Please use a PC Browser to access Register-Tadawul

Will Sarah M. Ward’s Board Appointment Shape GAM’s Focus on Governance and Financial Disclosure?

General American Investors Co Inc GAM | 58.52 | +0.37% |

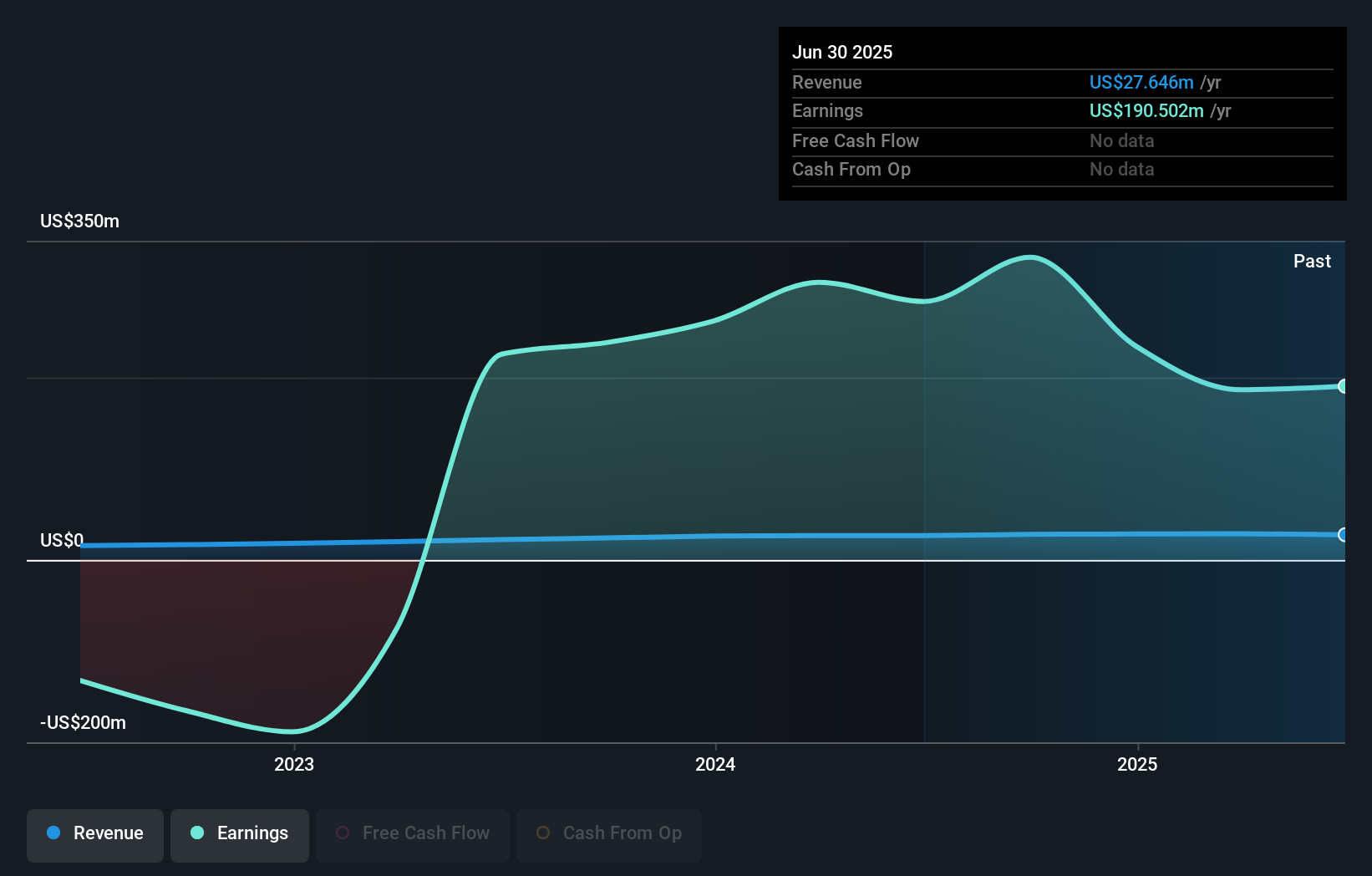

- General American Investors Company recently reported its half-year results for the period ended June 30, 2025, with revenue of US$12.56 million and net income of US$150.38 million, while also announcing the appointment of Sarah M. Ward to its Board of Directors.

- The addition of Ms. Ward, who brings substantial legal and financial industry expertise, signals continued emphasis on strong corporate governance alongside financial performance disclosure.

- We'll now consider how the recent board appointment could influence General American Investors Company's investment narrative moving forward.

Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

What Is General American Investors Company's Investment Narrative?

For anyone considering General American Investors Company, the big picture centers on believing in the company’s ability to generate consistent value through disciplined capital allocation, share buybacks, and income distribution, despite its more volatile earnings history. The latest news, pairing half-year financial results impacted by a large one-off gain with Sarah M. Ward’s fresh Board appointment, points to ongoing efforts to reinforce governance and oversight, but doesn’t fundamentally alter the primary short-term catalysts or risks. These remain tied to the sustainability of dividend payouts, reliability of recurring earnings, and whether underlying portfolio performance can steady net profit margins that have recently trended lower. Ms. Ward’s arrival may improve board renewal and corporate governance, yet, given the depth of experience already present, it is unlikely to have an immediate, material effect on operational outcomes or address the unstable dividend track record in the short term. Investors should keep a close eye on continued margin pressure and the ability to sustain their payout commitments, especially as prior analysis has highlighted the impact of non-recurring gains on reported results.

But, against these moves, the uncertainty around dividend stability is still a key consideration for investors. General American Investors Company's shares have been on the rise but are still potentially undervalued by 46%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on General American Investors Company - why the stock might be worth just $107.97!

Build Your Own General American Investors Company Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your General American Investors Company research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free General American Investors Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate General American Investors Company's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.