Please use a PC Browser to access Register-Tadawul

Will Solid Power’s (SLDP) Widening Losses Reveal Deeper Hurdles in Scaling Its Technology?

Solid Power, Inc. - Class A Common Stock SLDP | 3.47 | -3.88% |

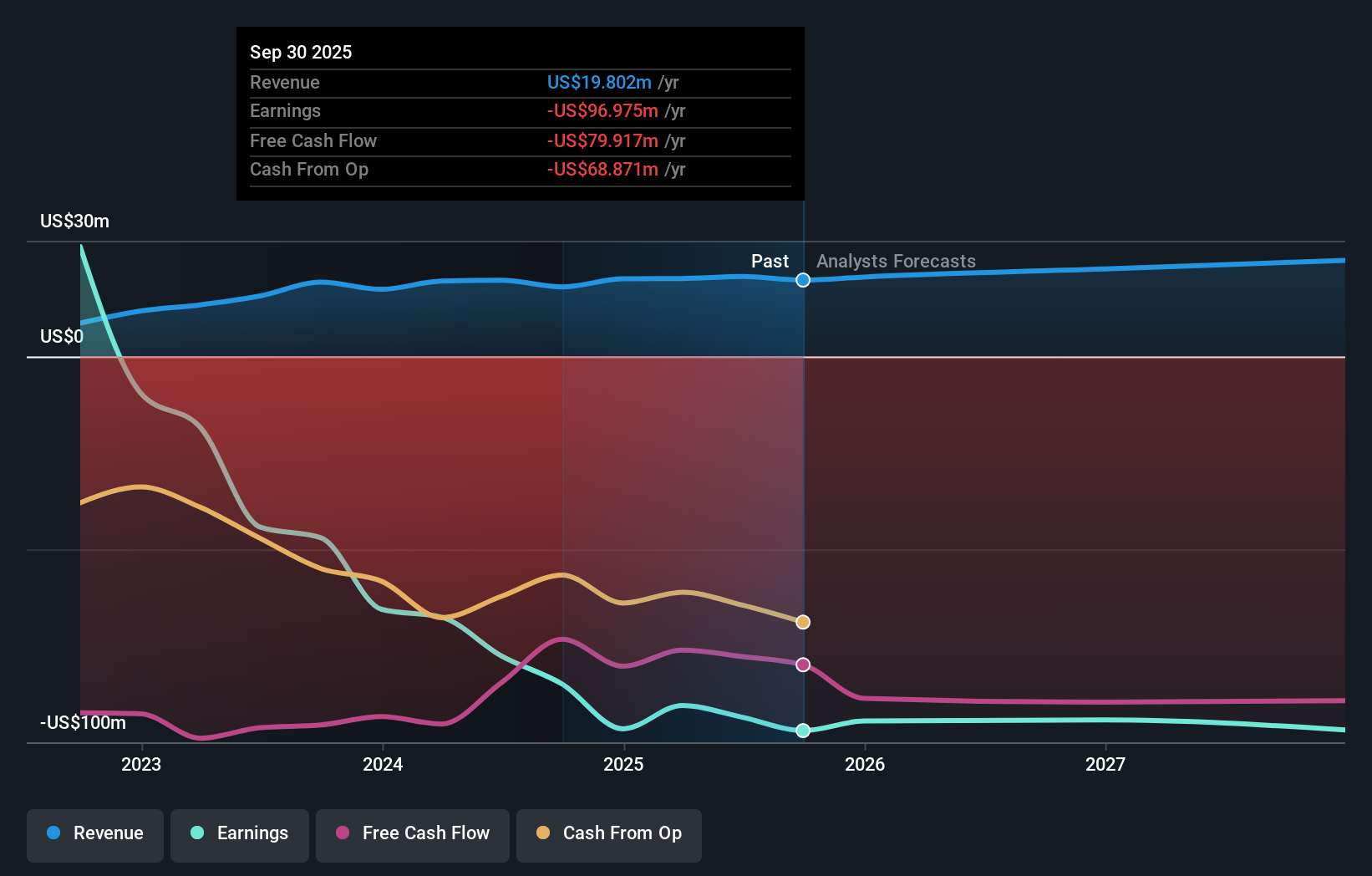

- Solid Power, Inc. recently reported third quarter 2025 earnings, detailing sales of US$3.73 million and a net loss of US$25.87 million, with revenue slightly lower than the same period last year.

- The company’s flat nine-month revenue combined with widening losses highlights ongoing challenges in converting early technological milestones into improved financial results.

- We'll examine how the larger year-over-year net loss may influence the investment narrative for Solid Power moving forward.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Solid Power Investment Narrative Recap

Solid Power’s investment case continues to center on its ability to commercialize breakthrough solid-state battery technology and secure key industry partnerships amid stiff competition. The recent third-quarter results, which showed steady revenue but widening net losses, do not materially alter the short-term catalyst: further validation of its batteries by major automakers. However, the persistent operating losses remain the biggest risk, as substantial spending is still needed to achieve profitable manufacturing scale.

Among recent announcements, the October collaboration with Samsung SDI and BMW stands out as particularly relevant. This partnership, which focuses on integrating Solid Power's electrolyte into Samsung SDI’s cells for a demonstration vehicle, may be a critical step toward broader industry adoption, a central catalyst for future revenue growth and improved margins. In contrast, investors should be aware that despite expanding partnerships, Solid Power’s consistent operating losses continue to...

Solid Power's outlook anticipates $33.2 million in revenue and $1.6 million in earnings by 2028. This projection is based on a 13.5% annual revenue growth rate and an earnings increase of $95.1 million from current earnings of -$93.5 million.

Uncover how Solid Power's forecasts yield a $4.00 fair value, a 34% downside to its current price.

Exploring Other Perspectives

Solid Power’s fair value estimates from the Simply Wall St Community range widely from US$0.21 to US$4.50, reflecting six different viewpoints. You will find especially diverse perspectives as operating losses remain a key concern influencing the company’s performance outlook.

Explore 6 other fair value estimates on Solid Power - why the stock might be worth less than half the current price!

Build Your Own Solid Power Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Solid Power research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Solid Power research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Solid Power's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.