Please use a PC Browser to access Register-Tadawul

Will Synaptics’ (SYNA) New Edge AI Chipset Redefine Its Competitive Position in Smart Devices?

Synaptics Incorporated SYNA | 89.23 | +2.20% |

- Earlier this week, Synaptics announced the launch of its Astra SL2600 Series, a new family of multimodal Edge AI processors aimed at powering next-generation smart devices across sectors like home automation, industrial equipment, and healthcare.

- A standout feature of the launch is the integration of Google's RISC-V-based Coral NPU and Synaptics' Torq Edge AI platform, signaling a developer-first approach and advancing on-device AI capabilities for a wide spectrum of IoT applications.

- We'll explore how the introduction of the Astra SL2600 processors could influence Synaptics' focus on Edge AI growth opportunities.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Synaptics Investment Narrative Recap

To own Synaptics, an investor needs to believe in the company’s ability to pivot from legacy segments toward scalable, high-growth Core IoT and Edge AI markets, unlocking greater revenue per design win through integrated silicon and software innovations. The Astra SL2600 launch directly supports this vision by strengthening Synaptics’ offering in Edge AI, but challenges remain in ramping sales channels and execution in underpenetrated industrial IoT, areas where progress, or lack of it, could influence near-term results and the company’s ability to reach a broader customer base.

Among recent announcements, the upcoming report of Q1 fiscal 2026 results on November 6, 2025, stands out, as it will provide the first clear indications of early customer traction and the initial financial impact from the Astra SL2600 rollout, all within the context of a company still targeting profitability and operational leverage.

However, compared to these growth ambitions, investors should be mindful of...

Synaptics' outlook anticipates $1.4 billion in revenue and $199.2 million in earnings by 2028. This scenario assumes annual revenue growth of 9.6% and a $247 million increase in earnings from the current level of -$47.8 million.

Uncover how Synaptics' forecasts yield a $82.25 fair value, a 18% upside to its current price.

Exploring Other Perspectives

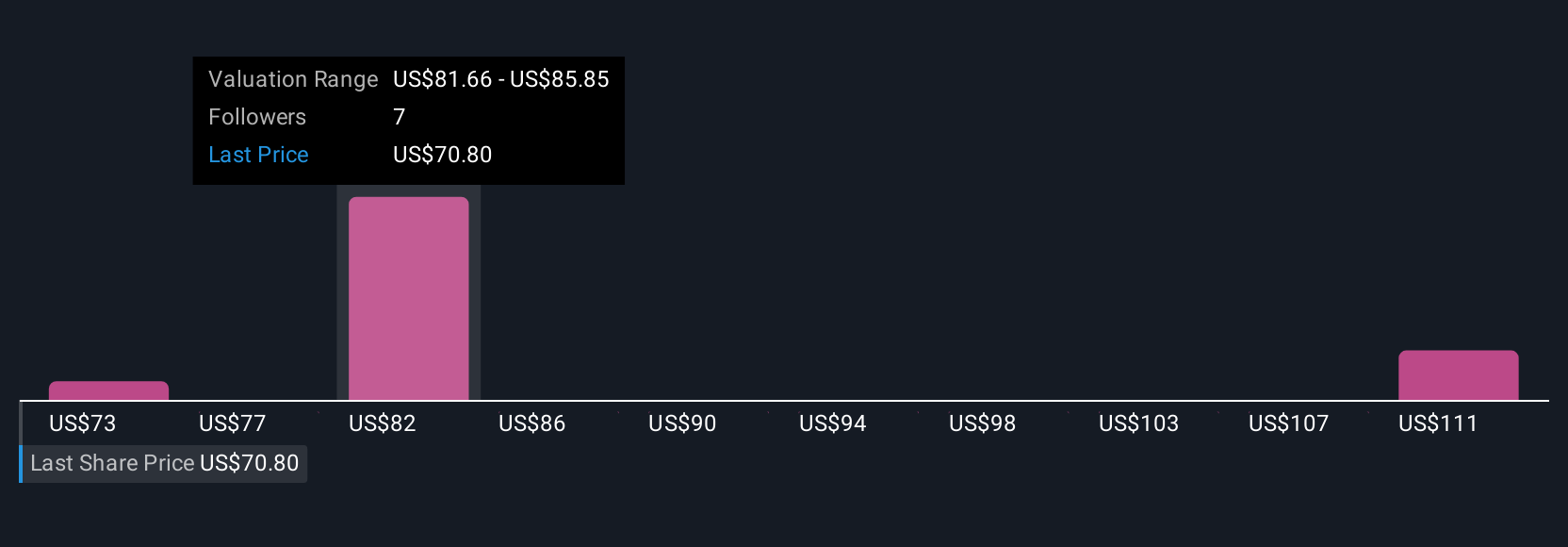

Four fair value estimates from the Simply Wall St Community span US$73.28 to US$114.99, reflecting a wide spectrum of investor views. Still, scaling Synaptics’ customer base and building a robust channel presence remains a key challenge that could shape results, these numbers show just how differently you and other market participants might see things.

Explore 4 other fair value estimates on Synaptics - why the stock might be worth as much as 66% more than the current price!

Build Your Own Synaptics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Synaptics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Synaptics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Synaptics' overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.