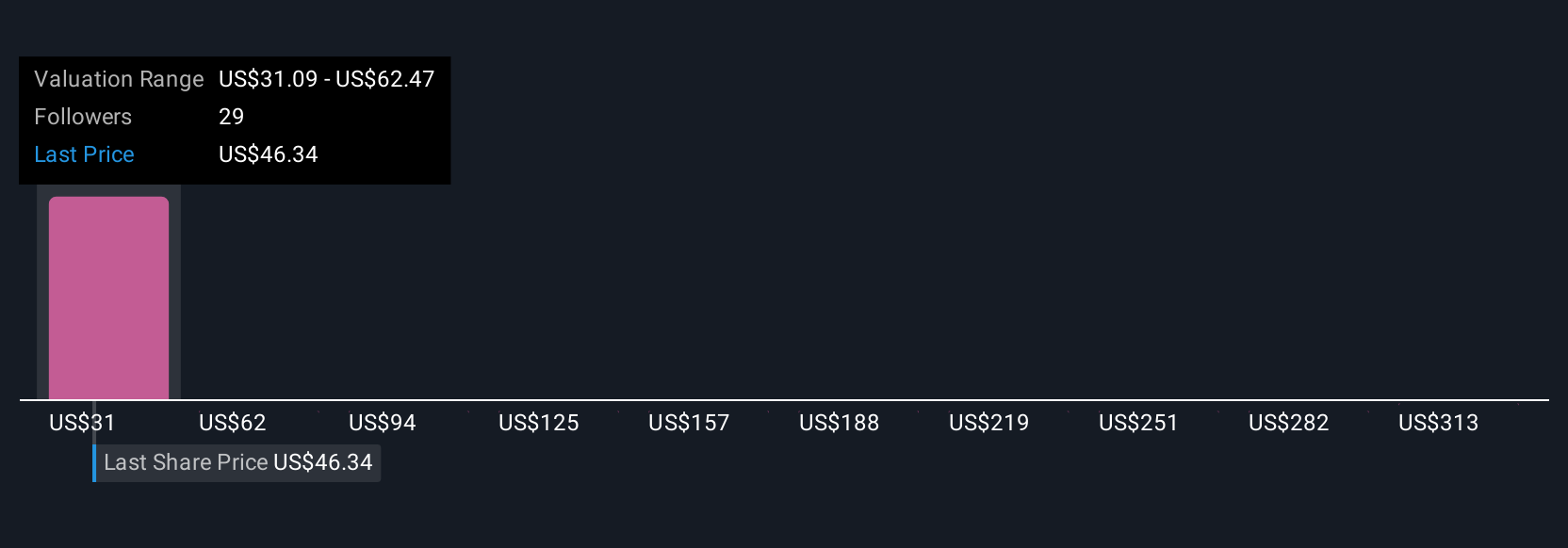

Simply Wall St Community members have submitted six fair value estimates for Artisan Partners Asset Management ranging from US$31.09 to US$344.87. These differences appear while concerns about operational costs and margin pressure could weigh on company performance, reminding you to consider multiple viewpoints before deciding.

Explore 6 other fair value estimates on Artisan Partners Asset Management - why the stock might be worth over 7x more than the current price!

Build Your Own Artisan Partners Asset Management Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Artisan Partners Asset Management research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Artisan Partners Asset Management research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Artisan Partners Asset Management's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.