Please use a PC Browser to access Register-Tadawul

Will Taiho’s Casdatifan Licensing in Asia Change Arcus Biosciences’ (RCUS) Narrative?

Arcus Biosciences RCUS | 21.53 | -14.36% |

- In October 2025, Taiho Pharmaceutical announced it exercised its option to license and develop Arcus Biosciences’s investigational HIF-2α inhibitor, casdatifan, for Japan and select Asian territories, triggering an option payment and the potential for future milestone and royalty payments to Arcus.

- This move marks the fifth time Taiho has exercised such an option with Arcus, providing further validation of Arcus’s late-stage programs and expanding the commercial reach of casdatifan, which is currently undergoing global Phase 3 trials for clear cell renal cell carcinoma.

- We will examine how Taiho’s option exercise in Asia shapes Arcus’s investment story through expanded pipeline validation and access to new markets.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Arcus Biosciences Investment Narrative Recap

To invest in Arcus Biosciences, you must believe in the potential of its late-stage oncology pipeline, especially the HIF-2α inhibitor casdatifan, to drive future revenue, despite regulatory challenges and competitive pressures. Taiho’s recent licensing deal in Asia further validates Arcus’s late-stage programs but does not materially alter the most important short-term catalyst: pivotal trial data readouts for casdatifan, as regulatory approval and trial results still represent the largest source of near-term uncertainty. The most immediate risk remains the potential for regulatory delays or setbacks that could impact timelines and expected revenue streams.

Of the recent company updates, the October announcement highlighting casdatifan’s positive efficacy as monotherapy in late-line clear cell renal cell carcinoma stands out. This is highly relevant, as it supports the key clinical catalyst, the global Phase 3 PEAK-1 trial, which underpins both Arcus’s partnership with Taiho and broader pipeline validation.

However, investors should be aware that setbacks in regulatory timelines could still...

Arcus Biosciences' outlook anticipates $327.1 million in revenue and $52.5 million in earnings by 2028. This is based on a projected annual revenue growth rate of 7.7% and a $350.5 million increase in earnings from current earnings of -$298.0 million.

Uncover how Arcus Biosciences' forecasts yield a $31.27 fair value, a 86% upside to its current price.

Exploring Other Perspectives

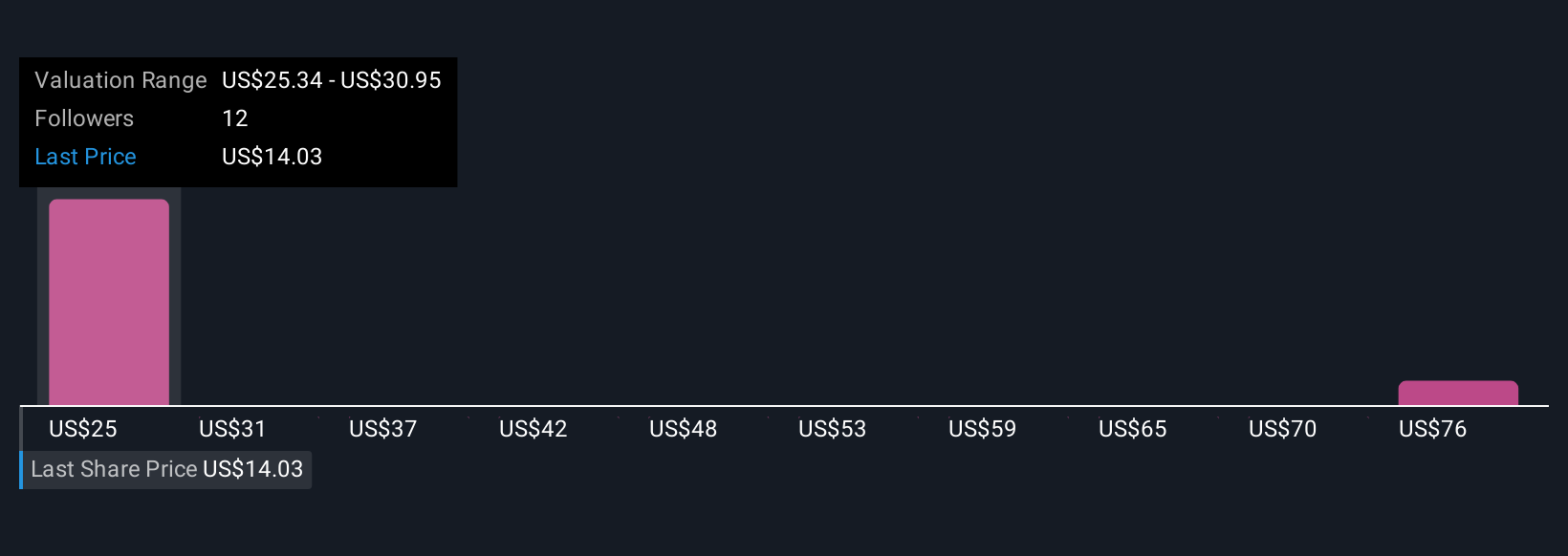

Simply Wall St Community fair value estimates for Arcus Biosciences span from US$25.34 to US$80.75, with four distinct viewpoints. With pivotal trial data as the next major catalyst, investors’ assumptions about regulatory outcomes may underpin these widely varying expectations.

Explore 4 other fair value estimates on Arcus Biosciences - why the stock might be worth over 4x more than the current price!

Build Your Own Arcus Biosciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arcus Biosciences research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Arcus Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arcus Biosciences' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.