Please use a PC Browser to access Register-Tadawul

Will Trade Desk's (TTD) New CRO Signal a Shift in Its Global Revenue Ambitions?

The Trade Desk TTD | 40.05 | +1.78% |

- On October 28, 2025, The Trade Desk announced that Anders Mortensen, a long-time Google executive with extensive experience in global digital advertising, would be appointed Chief Revenue Officer, succeeding Jed Dederick effective November 4, 2025.

- This leadership change places a proven leader in charge of The Trade Desk’s global revenue strategy at a pivotal time for the company's commercial expansion and continued focus on innovations in areas like Connected TV and Unified ID 2.0.

- We’ll review how Mortensen’s arrival from Google could influence The Trade Desk’s investment narrative, especially regarding global revenue generation and innovation leadership.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Trade Desk Investment Narrative Recap

Owning shares of The Trade Desk means believing in the long-term shift of global advertising toward data-driven, multi-channel platforms, with Connected TV and international expansion as ongoing growth engines. The recent appointment of Anders Mortensen as Chief Revenue Officer does not materially alter the short-term earnings catalyst tied to the upcoming Q3 results, but it could impact longer-term execution on global revenue and innovation. The biggest risk remains the company’s exposure to spending cuts from large enterprise clients, especially in sectors sensitive to macro headwinds.

Of the latest company announcements, the Q3 2025 earnings release slated for November 6 stands out as most closely linked to this leadership transition, since investors will be looking for early signs of Mortensen’s impact, or any updated commentary about the handover as it relates to commercial execution or revenue visibility. With executive transitions taking place just ahead of this key report, momentum in core channels such as CTV and ongoing client retention will be in sharper focus in the short term.

But while leadership change may grab attention, investors should be aware that the true pressure point in the near term is…

Trade Desk's narrative projects $4.3 billion in revenue and $823.2 million in earnings by 2028. This requires 17.1% yearly revenue growth and a $406 million increase in earnings from the current $417.2 million.

Uncover how Trade Desk's forecasts yield a $69.53 fair value, a 39% upside to its current price.

Exploring Other Perspectives

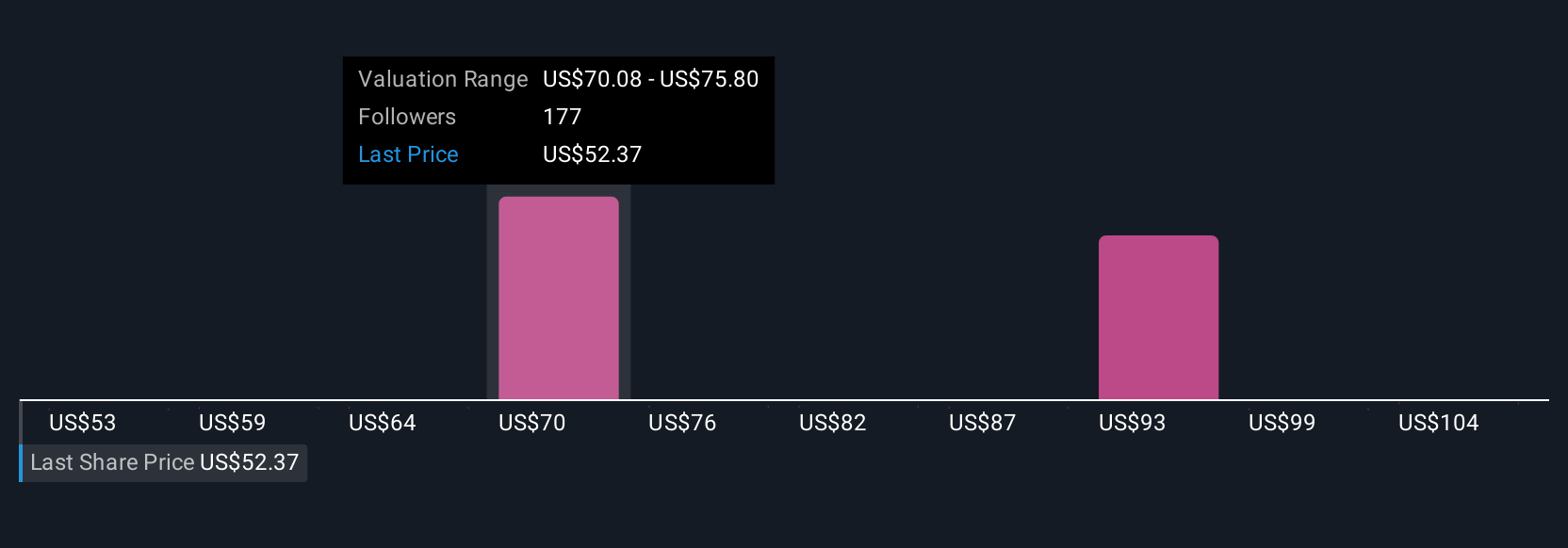

Thirty-nine unique fair value estimates from the Simply Wall St Community place The Trade Desk’s worth anywhere from US$39.48 to US$111.31 per share. Many see opportunity in the company's push for global revenue expansion though heavy reliance on major brands remains a risk that could shape performance in challenging economic periods.

Explore 39 other fair value estimates on Trade Desk - why the stock might be worth over 2x more than the current price!

Build Your Own Trade Desk Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trade Desk research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Trade Desk research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trade Desk's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.