Please use a PC Browser to access Register-Tadawul

Will RXO’s (RXO) Disclosure Practices Reshape Investor Trust in Management and Financial Strategy?

RXO, Inc. Common Stock RXO | 16.90 | +1.93% |

- In recent days, a shareholder rights law firm began investigating whether RXO, Inc. or certain of its officers and directors violated federal securities laws by misrepresenting or failing to timely disclose material information to investors. This development coincides with commentary on RXO’s rising costs and declining earnings, which has heightened investor concerns over the company’s financial transparency and profitability.

- The launch of this legal investigation into RXO's disclosure practices raises important questions about management oversight and the effectiveness of the company's risk controls.

- We’ll examine how investor concerns about RXO’s disclosure and cost pressures may alter the company’s investment narrative going forward.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

RXO Investment Narrative Recap

To be a shareholder in RXO, an investor must have confidence in the company's ability to leverage its AI-powered freight-matching technology and expand its higher-margin LTL brokerage, while withstanding ongoing freight industry softness and margin pressures. The recent investigation into RXO’s disclosure practices brings fresh scrutiny to management oversight, but unless substantiated, may not materially shift the short-term catalyst: the disruption or acceleration of earnings recovery ahead of the next results. The biggest immediate risk remains the persistence of rising costs outpacing revenue growth, which could further pressure profitability.

Among recent announcements, RXO’s integration of AI and logistics technology, highlighted at the NextGen Supply Chain Conference, is especially relevant. This focus directly ties to the company’s core catalyst: operating leverage and future margin improvement from digital adoption, even as sector headwinds persist. The potential of these initiatives to offset cost and demand challenges continues to be watched closely by investors.

However, with new legal oversight intensifying, investors should be aware that unresolved questions about financial disclosure could...

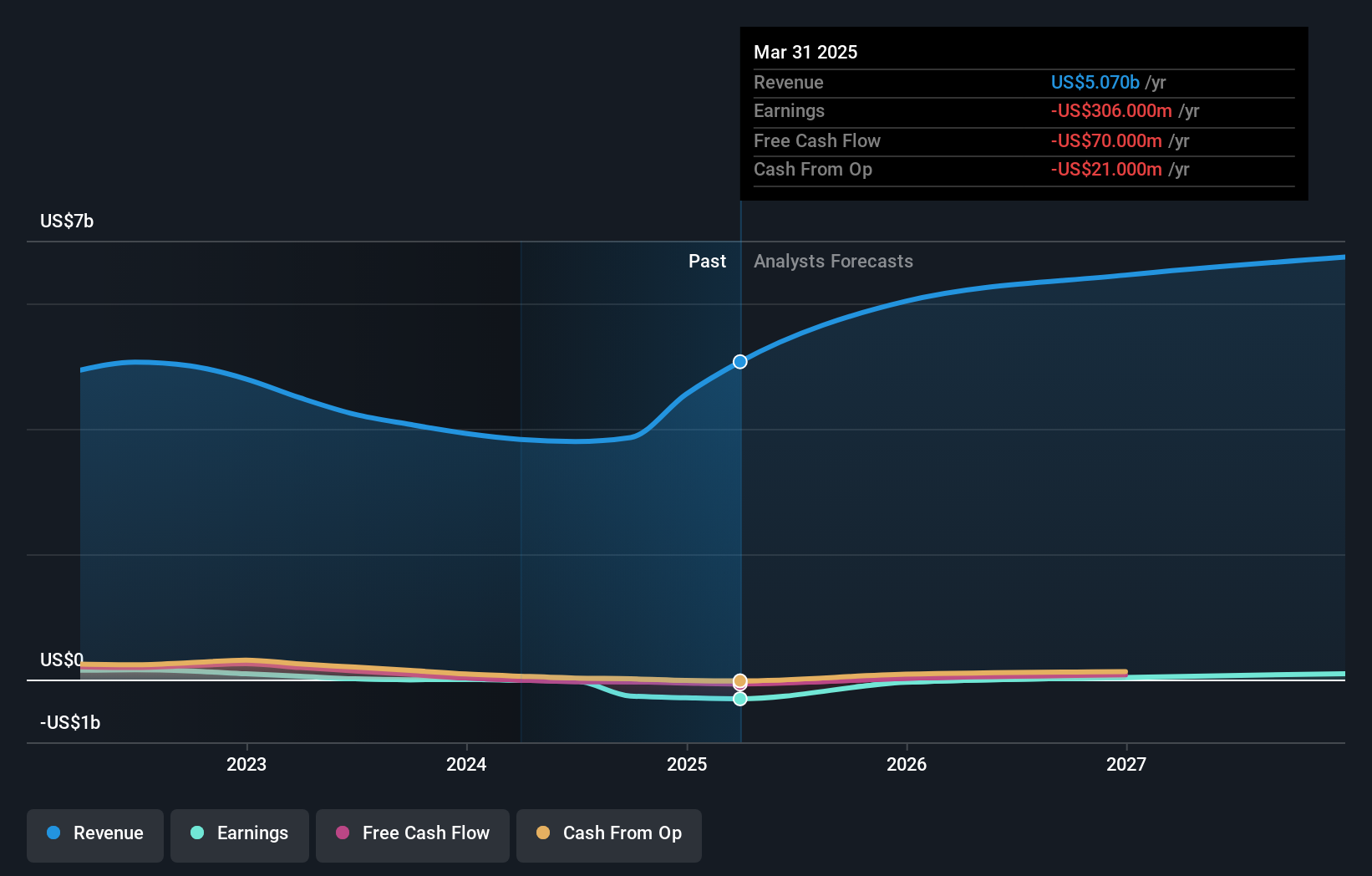

RXO's outlook anticipates $6.9 billion in revenue and $132.5 million in earnings by 2028. This is based on a projected annual revenue growth rate of 7.3% and an earnings increase of $440.5 million from current earnings of -$308.0 million.

Uncover how RXO's forecasts yield a $16.72 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 2 fair value estimates for RXO, ranging from US$16.72 to US$30.09, reflecting sharply contrasting outlooks. Revenue growth forecasts remain modest, so consider how these different views align with the broad risk of ongoing margin pressures and regulatory scrutiny.

Explore 2 other fair value estimates on RXO - why the stock might be worth just $16.72!

Build Your Own RXO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RXO research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free RXO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RXO's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.