Please use a PC Browser to access Register-Tadawul

Will Roivant Sciences' (ROIV) Immunovant Focus Refine Its Late-Stage Execution Strategy?

Roivant Sciences Ltd Ordinary Shares ROIV | 22.03 | -0.32% |

- Earlier this month, Roivant Sciences held a special call to discuss new Immunovant data and took part in the Morgan Stanley 23rd Annual Global Healthcare Conference in New York, featuring CEO Matthew Gline and CFO Richard Pulik as speakers.

- The decision to host a dedicated call on Immunovant’s data suggests the information shared was considered significant for stakeholders and may influence future expectations for Roivant’s clinical pipeline.

- We'll explore how this focused attention on Immunovant data could impact Roivant's investment narrative around late-stage trial catalysts and execution risks.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Roivant Sciences Investment Narrative Recap

To be a shareholder in Roivant Sciences, you need conviction in the company's ability to execute on late-stage clinical milestones and realize potential from its immunology and inflammation pipeline. The recent focus on Immunovant data, highlighted by the special call and participation at a major healthcare conference, puts attention on clinical outcomes that could serve as short-term catalysts. However, the update does not appear to materially shift the immediate risk of clinical trial execution delays or failures, which remain front of mind for investors.

Among the latest company announcements, the recent Q1 earnings report stands out, showing a significant widening of net loss alongside a steep drop in sales. This financial snapshot serves as a backdrop to the heightened expectations created by Roivant's latest Immunovant disclosures, reinforcing how ongoing development costs and early pipeline risks are closely tied to the timely delivery of positive trial results.

In contrast, while some late-stage programs continue to show promise, there are persistent risks around clinical timelines that investors should be aware of...

Roivant Sciences' narrative projects $520.7 million revenue and $83.8 million earnings by 2028. This requires 59.2% yearly revenue growth and a $4.5 billion decrease in earnings from $4.6 billion today.

Uncover how Roivant Sciences' forecasts yield a $17.00 fair value, a 21% upside to its current price.

Exploring Other Perspectives

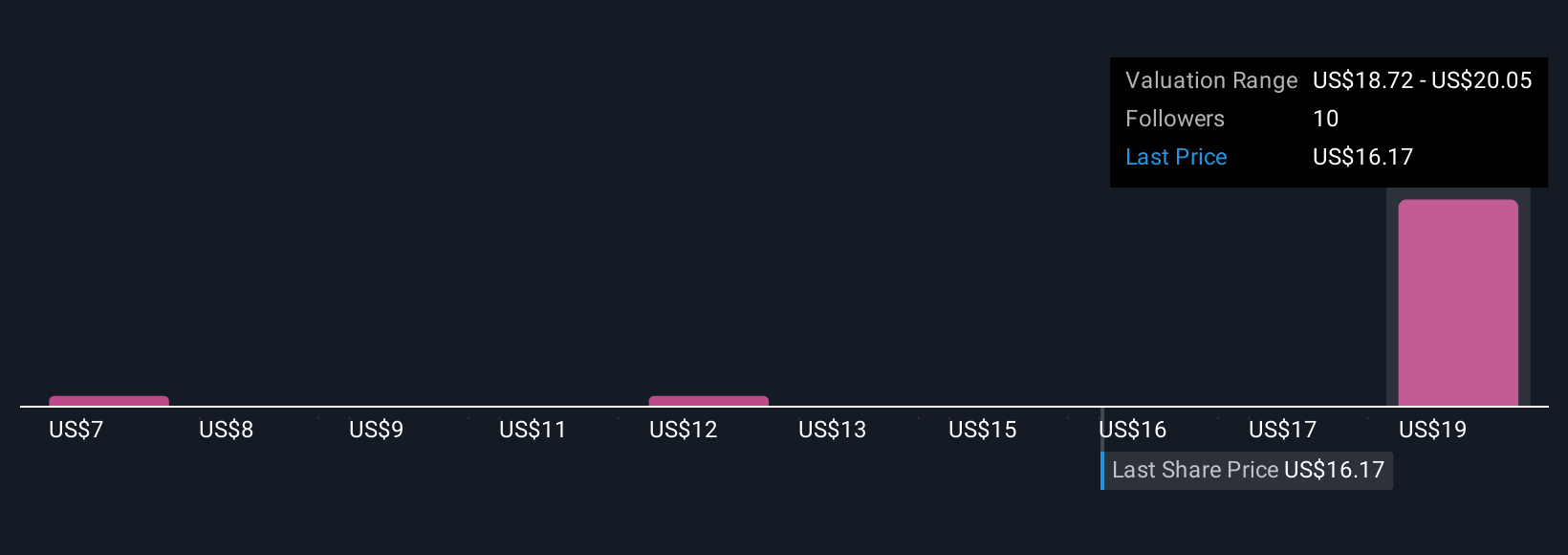

Simply Wall St Community members provided four fair value estimates for Roivant, ranging from US$6.84 to US$17.00 per share. While growth is a key catalyst, unresolved clinical trial risks continue to weigh on confidence, consider all these perspectives as you form your own view.

Explore 4 other fair value estimates on Roivant Sciences - why the stock might be worth less than half the current price!

Build Your Own Roivant Sciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Roivant Sciences research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Roivant Sciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Roivant Sciences' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.