Please use a PC Browser to access Register-Tadawul

Will Texas Pacific Land’s (TPL) Dual Listing Strengthen Its Asset-Light Model Amid Recent Earnings Questions?

Texas Pacific Land Trust TPL | 925.08 | +0.58% |

- Texas Pacific Land Corporation recently reported mixed second-quarter 2025 earnings, announced its dual listing as a Founding Member of NYSE Texas effective August 15, and highlighted continued strong institutional ownership alongside developments in its water business and resilient Permian operations.

- An important insight is that while the company maintains an asset-light, high-margin business model with meaningful institutional support, recent insider selling and an earnings shortfall may impact market perceptions and future investor activity.

- We’ll now assess how the company’s dual listing and earnings results may influence Texas Pacific Land’s longer-term investment narrative and risk profile.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Texas Pacific Land Investment Narrative Recap

Shareholders in Texas Pacific Land need to believe in the long-term durability of Permian Basin activity, continued demand for produced water services, and the company’s core asset-light model. The recent dual NYSE Texas listing and mixed second-quarter earnings do little to alter the primary near-term catalyst: growth in the water business, while the largest risk remains regulatory challenges or water scarcity impacting segment revenues. These news items, while incrementally influential, do not materially change the company’s overall risk-reward profile at present.

Among recent developments, the introduction of amended bylaws with proxy access stands out for investors, reinforcing corporate governance at a time of shifting institutional sentiment and insider activity. While not directly tied to short-term operating metrics, this move is relevant as it could shape how responsive the board is to evolving investor concerns about the catalysts and risks underpinning future performance.

Yet, even with these strengths, investors should be aware that, if water segment expansion faces new regulatory obstacles or higher costs, the current growth trajectory may be at risk...

Texas Pacific Land's outlook forecasts $895.3 million in revenue and $610.3 million in earnings by 2028. This implies a 7.2% annual revenue growth rate and a $150.1 million increase in earnings from $460.2 million currently.

Uncover how Texas Pacific Land's forecasts yield a $921.93 fair value, a 5% downside to its current price.

Exploring Other Perspectives

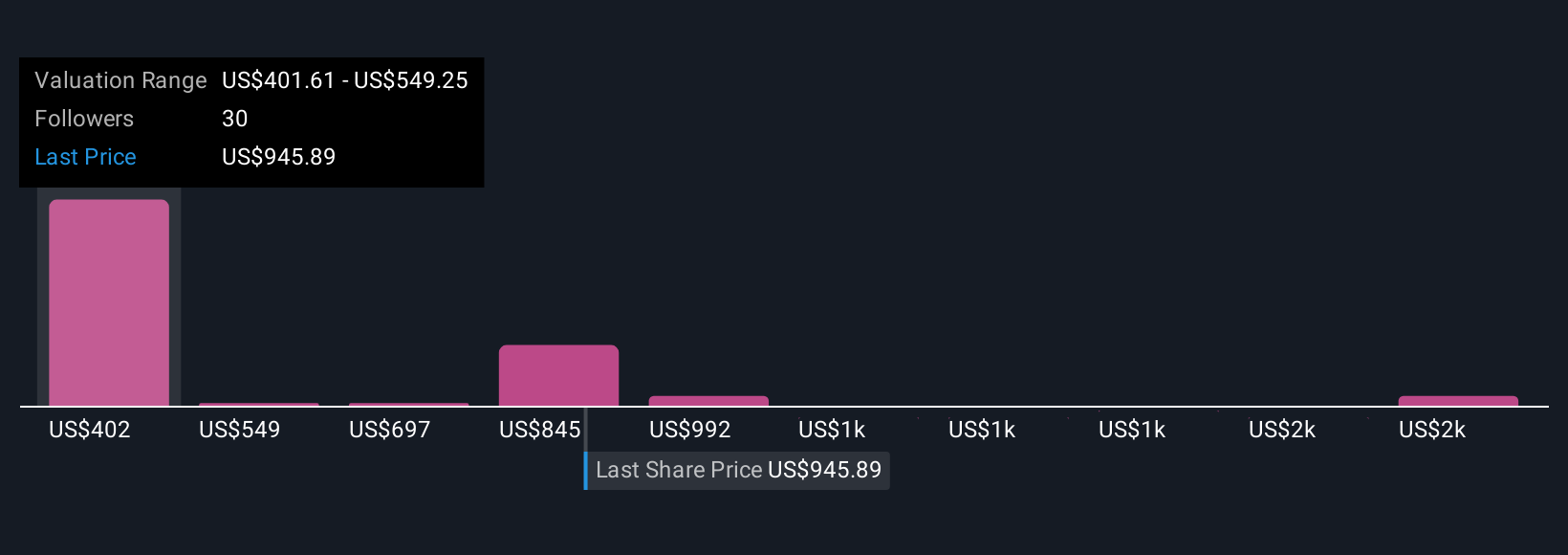

Fifteen fair value estimates from the Simply Wall St Community range from US$401.61 to US$1,877.96 per share, highlighting widespread disagreement around Texas Pacific Land’s true worth. This diversity of opinion comes as investors weigh the business’s strong margins and asset-light model against the potential impact of tightening water regulations on future returns.

Explore 15 other fair value estimates on Texas Pacific Land - why the stock might be worth as much as 93% more than the current price!

Build Your Own Texas Pacific Land Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Texas Pacific Land research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Texas Pacific Land research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Texas Pacific Land's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.