Please use a PC Browser to access Register-Tadawul

Will SharpLink Gaming’s (SBET) New Co-CEO Shift Its Digital Ambitions or Reinforce Core Strategy?

SharpLink Gaming SBET | 9.71 | +2.10% |

- On July 25, 2025, SharpLink Gaming appointed Joseph Chalom, a former BlackRock senior executive with significant digital finance experience, as its new Co-Chief Executive Officer, while current CEO Rob Phythian transitions to President and remains on the board.

- Chalom's background in executing high-profile digital asset initiatives and building institutional partnerships is expected to influence SharpLink's expansion into innovative financial technology arenas.

- We'll explore how the addition of Chalom and his expertise in digital assets may reshape SharpLink's broader investment narrative.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is SharpLink Gaming's Investment Narrative?

For SharpLink Gaming, the big picture now rests on whether a leadership overhaul, like the appointment of Joseph Chalom as Co-CEO, can steer the company through a complex phase of compliance and growth challenges. The timing is significant, with sharp swings in the share price, persistent net losses, and major fundraising moves continuing to shape short-term prospects. Chalom’s background in digital assets could shift attention to technology-driven initiatives or partnerships, and potentially bring sharper credibility with institutional partners. This might help attract capital or open new commercial avenues, but it doesn’t erase immediate concerns around heavy shareholder dilution, the company’s weak revenue base, or ongoing Nasdaq compliance risks. The bylaw changes and high-profile hire signal intent to reinvent, but they don’t guarantee near-term financial improvement. As the leadership transition unfolds, the main risk and catalyst story is itself changing in real time.

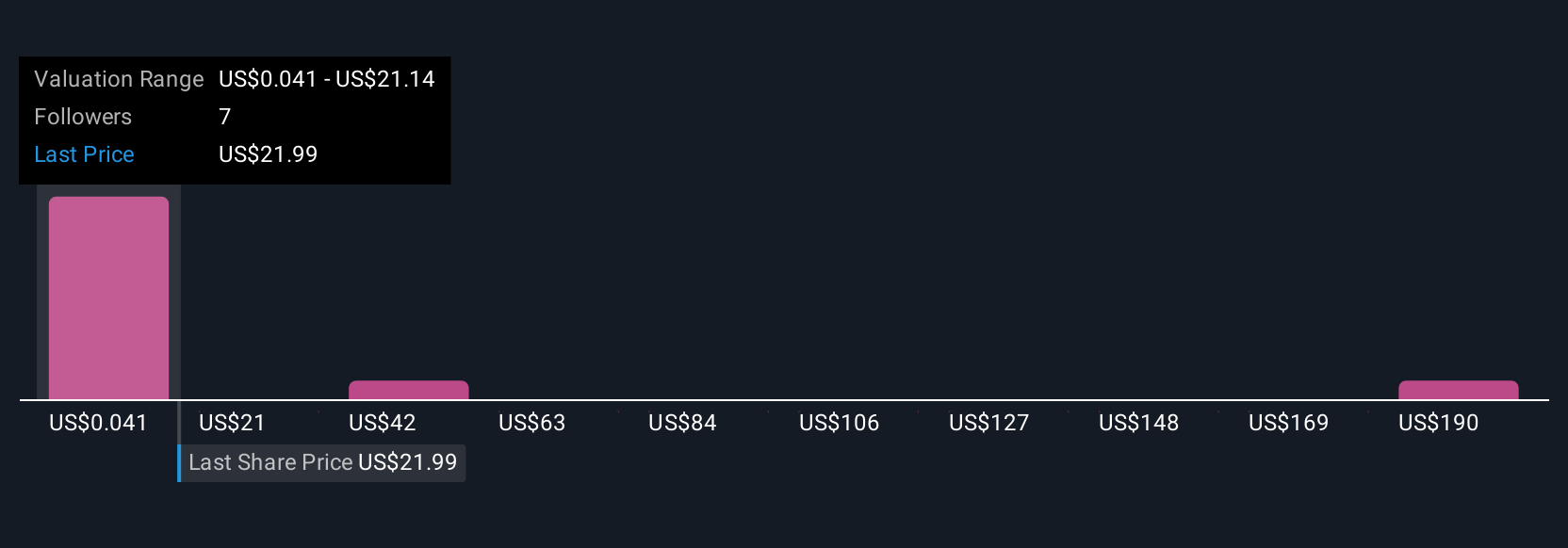

Yet dilution and compliance risks remain for those following recent headlines. According our valuation report, there's an indication that SharpLink Gaming's share price might be on the expensive side.Exploring Other Perspectives

Explore 8 other fair value estimates on SharpLink Gaming - why the stock might be worth less than half the current price!

Build Your Own SharpLink Gaming Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SharpLink Gaming research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free SharpLink Gaming research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SharpLink Gaming's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.