Please use a PC Browser to access Register-Tadawul

Will Travel + Leisure (TNL)'s Approach to Debt Hint at Resilience or Risk Ahead?

Travel+Leisure Co Ordinary Shares TNL | 70.92 70.92 | -0.48% 0.00% Pre |

- In recent days, Travel + Leisure Co. (NYSE:TNL) announced it will release its third quarter 2025 financial results on October 22, with executives set to discuss the company's business outlook and performance.

- While the company has moved from a loss to profitability and insiders have shown confidence through recent stock purchases, new concerns have emerged over weak demand and potential dilutive equity offerings due to high net-debt-to-EBITDA levels.

- Next, we'll consider how concerns about financial leverage and weak demand could affect Travel + Leisure's investment narrative and outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Travel + Leisure Investment Narrative Recap

To own shares of Travel + Leisure, investors need to believe in the resilience of its vacation ownership model and the company’s ability to manage debt while expanding. The recent announcement of the Q3 2025 results release is unlikely to impact the most important current catalyst, broadening the customer base through new brands and locations, though concerns about financial leverage and weak demand remain the biggest risks in the near term.

The recent launch of $500 million in senior secured notes to refinance existing debt stands out as particularly relevant. This move directly relates to ongoing concerns about the company's net-debt-to-EBITDA ratio and the risk that high leverage could limit financial flexibility, especially if sales momentum softens while expansion continues.

Yet, in contrast to periodic growth headlines, rising debt levels and risk of equity dilution are facts investors should be aware of...

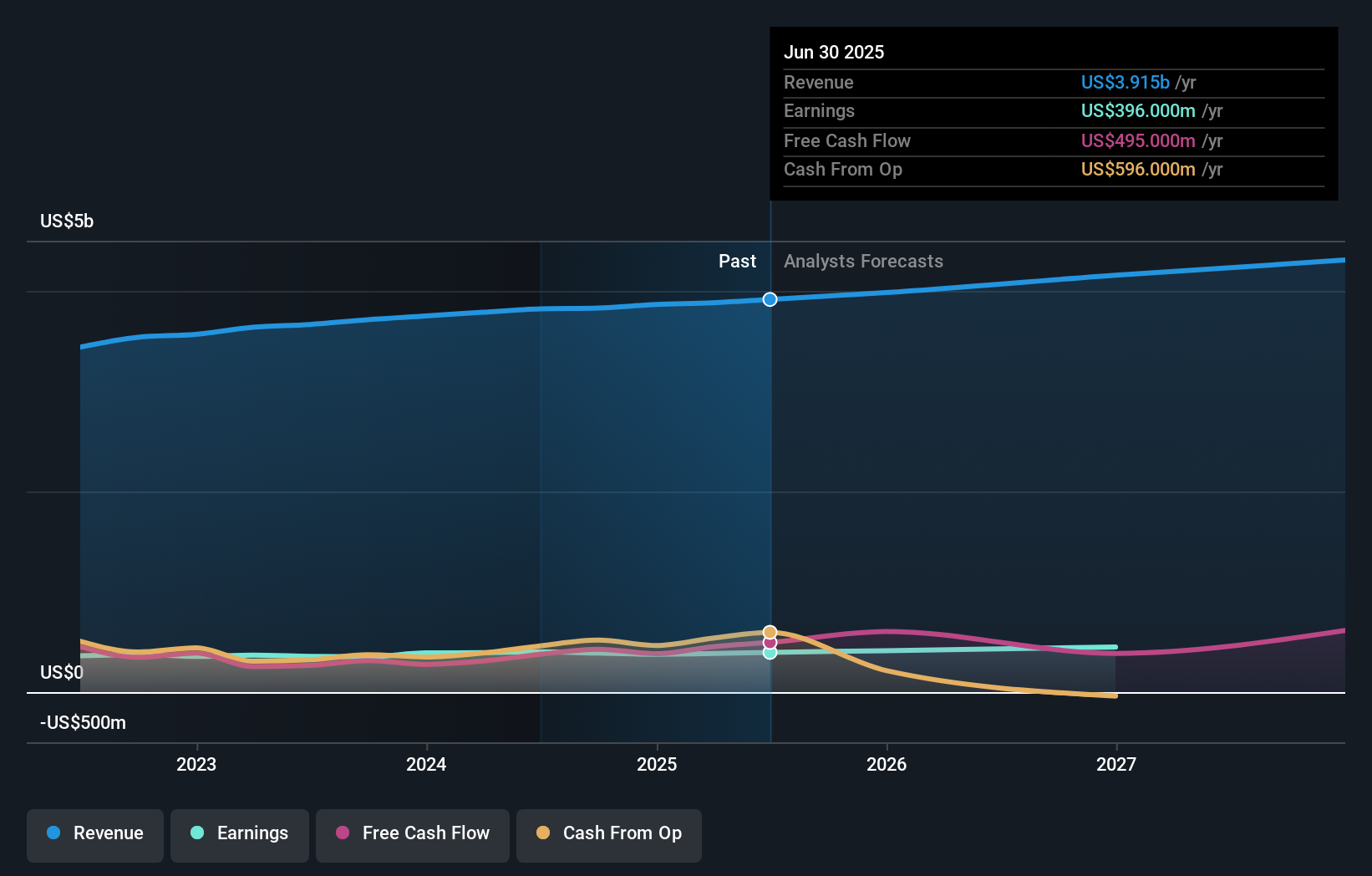

Travel + Leisure's narrative projects $4.4 billion revenue and $506.9 million earnings by 2028. This requires 3.9% yearly revenue growth and a $110.9 million earnings increase from $396.0 million today.

Uncover how Travel + Leisure's forecasts yield a $67.45 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have submitted four fair value estimates for Travel + Leisure, ranging from US$43.13 to US$61,186.95 per share. While community perspectives are broad, the company’s high dependence on its core Vacation Ownership business may sharpen debate over future outcomes.

Explore 4 other fair value estimates on Travel + Leisure - why the stock might be a potential multi-bagger!

Build Your Own Travel + Leisure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Travel + Leisure research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Travel + Leisure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Travel + Leisure's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.