Please use a PC Browser to access Register-Tadawul

Will Strong Q3 Beat And UBS Neutral Rating Change PJT Partners' (PJT) Advisory-Led Narrative?

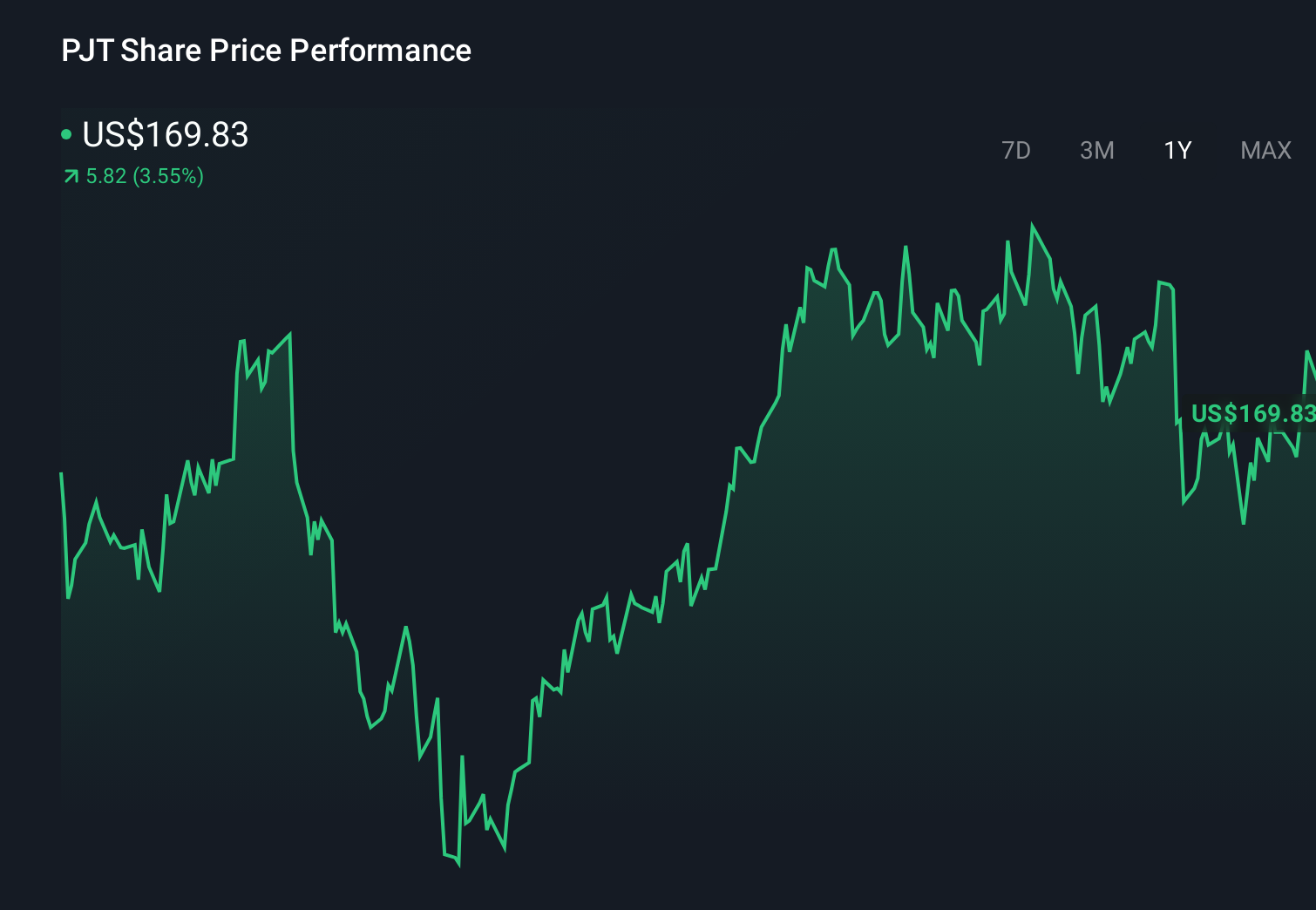

PJT Partners, Inc. Class A PJT | 151.63 | -0.76% |

- PJT Partners recently reported strong third quarter 2025 results, with earnings per share and revenue beating analyst expectations and underscoring the appeal of its advisory-focused model.

- UBS has initiated coverage with a Neutral rating, pointing to potential productivity gains from PJT’s multi-year investments in its Strategic Advisory franchise as a key long-term consideration.

- With recent results exceeding expectations and UBS emphasizing future productivity improvements, we’ll explore how this shapes PJT Partners’ broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is PJT Partners' Investment Narrative?

For PJT Partners, the investment case really comes down to whether you buy into its advisory-centric model, strong balance between payouts and reinvestment, and the ability to convert deal activity into high returns on equity. The latest quarter did not just beat expectations; it pushed the stock to a fresh high, which makes valuation and execution on future productivity gains more pressing short term catalysts than simple earnings momentum. UBS’s Neutral initiation, with an emphasis on partner productivity improvements from multi-year Strategic Advisory investments, fits with that shift: the market already appears to be pricing in a lot of the recent earnings acceleration, so incremental upside may depend on visible follow-through in margins rather than just revenue growth. At the same time, the share price’s small discount to consensus targets suggests the Q3 surprise has tightened, rather than reduced, the risk around paying up for quality.

However, investors should be aware of how much optimism is already reflected in today’s valuation. PJT Partners' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 3 other fair value estimates on PJT Partners - why the stock might be worth less than half the current price!

Build Your Own PJT Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PJT Partners research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free PJT Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PJT Partners' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.