Please use a PC Browser to access Register-Tadawul

Will Rush Enterprises’ (RUSH.A) Extended Credit Boost Management’s Flexibility or Signal Caution on Market Recovery?

- On September 30, 2025, Rush Enterprises and subsidiaries entered into a Fourth Amendment to their credit agreement, extending its maturity to September 30, 2028, and altering provisions related to their Canadian subsidiary.

- This amendment provides Rush Enterprises with extended financial flexibility during a period marked by ongoing industry headwinds and uncertainty in commercial truck markets.

- We'll explore how this extended credit agreement could bolster Rush Enterprises' resilience as it navigates ongoing delays in customer purchasing decisions.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Rush Enterprises Investment Narrative Recap

To be a shareholder in Rush Enterprises, you need to believe in the company’s ability to leverage its nationwide dealership scale and resilient parts and service business during periods of industry volatility. The recent credit agreement extension to 2028 offers additional liquidity but does not materially change the main short term catalyst: stabilization in truck purchasing activity as regulatory and freight market pressures linger. The biggest risk remains the prolonged slowdown in new vehicle sales due to order delays and regulatory uncertainty.

Of Rush’s recent announcements, the upcoming third quarter 2025 earnings release stands out as most relevant for tracking progress against these short term pressures. With revenues topping analyst estimates but still declining year over year, the earnings call will be a focal point for updates on demand, fleet utilization, and management’s response to industry challenges tied to both regulatory and freight market swings.

Yet investors should also consider: while the credit extension supports flexibility, longer term impacts from weak fleet activity may not be fully reflected in short term numbers...

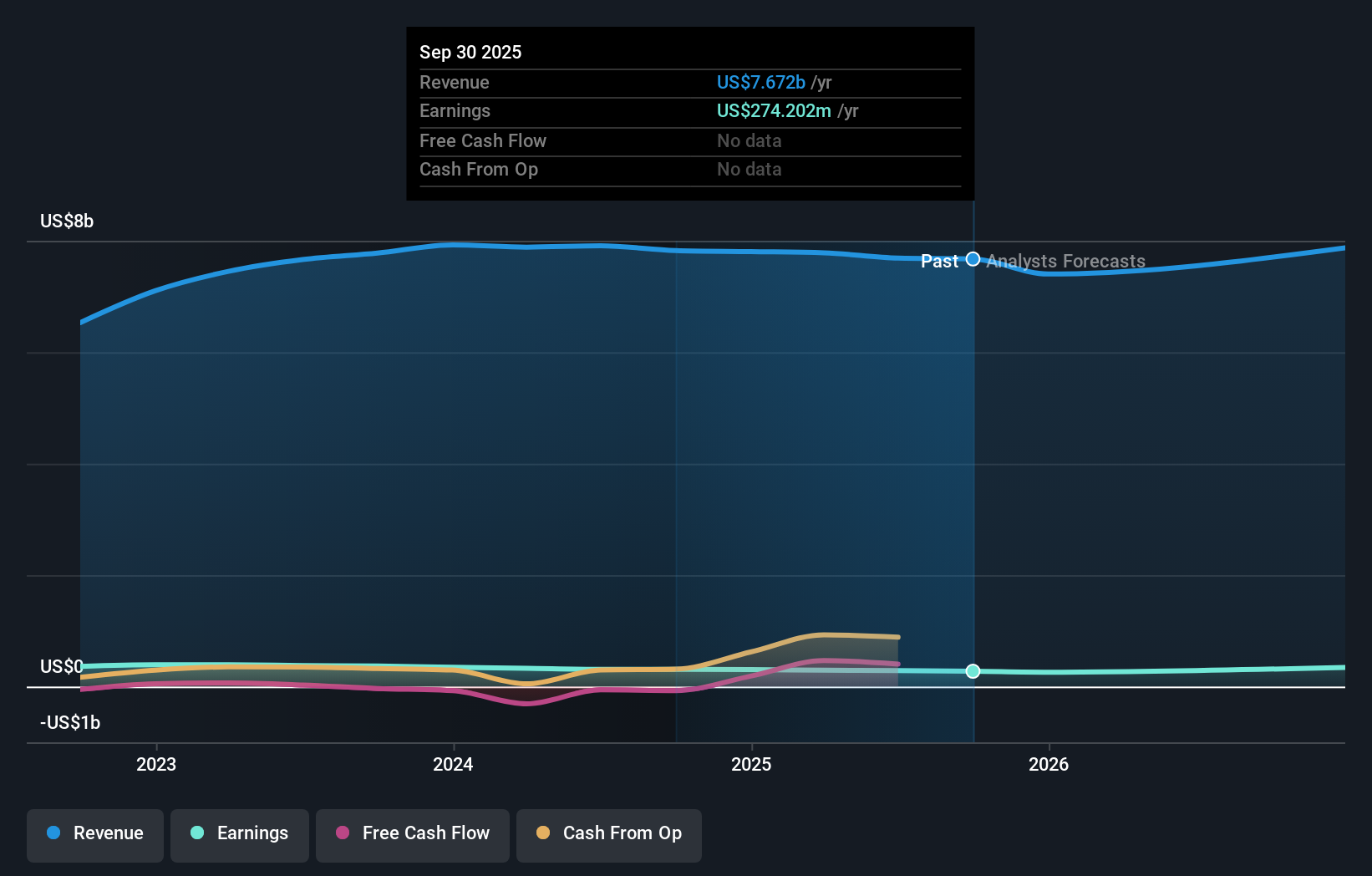

Rush Enterprises' outlook anticipates $7.6 billion in revenue and $440.7 million in earnings by 2028. This forecast is based on a projected annual revenue decline of 0.3% and a $154.1 million increase in earnings from the current $286.6 million.

Uncover how Rush Enterprises' forecasts yield a $60.00 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Ten private fair value estimates from the Simply Wall St Community all cluster at US$60 per share, before factoring in the recent credit extension. While some expect Rush’s service revenues to provide resilience as regulations shift, others warn that deeper freight demand weakness could still weigh on earnings for longer. Explore several viewpoints to shape your own outlook.

Explore another fair value estimate on Rush Enterprises - why the stock might be worth as much as 16% more than the current price!

Build Your Own Rush Enterprises Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rush Enterprises research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Rush Enterprises research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rush Enterprises' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.