Please use a PC Browser to access Register-Tadawul

Will S&P SmallCap 600 Inclusion Redefine Reynolds Consumer Products' (REYN) Investment Narrative?

Reynolds Consumer Products REYN | 22.77 | -0.13% |

- Reynolds Consumer Products was recently added to the S&P SmallCap 600 index, replacing SpartanNash Co. following its acquisition by C&S Wholesale Grocers LLC; the change became effective before the market opened on September 24, 2025.

- This inclusion suggests the company meets the index’s financial and operational benchmarks, often resulting in greater stock visibility, liquidity, and interest from institutional investors due to index fund purchases.

- We'll consider how joining the S&P SmallCap 600 index could influence Reynolds Consumer Products' investment narrative and future positioning.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Reynolds Consumer Products Investment Narrative Recap

To be a shareholder in Reynolds Consumer Products, you need to believe that demand for disposable household goods can remain resilient despite margin pressures and shifting consumer preferences. The company's recent addition to the S&P SmallCap 600 index has not changed the core short-term catalyst or the most significant risk, downward pressure on margins from input cost volatility remains the primary concern, and this index event is unlikely to materially offset those headwinds in the near term.

Of the company’s recent updates, the latest fiscal guidance stands out: Reynolds is projecting net revenues for Q3 and the full year 2025 to decline in the low single digits compared to the prior year. This cautious outlook is especially relevant, as it frames expectations following the index inclusion and puts the spotlight on cost management and margin recovery potential as key drivers for any near-term upside.

Yet, despite the surge in stock visibility, investors should consider that exposure to persistent raw material and tariff cost volatility remains a key risk…

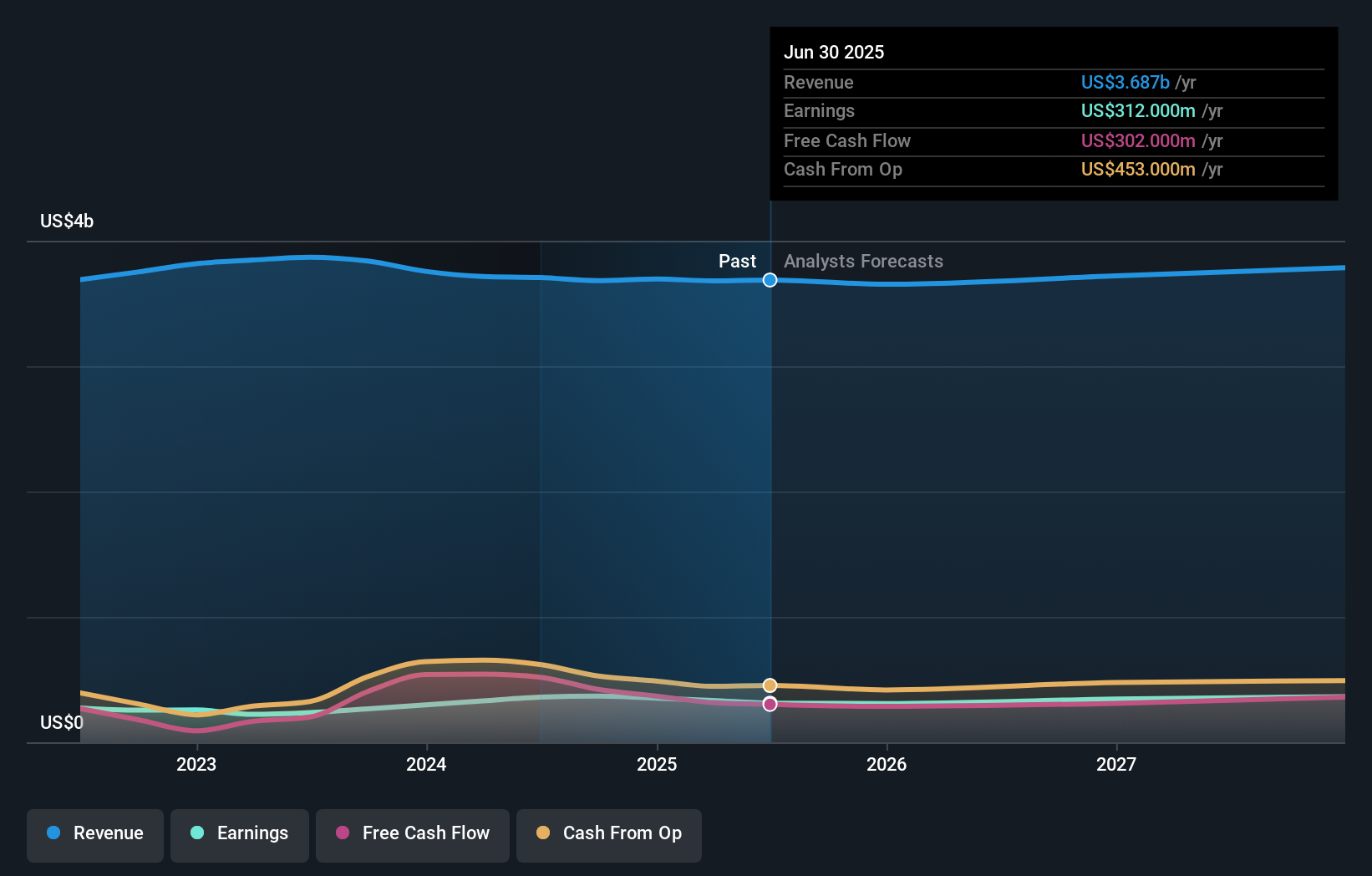

Reynolds Consumer Products' outlook projects $3.8 billion in revenue and $383.5 million in earnings by 2028. This is based on a 1.2% yearly revenue growth rate and a $71.5 million increase in earnings from the current $312.0 million.

Uncover how Reynolds Consumer Products' forecasts yield a $26.25 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from US$26.25 to US$49.74, based on two unique analyses. While some community members see room for upside, cost volatility remains central to the outlook and should prompt you to review alternative views on the company’s prospects.

Explore 2 other fair value estimates on Reynolds Consumer Products - why the stock might be worth just $26.25!

Build Your Own Reynolds Consumer Products Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Reynolds Consumer Products research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Reynolds Consumer Products research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Reynolds Consumer Products' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.