Please use a PC Browser to access Register-Tadawul

Will Strong Q2 Results, Leadership Transition, and G7 Reimbursement Reshape DexCom’s (DXCM) Growth Narrative?

DexCom, Inc. DXCM | 69.97 | +0.11% |

- DexCom reported strong second quarter 2025 earnings, raised full-year revenue guidance to US$4.60–4.63 billion, and announced CEO Kevin Sayer will retire on January 1, 2026, with President and COO Jake Leach named as his successor and appointed to the board.

- In addition, DexCom’s G7 system will now be reimbursed through Ontario’s drug benefit program, and the company introduced several new AI-driven enhancements for its glucose sensing platforms.

- We'll explore how DexCom's robust earnings and expanded G7 reimbursement shape its investment narrative and long-term growth outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

DexCom Investment Narrative Recap

To be a DexCom shareholder, you need to believe in the ongoing expansion of continuous glucose monitoring (CGM) in both the US and international markets, underpinned by technology leadership and broadening reimbursement. The latest earnings beat and raised revenue guidance reinforce this growth catalyst, while the planned CEO transition introduces some management execution risk; however, the impact on short-term catalysts from leadership change is not material at this stage. The most important risk to watch remains potential pricing pressure from CMS policy changes, which could emerge in coming years.

Of the recent announcements, the expansion of Ontario's public reimbursement for the DexCom G7 system is particularly significant. This not only supports current revenue momentum, but directly accelerates access to new patients, a key growth driver, especially as competition intensifies and as coverage in underpenetrated regions remains an investment focal point.

But in contrast to the company’s growth story, investors should also consider the risk of abrupt Medicare policy shifts that could impact future profits…

DexCom is forecasted to achieve $6.5 billion in revenue and $1.4 billion in earnings by 2028. This implies an annual revenue growth rate of 14.9% and an earnings increase of about $828 million from current earnings of $571.5 million.

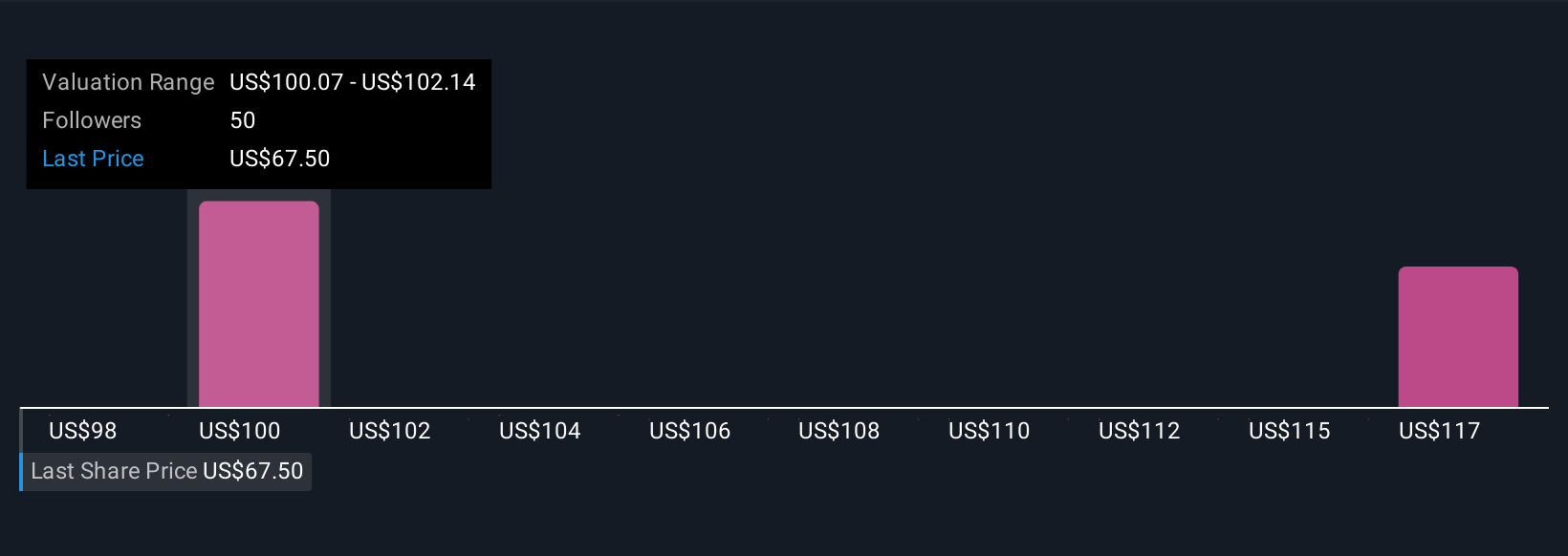

Uncover how DexCom's forecasts yield a $102.08 fair value, a 29% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have estimated DexCom’s fair value in a narrow range from US$102.08 to US$117.04, providing two community-generated viewpoints. With the company’s international reimbursement wins boosting addressable market size, you can see how different assumptions may affect individual outlooks for future performance.

Explore 2 other fair value estimates on DexCom - why the stock might be worth as much as 48% more than the current price!

Build Your Own DexCom Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DexCom research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free DexCom research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DexCom's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.