Please use a PC Browser to access Register-Tadawul

Will TIC Solutions' (TIC) Balance Sheet Moves Unlock New Avenues for Growth or Signal Caution?

Acuren Corporation Ltd. Ordinary Shares TIC | 10.58 | -2.40% |

- Earlier this month, Acuren Corporation changed its name to TIC Solutions, Inc., completed a US$250 million private placement with institutional investor participation, and filed a shelf registration to potentially offer up to US$277.7 million in common stock.

- This sequence of events signals the company is actively strengthening its balance sheet and may be positioning itself for expanded financing flexibility or growth initiatives.

- We'll explore how this sizable capital raise and shift toward greater financial flexibility may alter the outlook for TIC Solutions' investment narrative.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

TIC Solutions Investment Narrative Recap

For shareholders in TIC Solutions, the core investment story hinges on the company’s ability to successfully integrate its large NV5 acquisition and achieve targeted growth while managing elevated debt levels. The recent US$250 million capital raise and shelf registration increase short-term balance sheet flexibility, but they do not materially reduce the execution and integration risks that remain the stock’s most important catalyst and threat, respectively.

Of all recent announcements, the private placement completed on October 7, 2025, stands out as most relevant: bringing in institutional capital directly addresses near-term liquidity needs and provides resources to help manage debt costs and fund potential investments. However, as the company remains in the early stages of digesting its transformative acquisition, questions around synergy realization and sustained margin improvement remain central to the story.

By contrast, investors should pay close attention to the integration risk, especially if anticipated synergies and cost improvements are not rapidly realized...

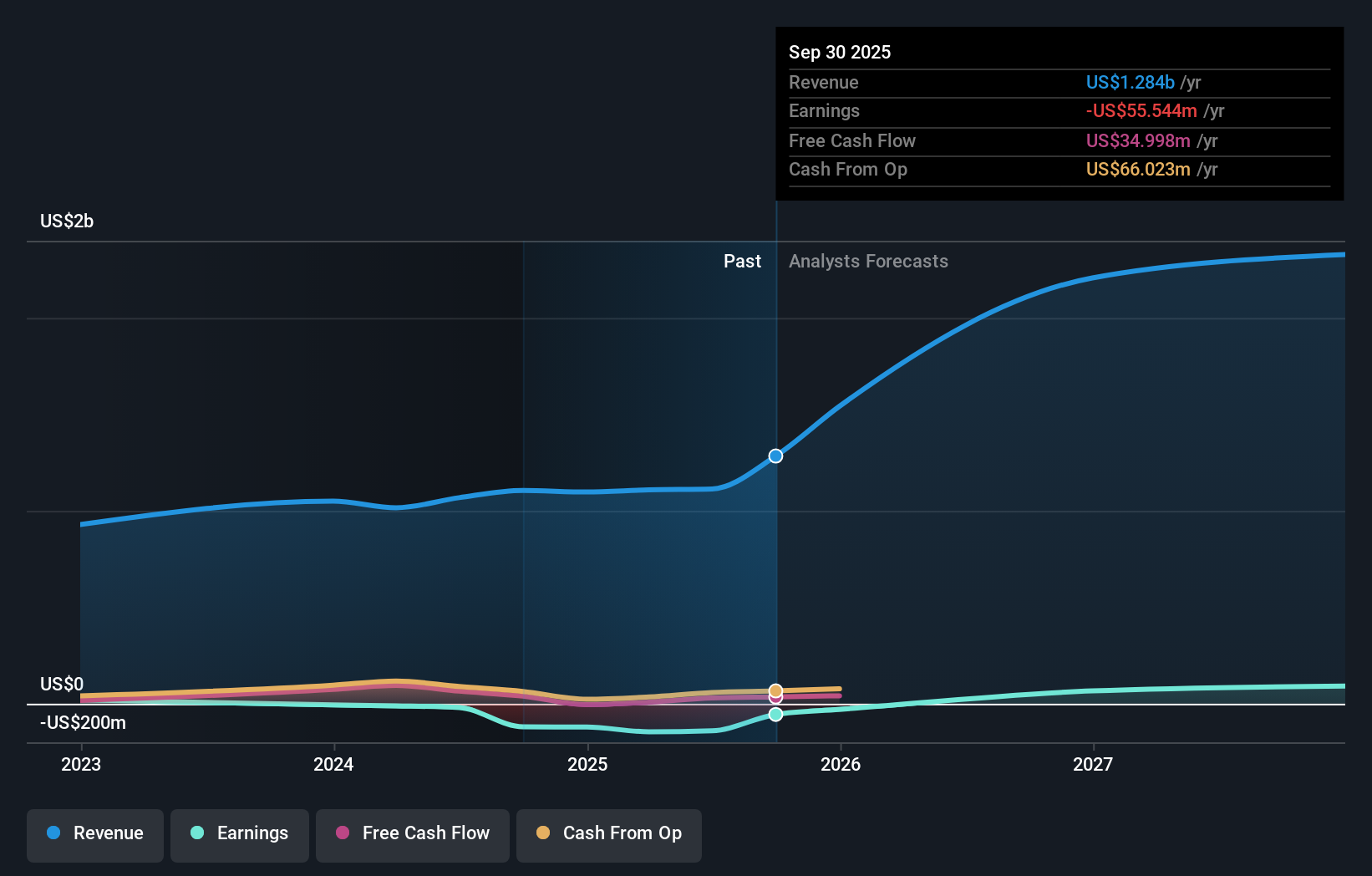

Acuren's outlook anticipates $3.0 billion in revenue and $141.5 million in earnings by 2028. Achieving this would require 39.0% annual revenue growth and a $282 million increase in earnings from the current -$140.5 million level.

Uncover how TIC Solutions' forecasts yield a $15.50 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Only one fair value estimate from the Simply Wall St Community is available, pegging TIC Solutions at US$2.48 per share. This sits well below analyst targets, highlighting how differing views on integration risk and margin improvement potential can shape widely varied opinions about the company's future trajectory.

Explore another fair value estimate on TIC Solutions - why the stock might be worth less than half the current price!

Build Your Own TIC Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TIC Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free TIC Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TIC Solutions' overall financial health at a glance.

No Opportunity In TIC Solutions?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.