Please use a PC Browser to access Register-Tadawul

Will Teladoc Health's (TDOC) AI Workplace Safety Tool Redefine Its Competitive Edge in Healthcare?

Teladoc Inc TDOC | 7.55 | -0.92% |

- Teladoc Health recently launched an AI-powered workplace violence intervention tool for hospitals, enhancing its Clarity monitoring solution with video, audio, and real-time notification features designed to improve staff safety and operational response.

- This development adds a new capability to Teladoc's digital platform, addressing a growing healthcare challenge and showcasing the company's broadening use of artificial intelligence in clinical settings.

- We'll examine how the introduction of AI-enabled workplace safety monitoring could influence Teladoc Health's investment case and growth outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Teladoc Health Investment Narrative Recap

To be a Teladoc Health shareholder, you need to believe in the long-term shift to digital healthcare, supported by ongoing innovation in virtual care and AI-powered clinical solutions. While the launch of the AI workplace violence tool strengthens Teladoc’s healthcare platform, its impact on the short-term catalyst, BetterHelp’s insurance segment restoring user growth, appears limited for now. The key risk of margin pressure from an ongoing revenue mix shift in BetterHelp remains unchanged.

Among recent announcements, Teladoc’s new Employee Assistance Program (Wellbound EAP) stands out for its focus on employee mental health, a critical area for hospitals also affected by workplace safety. This aligns with Teladoc’s push to broaden use cases and tackle customer pain points, but the company’s ability to grow key user segments profitably is still central to its future performance.

Yet, against the promise of operational progress, investors should also watch for signs that persistent churn and shrinking gross margins in BetterHelp may continue to challenge Teladoc’s path to profitability...

Teladoc Health's narrative projects $2.7 billion in revenue and $235.6 million in earnings by 2028. This requires a 1.9% yearly revenue growth and a $443 million earnings increase from current earnings of -$207.4 million.

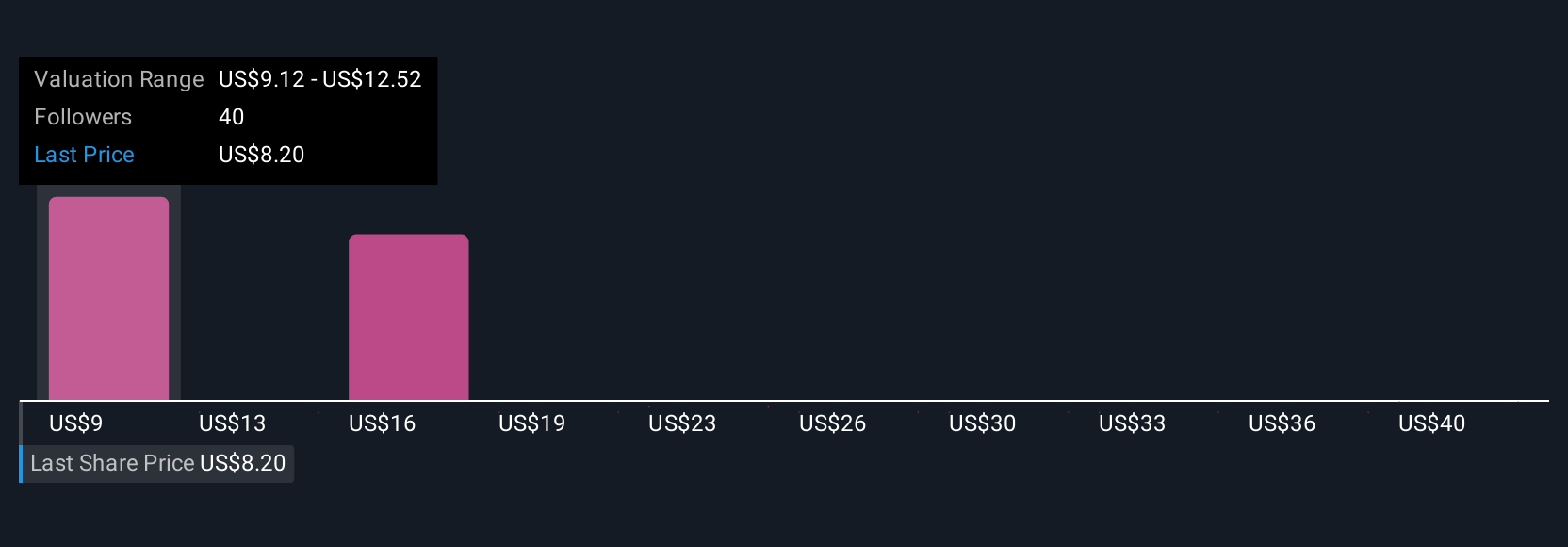

Uncover how Teladoc Health's forecasts yield a $9.12 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community fair value estimates for Teladoc Health range widely from US$9.13 to US$42.04, reflecting substantial differences in individual assessments. With ongoing margin risks tied to the BetterHelp segment, you may want to review these diverse viewpoints alongside your own outlook.

Explore 4 other fair value estimates on Teladoc Health - why the stock might be worth just $9.12!

Build Your Own Teladoc Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teladoc Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Teladoc Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teladoc Health's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.