Please use a PC Browser to access Register-Tadawul

Will S&P Global’s (SPGI) New AI Tools Redefine Its Competitive Edge in Financial Data?

S&P Global, Inc. SPGI | 501.03 | +0.70% |

- S&P Global has unveiled a suite of new AI-powered enhancements to its Capital IQ Pro platform, including Document Intelligence 2.0 and innovative index offerings that integrate advanced analytics directly into client workflows.

- These developments signal a growing commitment to embedding artificial intelligence at the core of S&P Global’s data and benchmarking business, expanding its reach and utility in financial analysis and investment management.

- We'll explore how these AI-enhanced product launches may shape S&P Global's investment narrative through expanded digital capabilities and customer engagement.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is S&P Global's Investment Narrative?

To be a shareholder in S&P Global, you need confidence in its ability to stay at the forefront of financial data, analytics, and benchmarking, especially as AI-driven solutions become central to client workflows. The company’s latest wave of AI-powered enhancements, particularly integrating Document Intelligence 2.0 directly into platforms like Salesforce, signals a commitment to embedding advanced technology across its services. While recent news points to real innovation and expanded reach, early market reaction has been tepid, and prior analysis suggested growth headwinds, premium valuation, and management changes as key risks. The full impact of these AI product launches may take time to materialize in financials or valuation. For now, they represent long-term digital transformation more than immediate catalysts, and may not significantly alter the near-term risk-reward balance unless adoption accelerates sharply. Investors should watch how these upgrades influence customer engagement and revenue trends going forward. On the other hand, current return on equity forecasts and elevated price multiples remain important considerations.

S&P Global's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

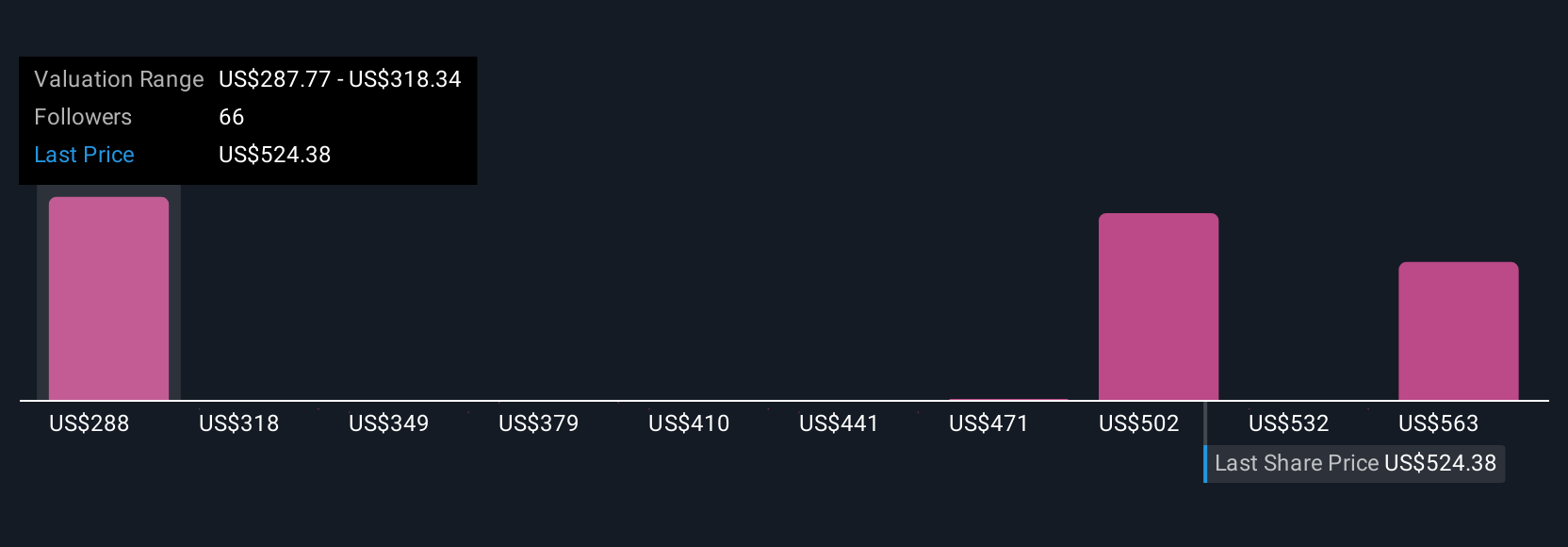

Explore 25 other fair value estimates on S&P Global - why the stock might be worth 40% less than the current price!

Build Your Own S&P Global Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your S&P Global research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free S&P Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate S&P Global's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.